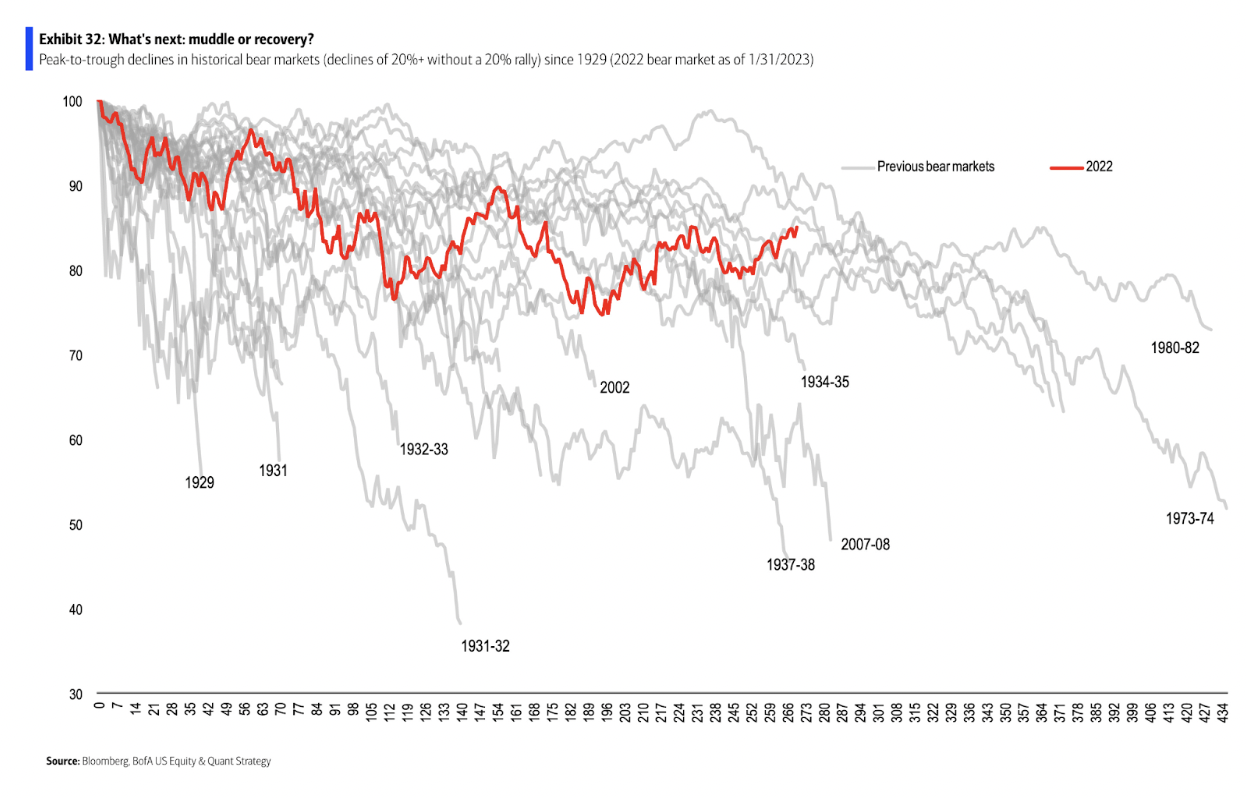

Have a look at the BAML chart above.1 It is one of my favorites, but for reasons that might not be readily apparent at first glance.

The chart shows the peak-to-trough declines of all the bear markets with the popular definition of a 20% decline, measured up until the start of the first 20% rally.2 The current move from 2022 highs is shown in red.

As Batnick points out, all of these horrendous periods of market pain are already factored into long-term returns of equities. Meaning, you do not get the 8-10% long-term gains without living through a significant number of market events, ranging from cyclical drawdowns to longer secular bear markets, and full-on crashes. It is all part of the dynamics of risk markets that by definition go up and down.

