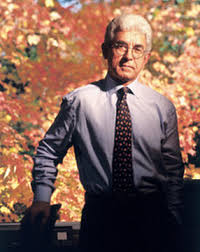

This year, we lost one of Wall Street’s brightest lights.

Beginning in 1974, and over the next 50 years of investing, Laszlo Birinyi closely watched the markets. He was one of the market’s most insightful observers and served clients with great distinction. He was a Truth-teller, especially about how people allowed financial Media to affect their emotions, and was unusually frank about his fellow strategists and Wall Street salespeople.

Beginning in 1974, and over the next 50 years of investing, Laszlo Birinyi closely watched the markets. He was one of the market’s most insightful observers and served clients with great distinction. He was a Truth-teller, especially about how people allowed financial Media to affect their emotions, and was unusually frank about his fellow strategists and Wall Street salespeople.

He became known for his innovative money flow analysis, which compared stock action based on trading volumes at different price levels.

Birinyi’s study of bull markets identified four stages: Reluctance, Consolidation, Grudging Acceptance, and Exuberance. The final phase is marked by fearless behavior, lots of newbies, and a rising likelihood of a crash. The contrarian conclusion was lots of negativity among strategists was encouraging.

Over 50 years, Birinyi developed a series of axioms:

Birinyi’s Axioms

Cyrano’s Principle: If it is as obvious as the nose on your face, the market also knows.The bearish case is always more compelling, and more articulate, while the bullish argument is usually about the future and the unknown.

Forecast environments, not events. Be bullish in a rising market and do not focus on the details.

Most indicators are descriptive, not indicative.

There is nothing more dangerous than an articulate incompetent.

Predicting rain doesn’t count; building arks or selling umbrellas does.

You are the only judge of experts.

Free advice is not worth it.

Investing really is a profession.

Previously:

MiB: Laszlo Birinyi (September 13, 2014)

How News Looks When Its Old (October 29, 2021)