My end-of-week morning train WFH reads:

• Millennials and boomers are competing for homes. Guess who’s winning? Rising prices, high rates and demographics are reversing millennial gains. (Financial Times)

• The 4 Billion Pieces of Paper Keeping Global Trade Afloat: The vast majority of trade is conducted using paper documents, but fraud is fueling a clamor to digitize the system. (Bloomberg)

• The Cash Machine Is Blue And Green: Selling people on the idea of a machine that spits out money was obviously not easy. But then a freak weather event happened, and everything began to click. (Tedium)

• No, China Isn’t Shifting Away From the Dollar or Dollar Bonds: China’s reserves has shifted its dollar reserves from Treasuries to Agencies, and made increased use of offshore custodians. The available evidence suggests that it still holds about 50 percent of its reserves in dollar bonds. (Council on Foreign Relations)

• An Orange County entrepreneur’s $60-million legal battle to stop Apple from steamrolling startups: Apple hatched a plan to obtain or emulate the technology without paying for it. Instead of acquiring it, Apple decided it could simply emulate its technology while raiding its brain trust. A decade later, they are locked in an acrimonious legal battle, alleging Apple infringed on his patents and stole trade secrets. If Kiani wins, it could stop Apple Watches, which are manufactured in China, from being imported into the U.S. (Los Angeles Times)

• How the Elon Musk biography exposes Walter Isaacson: One way to keep Musk’s myth intact is simply not to check things out. (The Verge)

• The ends of knowledge: Academics need to think harder about the purpose of their disciplines and whether some of those should come to an end. (Aeon) see also The Worth of Wild Ideas: Even if a leading theory of consciousness is wrong, it can still be useful to science. (Nautilus)

• You Gorged on Your European Vacation but Lost Weight. Why? Americans who eat their way through Europe sometimes come home surprised to see a lower number on the scale. (Wall Street Journal)

• Who’s afraid of an RFK Jr. independent run? “A couple of years ago, if you’d told me that someone named Robert F. Kennedy Jr. was running for president as an independent, I’d have said that it would really hurt the Democratic ticket . . . But RFK Jr. has such an odd mix of views, on a whole host of conspiracy theories, that he’s more appealing to far-right, libertarian sort of voters. I think he’s more likely to hurt Donald Trump than Joe Biden.” (Semafor)

• Maybe in Your Lifetime, People Will Live on the Moon and Then Mars: Through partnerships and 3-D printing, NASA is plotting how to build houses on the moon by 2040. (New York Times)

Be sure to check out our Masters in Business interview interview this weekend with author Michael Lewis. His latest book Going Infinite: The Rise and Fall of a New Tycoon about the rise and fall of FTX’s founder Sam Bankman Fried. Lewis spent a year embedded with Bankman Fried, who at one time was both the youngest billionaire worth nearly $100 billion dollars. The quirky crypto founder is now under arrest and awaiting trial for massive fraud.

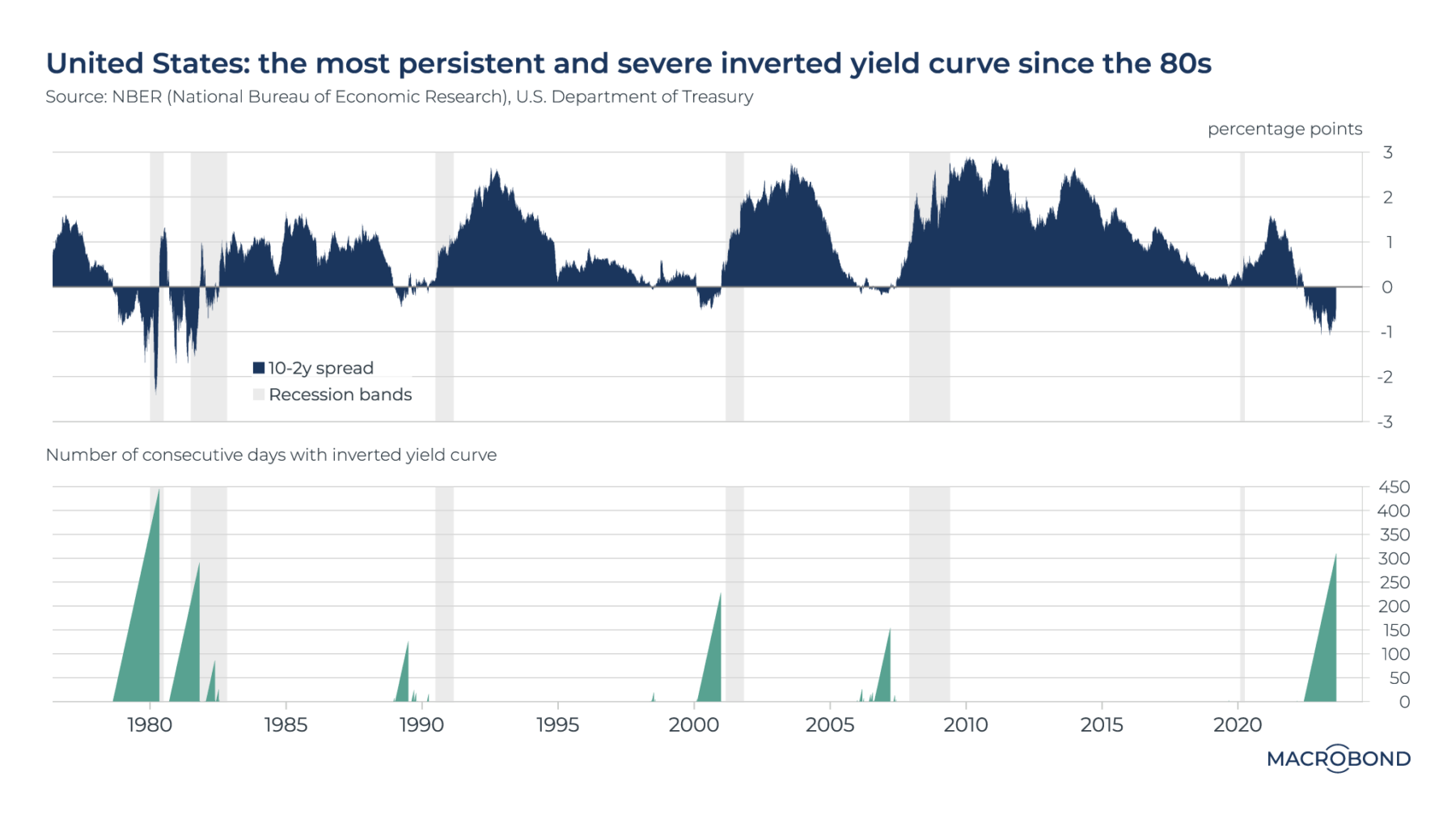

We are experiencing the most persistent and severe inverted US yield curve (usually a recession signal) since the Volcker era

Source: @MacrobondF

Sign up for our reads-only mailing list here.