To state the obvious: “If you want to be there for the good times, you must also suffer through the bad times.” It is a too often forgotten cliché.

As I thought about this, I had an insight from my own experiences:

The Bear Markets that mattered the least felt like they mattered the most (and vice versa).

Allow me to unpack how I reached this conclusion.

Since I began on a desk in the mid-1990s, I have lived through multiple cyclical (~20%) and secular (long-term) bear markets:

1990: Recession: Markets fell 19.9%

1998: Russian Ruble: Markets fell 15% in August, on the way to 19.3%

2000-03: Dotcom implosion: 81% Nasdaq crash

2007-09: GFC: SPX fall 56.8% as credit markets froze.

2000-13: Secular bear market: did not make new highs until March 2013

2018: 19.8% pullback as the economy slowed, FOMC hiked

2020: Pandemic crash: 33.9%, fastest fall but fastest recovery, too

2022: Stocks & bonds both down >10%, 1st time since 1981

All of these meet the unofficial definition of a bear of a ~20% move off of the peak.3

I graduated law school (’89) into the oncoming 1990 recession; data suggests this negatively impacts your lifetime earnings. I had zero dollars in the market and was deep in student loan debt. The first bear I experienced was utterly meaningless economically but still felt bad. By the mid-1990s, I was switching careers from law to finance. My economic future was uncertain, but I felt confident I could make a go of it. My portfolio was tiny; I had no 401k, and my wife’s 403(b), with less than a decade’s worth of contributions, was barely 5-figures. 1997 was a little scary, as was 1998. The 2000 crash was the worst of all of these: The Nasdaq plummeted 81% from peak to trough.

From a purely economic perspective, these crashes were meaningless to me. I had so little actual capital at stake, and so much time to contribute to my savings and allow them to compound. If anything, meaningful price decreases created genuine buying opportunities to accumulate more investments (not that I was smart enough to take advantage of them).

But that was not at all how it felt at the time; in a new job where market levels affected salary, bonuses, economic stability, and even financial survival for many, it did not feel good. In fact, it felt horrible. People all around me freaked out, stress levels went through the roof.

Each of these Bear Markets mattered very little financially, but that was not how it felt at the time.

Where things begin to get interesting is towards the back half of those 30+ years, from the GFC forward. By then, we began to have meaningful assets in our savings/retirement accounts and the bear markets had a bigger economic impact on those finances. The GFC and the pandemic were global phenomena; the 2022 market was the worst since 1981 for a 60/40 portfolio. Not only is my portfolio substantially larger, but my entire business is closely tied to markets. My 401k, my salary, and the value of the firm are all tied up in how markets are doing. Downturns literally cost millions and should hurt a lot . . . but they don’t, and in fact, they have the exact opposite effect.

These recent Bear Markets mattered a great deal to me economically but did not feel that way.

This was curious, but the more you think about it, the more it makes sense. Let’s reframe the idea of bear markets; where I land is putting them into the broader context of life experiences. You get older, you live through these things before; you know everything is cyclical. “This too shall pass” is attributed to King Solomon, an adage to remind the sovereign to be humble in the face of good times and optimistic in periods of despair.

Markets are the same way: They go up, they go down, and it’s out of your control. How you respond to challenges and opportunities they present matters a great deal.

I have a suspicion that the biggest single factor that determines your success or failure when these events occur is simply the way you psychologically contextualize what is occurring. And as it turns out, that is (somewhat) in your control…

Previously:

What if Dunning Kruger Explains Everything? (February 27, 2023)

Looking at the Very Very Long Term (November 6, 2003)

____________

1. Thanks to Josh and Mike for chatting this up in this week’s What Are Your Thoughts?

2. You probably know I hate the 20% definition but let’s work with it for now; note mid-year 2022 bounce never got over 20%.

3. Intraday prices? Which index?

Since the 20% number is literally made up, I included those drawdowns that subjectively felt like they were cyclical bear markets, even if they are a fraction of a point off of the SPX being down 20% on a closing basis.