A reader asks:

When we read articles about “How much you should have saved by age X”, should it not be “How much income you will be earning with savings Y”? Here’s my scenario: Mid 30s, worked at a public University for 11 years and left to take a job in the private sector. I have a pension at the University with a guaranteed fixed income and just starting a new 401(K). Total retirement savings doesn’t help me know if I’m on pace. Assuming a presumed 5% withdrawal rate and 8% 401(k) growth rate, wouldn’t a “calculated retirement payout” that can include things like pensions and Social Security be better than “make sure you have $1M by 50, etc.”?

Remember this commercial where people are walking around carrying their retirement number:

I need $500,000 to retire. Well I need $1 million. I couldn’t retire on anything less than $5 million!

I get the idea.

Goals and benchmarks are an important part of any long-term planning process. How do you plan ahead if you don’t know where you want to be?

But when it comes to retirement planning there are simply too many unknown variables. This is especially true for some in their 20s, 30s or even 40s.

Former Fed Chair Ben Bernanke once said, “Life is amazingly unpredictable; any 22-year-old who thinks he or she knows where they will be in 10 years, much less in 30, is simply lacking imagination.”

Life changes over time but so do incomes, savings rates, spending rates, inflation rates, interest rates, stock market returns and about a hundred other things you have no control over.

This is why financial planning is a process not an event. You need to make course corrections to your plan along the way as new information and circumstances come to light.

I do like the idea of backing into how much you need to save based on how much you need to spend.

Daniel Kahneman once asked, “How do you understand memory? You don’t study memory. You study forgetting.”

As Charlie Munger likes to say, “Invert, always invert.”

It’s pointless to try to figure out how much you’ll need in savings or income if you don’t have a good understanding of how much it costs for you to live.

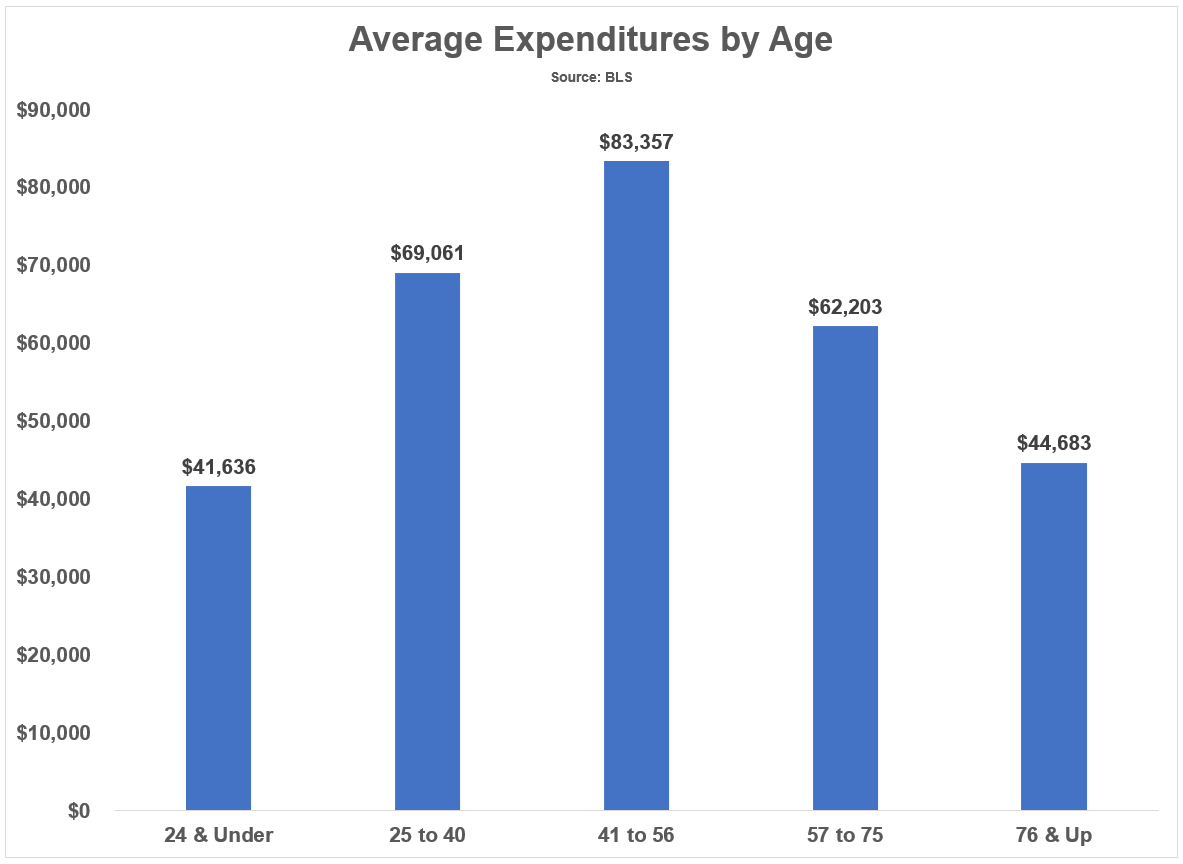

The Bureau of Labor Statistics publishes average annual spending levels by different age ranges:

Everyone’s circumstances are different but if we look at spending levels by different age groups you can see spending generally ramps up in your 20s and 30s, peaks in your 40s and 50s and slowly declines from there.

This makes sense as a general rule of thumb.

Young people don’t have high enough incomes to spend a lot. In your 40s and 50s, there are more responsibilities when it comes to spending plus you reach your peak earning years. And when you get up there in age, you’re not as active anymore so you don’t spend as much.

There are a lot of hard questions when it comes to retirement planning:

- Do I have enough money saved?

- How much will healthcare cost during retirement?

- When should I take Social Security?

- What if there is a market crash right after I retire?

- What will my tax rate be in retirement?

- What returns should I bank on going forward?

- How can I be sure my money will last?

The retirement equation is often fuzzy because there aren’t a lot of concrete answers to these questions. The dreaded ‘it depends’ applies here.

The only way to answer those questions is to ask yourself even more questions:

- How much debt do I have?

- What is my lifestyle inflation?

- What is my savings rate and how will it change over time?

- What assumptions am I using for market returns?

- Will I have any dependents relying on me to support them financially?

- How expensive is the cost of living where I reside?

- How much of my portfolio do I plan on spending down each year?

- How will my spending change as I age?

- How flexible will I be with my spending depending on market performance?

- What are my other sources of income in retirement (pensions, social security, part-time work, etc.)?

- What do I actually want to do with my money?

- How long am I going to live?

This is why it’s so important to tie your investments with your goals. How can you possibly know what to invest in if you don’t know why you’re investing in the first place?

The past is certain but the future should be looked at through a range of potential outcomes.

As expectations turn into reality, you can update your priors and your financial plan when necessary.

The truth is your number will change over time as you age and spend down your portfolio and see expected returns turn into historical returns.

The question of how much you’ll need can and will change over time.

Financial planning requires you to move the goalposts on a consistent basis both in terms of numbers and expectations since the future never turns out how we anticipate.

We discussed this question on the latest edition of Ask the Compound:

RWM advisor Ross Cohen joined me this week to go over other questions about saving vs. spending, yields on short-term bonds vs. money market funds, the different investment accounts you can open for your kids and retirement accounts for people who are self-employed.

Further Reading:

How Much Should You Have Saved in Your 30s?

Podcast version here: