Tax Planning for Startup Founders and Employees

Harness Wealth

FEBRUARY 26, 2023

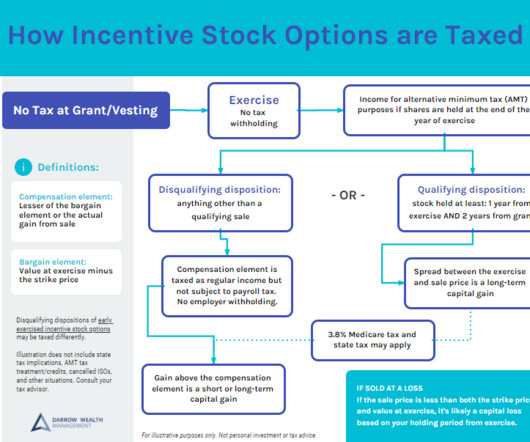

Cost-saving tax planning can be much more difficult to implement after your company is well-established and has reached the stage where an IPO, merger, or acquisition becomes a likely event. Types of shares to offer: ISOs, NSOs, RSAs, RSUs Startups must determine how best to issue stock shares to employees.

Let's personalize your content