Weekend Reading For Financial Planners (December 28–29)

Nerd's Eye View

DECEMBER 27, 2024

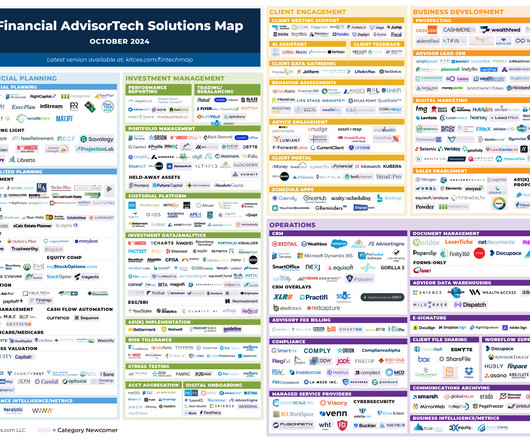

The report suggests this might be due in part to increased RIA valuations and the assumption of some firm founders that next-generation employees won't be financially able to buy out the firm from them, though additional data indicates that many firms don't have career paths in place that could help next-generation advisors envision their path to firm (..)

Let's personalize your content