Retirement Planning Cannot Be Linear

Wealth Management

APRIL 9, 2024

Adopting an adaptive approach to retirement planning acknowledges the dynamic nature of spending patterns and emphasizes flexibility in financial strategies.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Retirement Planning Related Topics

Retirement Planning Related Topics

Wealth Management

APRIL 9, 2024

Adopting an adaptive approach to retirement planning acknowledges the dynamic nature of spending patterns and emphasizes flexibility in financial strategies.

Carson Wealth

MARCH 7, 2024

By Jake Anderson, CFP ® , Wealth Planner When helping clients begin retirement planning, the same questions often arise: What should my retirement plan look like? Your lifestyle, goals, family situation, and risk tolerance will give a unique signature to your retirement plan. How much should I be saving?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? You need to start a retirement plan today.

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Your Richest Life

APRIL 15, 2024

Do you have a plan in place for your retirement? For many people, the extent of their retirement planning includes signing up for the plan at work – which is often more of a starting point than a comprehensive retirement plan. You can use multiple accounts to help boost your savings.

Wealth Management

MARCH 19, 2024

The key is finding the right firm that will enhance an advisor’s ability to work with retirement plans in an efficient and scalable manner.

WiserAdvisor

MARCH 13, 2024

Within this framework, the concept of the five pillars of retirement planning emerges as a valuable strategy. These pillars provide a comprehensive framework for building a resilient and sustainable plan. Pillar 4: Estate planning Estate planning is often overlooked and deferred as an end-of-life task.

The Better Letter

APRIL 6, 2023

Realistic Retirement Planning My children have consistently (and kindly) remarked about how grateful they are to have been able to graduate (with honors) from fine universities without any debt. Our retirement planning took a hit to do so. Much retirement planning advice focuses on saving more and saving earlier.

Talon Wealth

OCTOBER 26, 2023

Retirement planning is a critical part of financial security that many women still overlook. However, remember that as a woman, you have a longer life expectancy than a man, which means retirement planning is even more important. Retirement planning is an important part of financial security for women.

Talon Wealth

SEPTEMBER 14, 2023

Retirement planning can be a difficult and confusing process for couples. By focusing on a few key areas, setting financial goals, and doing your research, you can find ways to enjoy retirement together. Set Financial Goals In retirement, educate yourself on your financial situation and investment strategy.

Financial Symmetry

OCTOBER 30, 2023

There’s so much we can overlook with retirement plans. On this special Halloween-themed episode we’re sharing some retirement plan horror stories to avoid in your own wealth-building journey. Listen in to ensure that these horrors don’t ruin your retirement plans.

Getting Your Financial Ducks In A Row

APRIL 3, 2023

We’ve covered a lot of ground with regard to how various tax laws impact your retirement plans: pensions, IRAs, 403(b) and 401(k) plans. But we’ve primarily focused on the US income tax laws (the IRS) affect your plans – and there are many nuances that you need to take into account with regard to state tax laws.

Integrity Financial Planning

NOVEMBER 7, 2023

There are many important birthdays when it comes to retirement planning. So, as you approach your retirement, it’s crucial to have a few of these in mind as key milestones. 1] But you can begin to claim at 62 if that fits into your financial plan. 1] IRA holders can contribute $7,500 a year to their accounts. [1]

Wealth Management

OCTOBER 4, 2023

Advisors look toward holistic client-focused strategies with converging retirement planning and wealth management.

Getting Your Financial Ducks In A Row

NOVEMBER 7, 2022

When you have the bulk of your financial assets in retirement plans, you might accidentally expose yourself to some risks that you haven’t thought about… since retirement plan assets are much more likely to be impacted by changes to legislation – as we have seen in the past. No related posts.

WiserAdvisor

NOVEMBER 14, 2023

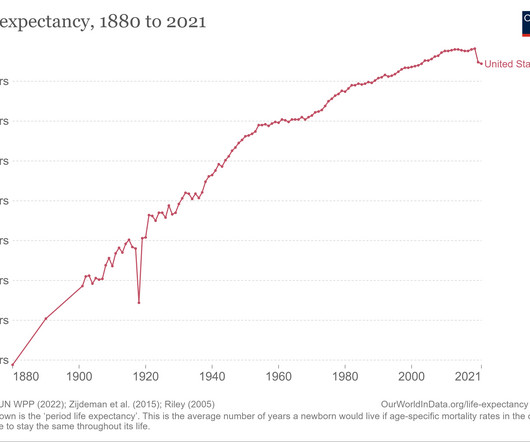

Retirement planning is an essential aspect of financial security, especially as one transitions from a phase of regular income to relying on savings and investments. With increased life expectancy, the modern retirement plan may need to account for not only a longer life but also for the increased expectations during this phase.

