Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures:

• Tackling the biggest fraud in US history – pandemic relief: With estimates indicating that as much as $560 billion, or nearly 20%, was stolen out of more than $3 trillion distributed through the three main pandemic aid programs, Mr. Jaklitsch’s case illustrates the twin challenges now facing states and the federal government as they grapple with what is likely the biggest fraud in U.S. history. (Christian Science Monitor)

• Clarence Thomas and the Billionaire: For over 20 years, Supreme Court Justice Clarence Thomas has been treated to luxury vacations by billionaire Republican donor Harlan Crow. He goes on cruises in far-flung locales on Crow’s yacht, flies on his private jet, and keeps company with Crow’s powerful friends at the billionaire’s private resort. The extent of Crow’s largesse has never been revealed. Until now. (ProPublica) see also Clarence Thomas’s brazen violation of ethics rules, briefly explained: By allegedly accepting luxury trips from a Republican megadonor — and not disclosing them — Thomas may have run afoul of federal ethics law. (Vox) see also Clarence Thomas Broke the Law and It Isn’t Even Close: It probably won’t matter. But it should.. (Slate)

• Private Equity and Its Hospitals: “Safety net hospitals” serve communities like those in Delaware County, Pennsylvania. Finance companies serve themselves. (Washington Monthly)

• Inside TurboTax’s 20-Year Fight to Stop Americans From Filing Their Taxes for Free: Using lobbying, the revolving door and “dark pattern” customer tricks, Intuit fended off the government’s attempts to make tax filing free and easy, and created its multi-billion-dollar franchise. (ProPublica) see also “If You’re Getting a W-2, You’re a Sucker” There are many differences between the rich and the rest of us, but one of the most consequential for your taxes is whether most of your income comes from wages. (ProPublica)

• Dark money groups push election denialism on US state officials: Groups have created incubator of policies that would restrict ballot access and amplify election fraud claims. (The Guardian)

• How an Early Oil Industry Study Became Key in Climate Lawsuits: For decades, 1960s research for the American Petroleum Institute warning of the risks of burning fossil fuels had been forgotten. But two papers discovered in libraries are now playing a key role in lawsuits aimed at holding oil companies accountable for climate change. (Yale Environment 360) see also The thread that ties the recent chemical spills together: The growing oil and gas industry means more incidents like East Palestine. (Vox)

• The Dirty Secrets of a Smear Campaign: Rumors destroyed Hazim Nada’s company. Then hackers handed him terabytes of files exposing a covert campaign against him—and the culprit wasn’t a rival but an entire country. (New Yorker)

• ‘Scary’ new data on the last ice age raises concerns about future sea levels: A new study shows an ancient ice sheet retreated at a startling 2,000 feet per day, shedding light on how quickly ice in Antarctica could melt and raise global sea levels in today’s warming world. (Washington Post) see also The City That Fell Off a Cliff: Beneath the waves, off the Suffolk Coast, lies a city taken by the sea through centuries of erosion. Matthew Green revisits Dunwich, a once lively port transfigured into a symbol of loss, both eerie and profound, for generations of artists, poets, and historians drawn to its ruinous shores. (Public Domain Review)

• A Front Company and a Fake Identity: How the U.S. Came to Use Spyware It Was Trying to Kill. The Biden administration has been trying to choke off use of hacking tools made by the Israeli firm NSO. It turns out that not every part of the government has gotten the message. (New York Times)

• “Blurred Lines,” Harbinger of Doom: How Robin Thicke, Pharrell, and T.I.’s cursed megahit predicted everything bad about the past decade in pop culture. (Pitchfork)

Be sure to check out our Masters in Business next week with Aswath Damodaran, Professor of Finance at New York University’s Stern School of Business. Known as the Dean of Valuation, he teaches Corporate Finance and Valuation to the MBA students at Stern where he has been voted “Professor of the Year” by the graduating M.B.A. class nine times. His textbook “Investment Valuation” is the standard in the field. His next book comes out in December, and is titled The Corporate Lifecycle: Business, Investment, and Management Implications.

