My-Tuesday morning train WFH reads:

• When Will Interest Rates Really Start to Matter? For the longest time pundits predicted interest rates would go higher yet they did nothing but go lower year after year. Then when rates hit 0% it seemed like everyone assumed we would experience lower rates forever…just in time for rates to rise higher than anyone thought was possible in such a short period of time. So it goes when it comes to the markets. (A Wealth of Common Sense)

• Five Ways the Bull Market Makes Investors: Nervous Investors can’t stop looking over their shoulders for major risks looming in markets. (Wall Street Journal) see also Five Revealing Pictures: Professional money managers do well on their “slower”, buying decisions (actually well enough to beat benchmark portfolios!). It’s on their “faster”, selling decisions that money mangers significantly underperform (Sapient Capital)

• Howard Marks on Taking the Temperature: “You know, looking back, I think my market calls have been about right.” The response: “That’s because you did it 5 times in 50 years.” It struck me like an epiphany: Those five instances the markets were either crazily elevated or massively depressed, and as a result, I was able to recommend becoming more defensive or more aggressive with a good chance of being right. (Oaktree Capital)

• Taylor Swift Is Halfway Through Her Rerecording Project. It’s Paid Off Big Time: The remaking of Swift’s early discography, which includes her first six albums, has so far found success, with fans eager to listen to her new vocals, unpack its various easter eggs, and purchase new merchandise. Speak Now (Taylor’s Version) is expected to debut at No. 1 on the Billboard 200 chart, which would give Swift the third-most No. 1 albums of any artist of all time, surpassing Barbra Streisand And Bruce Springsteen. (Time)

• How Fossil-Fuel-Owning Alts Managers Became Green-Energy Leaders: Firms like Brookfield and Carlyle are buying up polluters and promising to scrub them clean (Institutional Investor)

• 2024 Rolls-Royce Spectre EV: RR introduces its first all-electric vehicle, as it plans to phase out ICE by 2030. (The Big Picture) see also Best Electric Vehicles of 2023 and 2024: We’ve selected the best electric cars you can buy today that include a wide range of SUVs, hatchbacks, sedans, and even pickup trucks. (Car and Driver)

• Elon Musk Is Making Mark Zuckerberg Seem Cool Again: The Facebook co-founder is seizing the moment with a win after years of tumult (Wall Street Journal)

• The Last Place on Earth Any Tourist Should Go: Take Antarctica off your travel bucket list. All of these attractions are getting harder to find in the rest of the world. They’re disappearing in Antarctica too. The continent is melting; whole chunks are prematurely tumbling into the ocean. And more people than ever are in Antarctica because tourism is on a tear. (The Atlantic)

• Investors Bought Nearly $1 Billion in Land Near a California Air Force Base. Officials Want to Know Who Exactly They Are. Flannery Associates’ purchases near Travis Air Force Base have alarmed local and federal officials . (Wall Street Journal)

• Turner Classic Movies Is a National Treasure: The channel has an astounding degree of control over a crucial part of American cinema. It should become a public resource available to all. (New Yorker)

Be sure to check out our Masters in Business this weekend with Franklin Templeton CEO Jenny Johnson, which manages $1.5 trillion dollar in client assets. She has worked at FT since 1988, and held leadership roles in investment management, distribution, technology, operations, and high-net-worth clients. Franklin Templeton oversees more than 9000 employees and 1300 investment professionals. Johnson is on the list of most powerful women (Barron’s, Forbes, American Banker, and more). She has been CEO since February 2020.

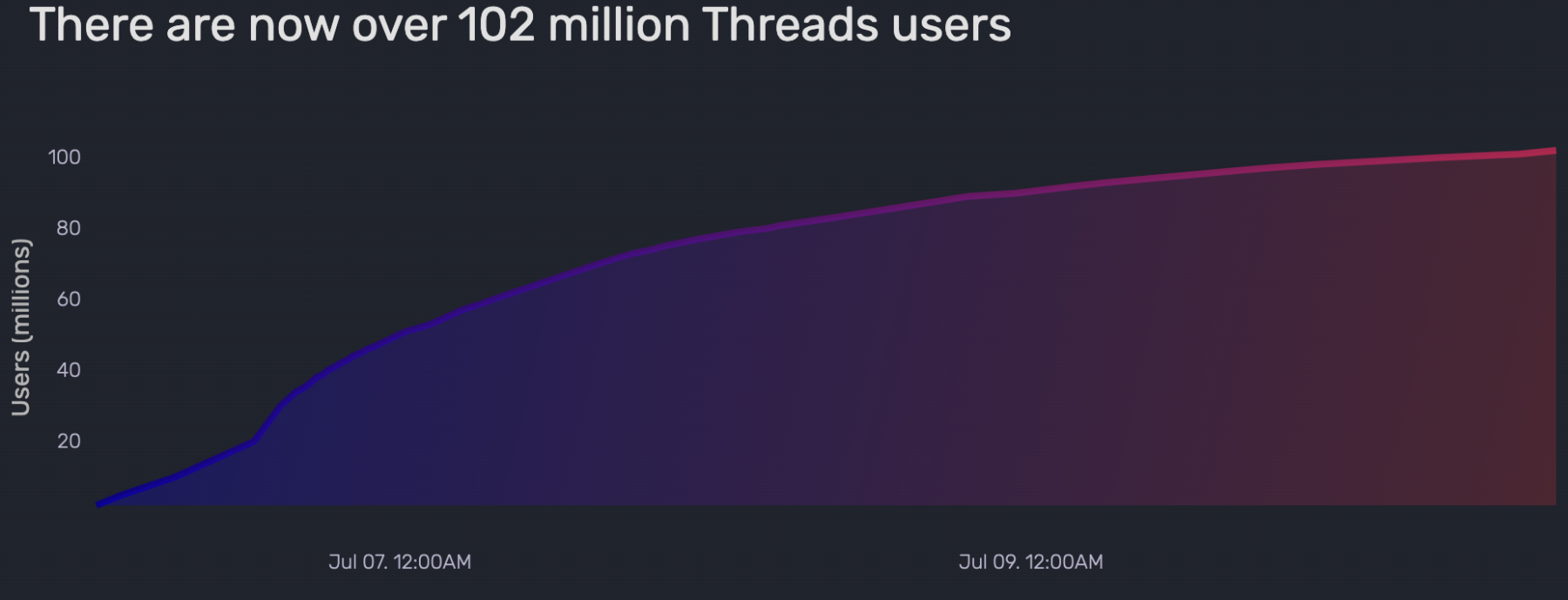

There are now over 102 million Threads users

Source: Quiverquant

Sign up for our reads-only mailing list here.