Advisor Perspectives

NOVEMBER 19, 2023

Individuals are increasingly looking for more tailored investment solutions, so it makes sense for plan fiduciaries to consider a more personalized approach, according to John Kutz, National Retirement Plan Strategist. He says personalization may be the ticket to better retirement outcomes.

A Wealth of Common Sense

AUGUST 4, 2023

The most popular retirement plan for people in the early-20th century and before was simple — you died. Most people simply worked until they dropped dead because a life of leisure in retirement wasn’t a thing for most people. No gold watch ceremonies when you hung it up at the office.

Wealth Management

FEBRUARY 16, 2023

The author of the recently published book, Retirement Reboot: Commonsense Financial Strategies for Getting Back on Track, discusses the challenges of retirement planning from both an advisor’s and client’s perspective.

Advisor Perspectives

JULY 3, 2023

I will describe the general process used by actuaries to maintain financial sustainability, to encourage advisors to employ this same process to their client’s retirement planning.

Talon Wealth

OCTOBER 26, 2023

Retirement planning can be a difficult and confusing process for couples. By focusing on a few key areas, setting financial goals, and doing your research, you can find ways to enjoy retirement together. Set Financial Goals In retirement, educate yourself on your financial situation and investment strategy.

Wealth Management

JUNE 12, 2023

But most wealth, retirement plan and benefits advisors are still stuck in silos and old business models.

Integrity Financial Planning

MARCH 13, 2023

4] Conclusion As you can tell, taxes are a major part of retirement planning, and often making the right choice for your retirement involves being savvy about which tax-advantaged retirement savings vehicles to use.

NAIFA Advisor Today

SEPTEMBER 16, 2022

Here are three ways people 62 and older (working in tandem with their advisors) can incorporate reverse mortgages into sound retirement plans to potentially improve retirement outcomes.

Advisor Perspectives

SEPTEMBER 24, 2023

For many wealth advisors, workplace retirement plans are either a burden or an afterthought, according to John Kutz, National Retirement Plan Strategist at Franklin Templeton. He and his team explore why embracing these plans can benefit their practice, and their clients.

Validea

MARCH 14, 2023

We discuss regular and Roth IRAs and 401ks and how to decide between them, the importance of human capital, how to balance retirement saving with other priorities and a lot more. Watch on YouTube Listen on Apple Podcasts Listen on Spotify The post Retirement Planning for Young Investors appeared first on Validea's Guru Investor Blog.

Advisor Perspectives

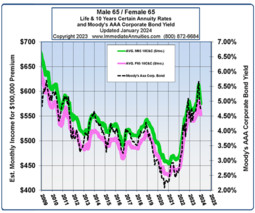

APRIL 15, 2024

With the interest-rate peak being the highest in 15 years, now is the opportunity to lock in near-peak lifetime income payments while avoiding future stock market losses.

Integrity Financial Planning

NOVEMBER 16, 2022

Why would someone not want to retire? (9:51). What if you don’t have enough money to retire? (13:59). The post Retirement Planning with Mr. Miyagi appeared first on Integrity Financial Planning, Inc. You don’t need to know everything to succeed. (4:25). Success doesn’t happen overnight. (5:38).

Random Roger's Retirement Planning

DECEMBER 23, 2022

We spend a lot of time here on unexpected, one-off, unbudgetable expenses that can blow up a retirement plan that doesn't have a lot of margin for error. This sort of potential sequence of expenses is an example of why retirement plan resiliency and flexibility is so important.

Carson Wealth

AUGUST 23, 2022

Retirement plans like 401(k)s and traditional or Roth IRAs can be an easy and effective way to save for retirement. Contributions to a traditional 401(k), IRA, and other retirements plans are usually deductible up to a limit. However, not all retirement plan contributions are tax deductible.