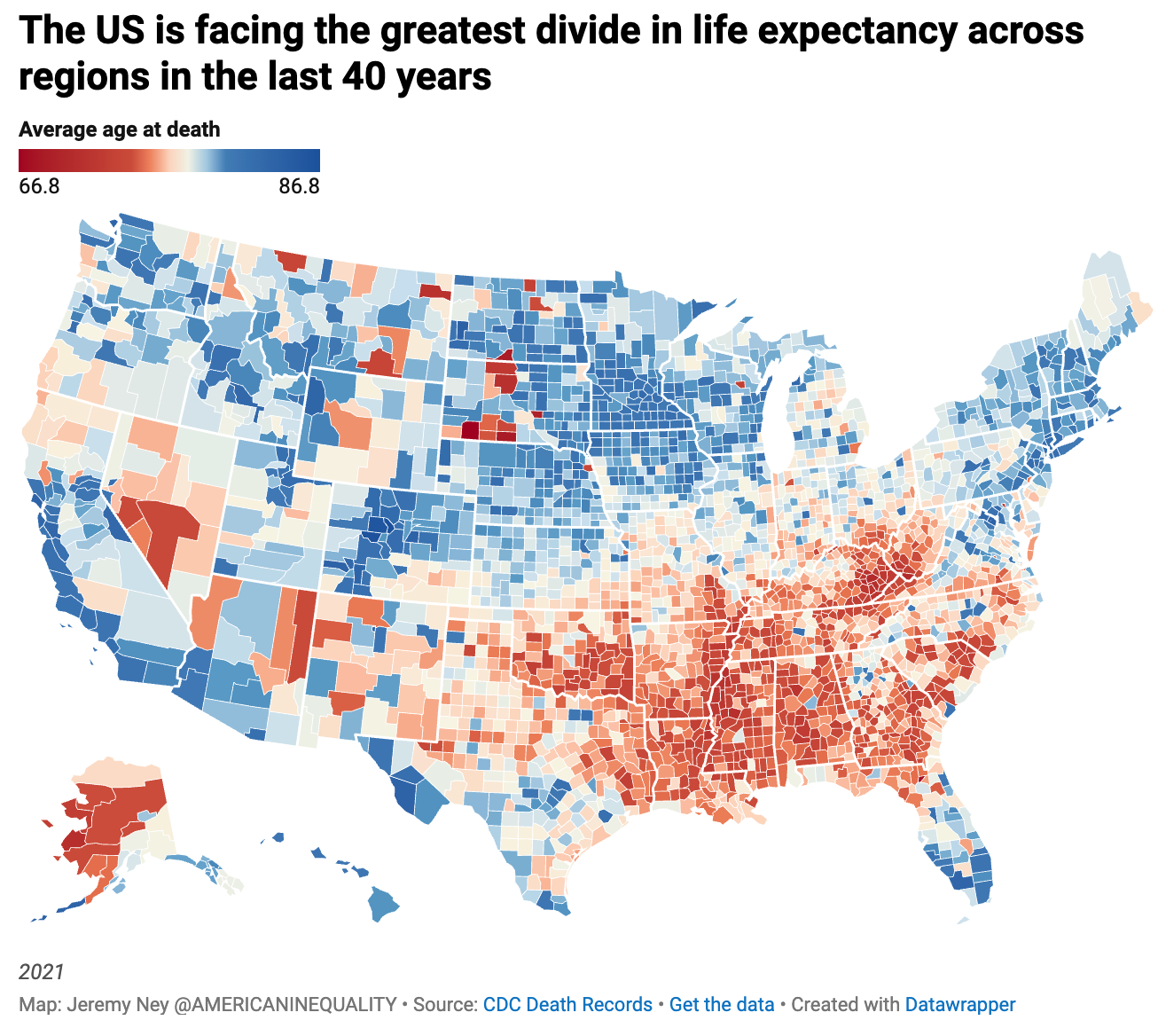

Life Expectancy and Inequality

Source: Medium

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.