Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job at a startup or private company with plans for an exit, there’s a lot to consider before accepting an offer. Depending on your life stage and financial position, you may be looking to increase or reduce the role of equity in your offer in exchange for more cash compensation today. Here are some considerations for how to negotiate equity in a private company or startup.

Negotiating equity in a startup or private company job offer

As with all aspects of your personal financial situation, the facts and circumstances about the company and your offer will be unique. Because of that, there’s no one-size-fits-all approach to negotiating, as the best outcome will vary with the situation. Further, negotiations are inherently a give and take. Asking for the moon is not only unlikely to be met with success, but it could damage the relationship with the employer. Rescinded offers are uncommon but not unheard of.

When considering the best approach for your situation, it’s important to prioritize your needs then wants. For example, if you have kids in college, you might be more focused on job stability and cash compensation today versus stock options in a company that might go public in ten years.

Don’t shy away from getting legal help

Strongly consider working with an employment attorney to review an agreement before accepting it. There are lots of material legal issues at play which are entirely outside the scope of this article. But don’t think hiring an attorney will cause the company to rescind the offer. You can seek legal advice without the company knowing, which can help keep things amicable.

Craig Levey, Partner and employment attorney at Bennett and Belfort in Cambridge, MA explains, “it is normal business practice to hire an employment law attorney to review and negotiate your equity agreement. In fact, most companies expect there to be legal counsel involved to ensure the individual has a full understanding of the legal terms included in the proposed agreement. From the individual’s perspective, you want to enter into the agreement with ‘eyes wide open’ as to all terms, including potential pitfalls.”

Particularly if you aren’t working with a financial advisor with experience with stock compensation, an attorney may be able to help you understand the equity side of the offer. In Craig’s experience, “many individuals have a false expectation as to when the equity options will vest, and legal counsel can provide clarity and suggest revisions if necessary.”

From a financial standpoint, here are some tips on approaching an equity negotiation at a private company or startup.

Start by taking stock of the situation

How much leverage do you think you have? What would you be leaving on the table at your current job if you left? Prepare for the negotiation by taking stock of the facts.

- Are you currently employed? Did you apply for this position or were you recruited? If you were laid off or are not currently employed, generally, you will have less leverage to negotiate terms.

- Are you in a strong negotiating position due to other factors? Does the company have an urgent hiring need? How unique is the skill set of this role? Are you particularly qualified for the position or is it a stretch (be honest with yourself)?

- What are you leaving behind? Quantify the value of unvested stock options/equity compensation, bonus income, 401(k) matching, salary, vacation time, and other benefits. A total compensation package is about a lot more than just cash payments. Also consider the job security you currently have relative to the new company.

- Why this job? Is this job your dream job? How long do you see yourself at the company? Is the position a stepping-stone to open doors at other firms? How passionate are you about what the company does and your role?

- What is the company’s expected timeline to liquidity and anticipated path (M&A, IPO, private equity, etc.)?

- Understand the company’s financial position. This is important for your own job security as well as the company’s ability to offer cash vs stock compensation.

Unpack the equity offer

What does the initial offer entail? Here are key provisions to gather:

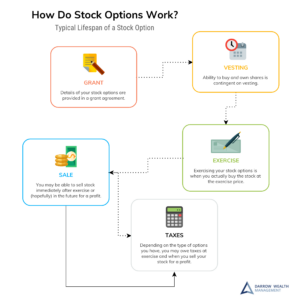

- What type of equity is being offered and how many shares

- Strike or purchase price for the equity

- Current 409a valuation

- Vesting schedule

Warning! Do NOT get ahead of yourself about the potential for a windfall. A lot of things need to go right. The company needs to grow and succeed, there must liquidity eventually, you need to vest in the stock AND afford to exercise (in most cases). Then there are the tax implications. Changes in the market/economy or industry landscape are also outside your control but can easily derail well-laid plans. The company will have a stellar pitch and want you to drink the Kool-Aid, but you need to be realistic about the risk and opportunity.

Use the offer to define your priorities in the negotiation

The details of the actual equity offer will help shape what you might ask for in a negotiation. Consider your expected timeline with the company and their projected path to liquidity. Depending on the composition of the equity, time horizon, and your financial situation, your goals in negotiating will differ.

For example, if the company is a startup with a longer runway, there may be an opportunity to exercise shares with relatively little cash outlay. This can also help with longer term tax planning optimization.

In this situation, if the cost to buy the shares is manageable and the taxable spread between the current value of the stock and the strike (or purchase) price is really low or even zero, you may want to ask about early exercise provisions (assuming you plan to stay at the company through vesting). Further, given the differing tax treatment depending on the type of equity, consider if it makes sense to ask for restricted stock or non-qualified stock options instead of incentive stock options in this example with an 83(b) election.

On the other hand, if the cost to buy the stock or tax impact would be prohibitive or unwise, then you’re probably not going to be able to exercise stock options even after vesting. In this situation, your upside is tied directly to a liquidity event (like an IPO or acquisition) and hopefully in-the-money shares are exchanged for cash or you have public market liquidity to pay tax or sell shares to exercise.

If liquidity seems a long way off or if you don’t anticipate staying with the company until that happens, consider asking for an extended period of time after separation from service to exercise options. Without it, you’ll only get 30 to 90 days. Also consider prioritizing cash compensation as the likelihood of benefiting from equity decreases.

Examples of negotiable terms in an offer and questions to ask

Given the variables that can apply depending on the situation, consider discussing your personal situation with an employment attorney and a financial advisor experienced with equity compensation negotiations. Here are some examples of terms you may be able to negotiate during the process, but by no means an exhaustive list.

Potential items to negotiate

- Better vesting terms

- What happens to your unvested stock after a merger, acquisition, or IPO? Ask for accelerated vesting of stock upon change in control (find out the definition of change in control first)

- Early exercise

- More shares

- Different type of equity (incentive vs nonqualified stock options, restricted stock, and RSUs). Keep in mind the different tax treatment and portability (or lack thereof) if you leave

- Consider negotiating severance upfront, inclusive of a bonus target and accelerated vesting of options

- Ask for an extended time after separation from service to exercise stock options (without it, you’ll only get 30 to 90 days for ISOs and NSOs and expect unvested restricted stock/RSUs to be forfeited

- Negotiate sign on bonus, salary, annual bonus target (if company is concerned about retention with cash-based payments, consider offering to have bonuses vest over a year)

- Compensation for forfeited stock, bonus, or other benefits in connection with accepting the new offer. And consider how you’d like to be compensated or in what combination (cash, stock, more vacation time, flexibility, etc.)

Questions to ask the company (and possibly negotiate depending on the answer)

- Is the company is planning to update the 409a soon?

- What are the repurchase rights if you leave the company?

- What happens to stock if you retire or are laid off?

- Non-compete agreements if you leave?

- If you have a bonus target, how is that calculated? Will you be paid pro-rata if you leave, retire, or are laid off before it is paid?

Negotiating equity in a private company is a key part to helping ensure a positive financial outcome. A lot of money can be made, lost or needlessly risked in pursuit of stock-based compensation. So be sure to make all your financial decisions on a realistic risk-adjusted basis. That said, the best opportunity you have to negotiate is during the initial offer. Don’t let it pass you by!

Article was written by Darrow Wealth Management President Kristin McKenna and originally appeared on Forbes.