The Financial Literates

MARCH 23, 2022

10 Myths About Retirement planning Retirement planning has gained prime importance largely due to changes in the lifestyle of people, an increase in life expectancy, the concept of nuclear families, and an urge to live independent retirement life without being financially dependent on children.

The Financial Literates

MARCH 23, 2022

10 Myths About Retirement planning Retirement planning has gained prime importance largely due to changes in the lifestyle of people, an increase in life expectancy, the concept of nuclear families, and an urge to live independent retirement life without being financially dependent on children.

Validea

APRIL 24, 2023

In this episode of the Education of a Financial Planner, we take a detailed look at Monte Carlo simulation and how it is used in retirement planning. The look at the inputs that are used, how the simulation works and how to interpret the results.

Integrity Financial Planning

NOVEMBER 2, 2022

Coach Brian is here to guide you through what you need to know when it comes to your financial plan. We compare different football analogies to retirement planning to help you understand where you’re headed and find out if you’re making the right decisions. But first, we answer some questions from the mailbag.

Advisor Perspectives

JULY 7, 2023

Small business owners without workplace retirement plans now may take advantage of expanded tax credits if they establish one, according to John Kutz, National Retirement Plan Strategist at Franklin Templeton. He outlines recent regulatory and legal developments.

Wealth Management

MARCH 6, 2024

Beltz Ianni & Assoc., in Rochester, N.Y., has left LPL to become the sixth firm acquired by the indie RIA since its April 2023 debut.

Integrity Financial Planning

MARCH 15, 2023

18:46) The post The Downsides of a DIY Retirement Plan appeared first on Integrity Financial Planning, Inc. (11:14) Bonds are more predictable but still not guaranteed. (15:47) 15:47) Mailbag: What do we do about the taxes on selling our lake house? (18:46)

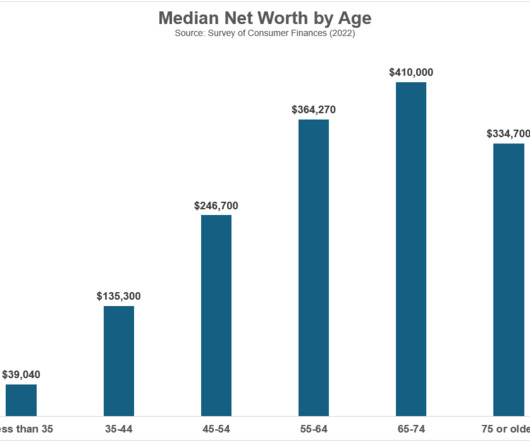

A Wealth of Common Sense

MARCH 14, 2024

This past week, I received three questions about retirement, all of which concern long-term planning at different stages of life. A reader asks: Chatting with the friends, we all seemed to be relatively close to one another in terms of cash on hand, investments in the market and current incomes.

Validea

MARCH 27, 2023

We discuss the Roth vs. traditional IRA debate, the importance of avoiding lifestyle creep, how to think about how much you need for retirement, the benefits of Monte Carlo simulation and a lot more.

Carson Wealth

AUGUST 25, 2022

often fail to consider sequence of return, housing, longevity, health or family risks faced in retirement. Focus on Your Retirement Plan Rather Than a Magic Number. would be “How do I plan for retirement?“ Social Security is a federal retirement plan originally created under the Social Security Act of 1935.

Random Roger's Retirement Planning

AUGUST 18, 2022

These are all things to incorporate into retirement planning in case every assumption we make at 40 or 50 turns out to be wrong. The back ups rely on my preserving optionality by maintaining relationships and the ability to bend down and pick up heavy things (a good way to frame staying able bodied).

Wealth Management

APRIL 14, 2023

OneDigital acquired Huntington National Bank’s 401(k) and retirement plan business this week, while Clearstead Advisors picked up local firm CLS Consulting. The Mather Group and NewEdge Wealth both announced key hires.

Nationwide Financial

JANUARY 10, 2023

Financial professionals, advisors and consultants can help plan sponsors understand how guaranteed lifetime income investment options may fit into their investment line-up. 2022 was a difficult year for many American retirement savers who watched markets drop and inflation dent their monthly budgets.

Steve Sanduski

APRIL 8, 2023

As I think about the nature of retirement planning, it is highly left-hemisphere focused. What’s missing from retirement planning, and financial planning in general, is the value, nuance, and context that right-hemisphere thinking brings to the table. What does all this have to do with retirement planning?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content