Most people don’t know that it is the editors, not the writers, who craft headlines. This should be common knowledge among media consumers (but it’s not). Perhaps this is why well-written articles are often skewed or even undone by clickbait headlines.

Case in point: Wall Street’s ESG Craze Is Fading

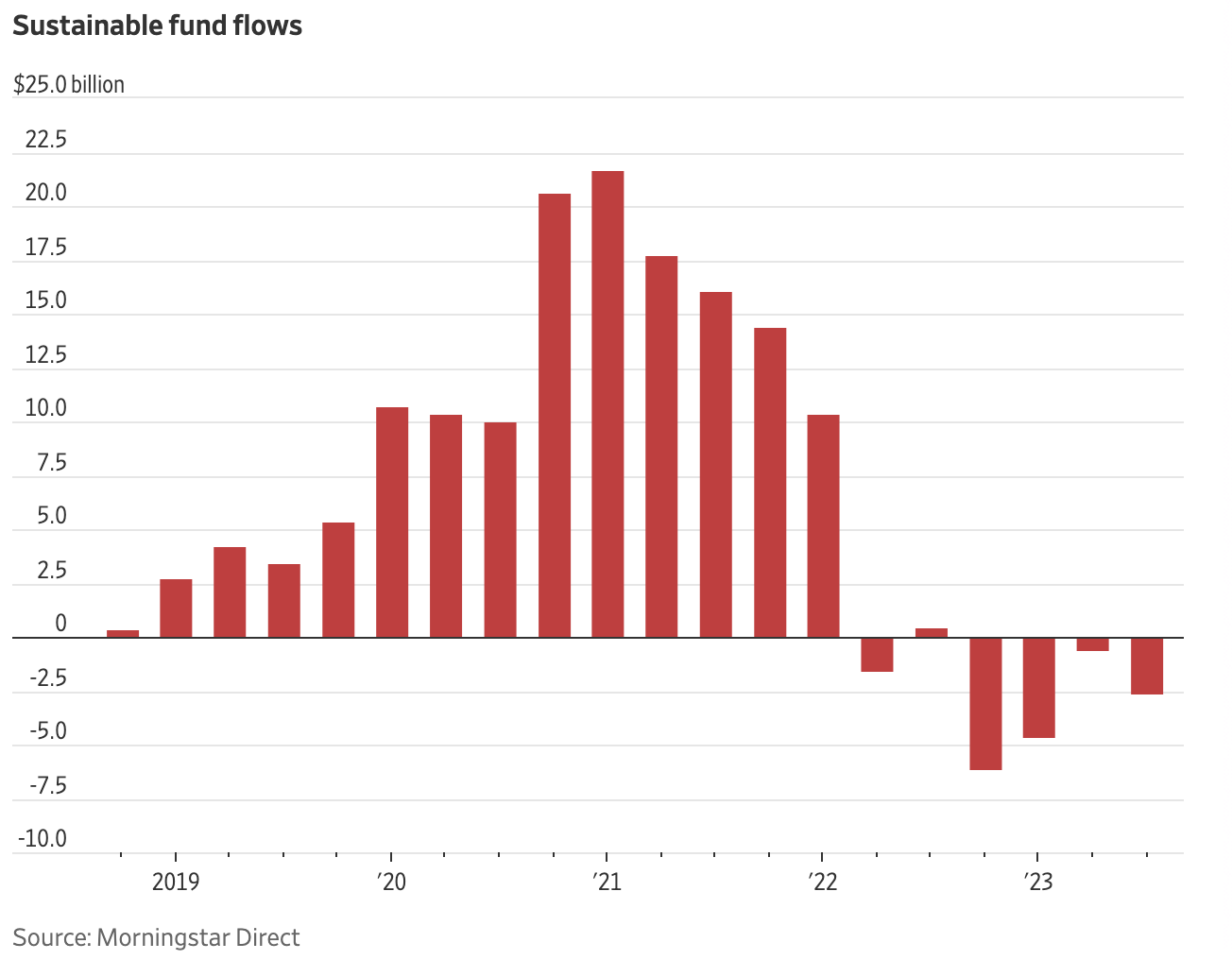

As the article points out, “investors withdrew more than $14 billion from sustainable funds this year” after weak performance traced in part to higher interest rates.1 But the article also points out that there is $299 billion remaining in funds (source: Morningstar). As the chart above shows, about a third of these inflows occurred during the prior decade. I would not cite a ~5% decrease as proof a “craze is fading.”

Worth mentioning: MSCI notes over $30 trillion is invested globally using ESG strategies.

Nuance can get lost when investing strategies become politicized, Perhaps a little history might help shed some light on the subject.2

We can trace socially responsible investing back to the 1800s, when religious groups avoided companies that made their money from alcohol, tobacco, or gambling. In the 1960s, students forced Ivy League college endowments to divest from South Africa in an era of legal apartheid. More recently, the Conference of Catholic Bishops do not allow their endowment to invest in companies that produce contraception, abortifacients or perform stem cell research.3

Meir Statman has spent his career researching how investor psychology impacts their behavior. His book What Investors Really Want delves deeply into that topic. As it turns out, investors are motivated not just by financial returns, but also by the “expressive and emotional benefits” their capital can have. The Santa Clara University Professor of Finance observes that investing “reflects our values, tastes, and status.”

My firm RWM uses Canvas for those clients who want their portfolios to reflect their values. The most popular ESG application of direct indexing software has been to remove guns and tobacco from portfolios. There are many other ways to use the software to affect how you invest; I’ll discuss this further in a future post.4

Consider ESG in the context of U.S. demographics: America is in the early days of a $68 trillion transfer of wealth from the post-War World 2 generation to their children and grandchildren. Their values, especially as expressed in how they deploy their capital, will be significant for decades to come.

No wonder socially responsible investing has become so politicized – that is a lot of cash up for grabs.

Those politics around ESG investing have become a battle over “Wokeness,” but anyone who studies the space can see that is not at all what ESG investing is about. It reflects the desire for investors to have their portfolios reflect their personal values. This is true whether you are pro-life or pro-environment.

Previously:

Tax Alpha (April 14, 2022)

Accessing Losses via Direct Indexing (April 14, 2021)

The Cutting Edge (September 30, 2021)

USA Is Smashing Its Clean Energy Targets (October 17, 2017)

Sources:

Wall Street’s ESG Craze Is Fading

By Shane Shifflett

WSJ, Nov. 19, 2023

Who Cares Wins: The Global Compact Connecting Financial Markets to a Changing World

Swiss Federal Department of Foreign Affairs, United Nations, 2004

__________

1: WSJ: “Conventional funds also lost money, but the pain was more acute for climate and other thematic products hit by high-interest rates and other factors.”

2. The acronym “ESG” became popularized in a 2004 UN report “Who Cares Wins.”

3. Discussed with Ari Rosenbaum of O’Shaughnessy Asset Management in “At the Money: Aligning Investments With Personal Values.” (Oct 31, 2023)

4. Our internal reviews show RWM clients use direct indexing (in order of popularity) t0 A) Tax loss harvest to offset capital gain taxes; 2) Reduce exposure to the market sector of their employer/stock options; 3) Express ESG views in what they own.