Dear Mr. Market:

Let’s first remind our readers again of who this “Mr. Market” character is. Our investment blog and star personality is in reference to Benjamin Graham’s metaphor in his book “The Intelligent Investor,” where he personifies the stock market as Mr. Market, an emotional and erratic character. Over the past few decades, rarely have we seen such unprecedented market action but also a total tug of war between emotions, volatility, politics, and who will win ; the bulls or the bears. If you’re in the camp of being scared, confused, or frustrated…you are definitely not alone.

In the ever-changing world of financial markets, one must skillfully decipher signals, connect the dots, and make astute decisions that will mold the destiny of our investment portfolios. At this pivotal juncture, the question looms large: Are we relishing a Bull Market respite or merely observing a deceptive Bear Market rally?

Bull Market Respite: Optimists argue that the recent surge in market performance heralds a much-needed reprieve. Signs of economic rejuvenation, accompanied by recovering corporate earnings, have sparked renewed investor optimism. The supportive policies of central banks and promising sectoral advances (like tech and AI), paint a picture of resilience against recent market upheavals. However, caution is the watchword; these respites are often ephemeral, and prudence is our guiding light in these uncharted waters.

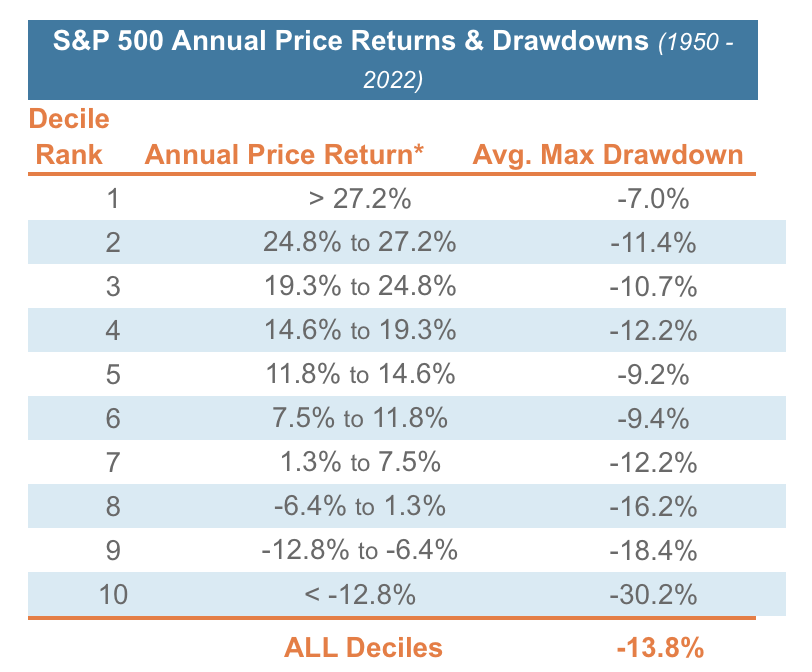

It’s completely normal to expect the market to take a breather. Most “experts” and pundits have been totally wrong predicting the start of this year so they’ve been increasingly married to their wrong premises. Like a broken clock being right twice a day, perhaps some of these bears will enjoy the recent market selloff but this is actually nothing unusual. In the chart below, we point you to where we still think the year will finish (up double digits)…specifically looking at “decile rank #5” as we believe we’ll finish the year in this range. That said, a -10% pullback would not be anything out of the ordinary.

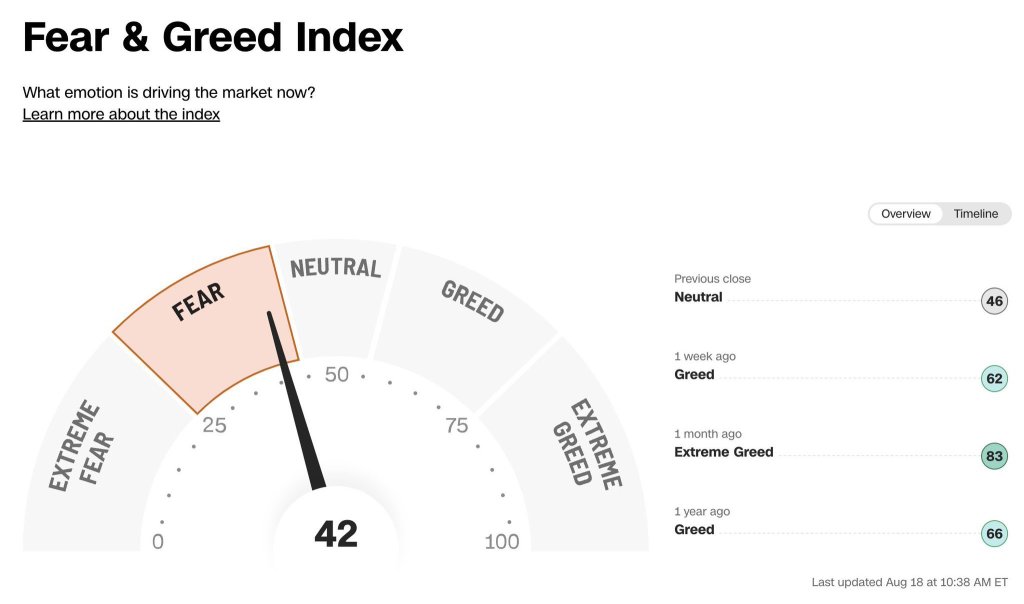

Bear Market Rally: Skeptics, however, point to the pages of history and the dangers lingering on the horizon. Bear markets are known to play tricks, proffering fleeting rays of hope before resuming their downward descent. This rally may well be a cunning mirage, driven by short-term market sentiment rather than a seismic shift in the bedrock of economic fundamentals. It is a seductive call that lulls the unguarded into perilous waters. It’s not hard to be bearish right now and there is more cash (over $5.3 trillion!) on the sidelines having missed the bulk of the 2023 recovery. Investor sentiment has increasingly turned bearish which usually tells us that the herd is late to the party. Last week we also saw the “Fear and Greed Index” tick up to a score of 42 for the first time since early Spring.

The Warning Signs: Amidst these debates, a key indicator demands our attention: the 10-year Treasury yield. Hovering stubbornly above 4.30%, this figure has historically foretold imminent recessions and, often, catastrophic market crashes. It’s a clarion call to heed, an ominous shadow cast upon the landscape. While it’s crucial not to be unduly swayed by one metric, the implications cannot be dismissed. We must be armed with knowledge, preparedness, and adaptability.

Much will continue to be made about the inverted yield curve, the 10 year Treasury above 4%, along with a looming and massive credit event that’s sure to come. Sure…there is ALWAYS a recession on the horizon but remember to look at things in full context. Perhaps we’re actually just getting back to normal after some extraordinary and truly unprecedented events the past couple of years?

In such crossroads, wisdom brings us back to “Dear Mr. Market,” reminding us that “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” Our focus should be the horizon, our approach, tempered by astuteness and patience.

Our path forward is shrouded in uncertainty, and therein lies its beauty. Above all else we encourage you to take your emotions out of this and stick to your plan. We, as investors, must embrace the unknown armed with intellect and discipline. Lastly, as we enter what undoubtedly will continue to be a “tug of war” for the next few weeks and months, we do indeed think the stock market will pull back some more. How much…nobody knows, but barring some cataclysmic event, simply expect a negative August and September (with some head fakes sprinkled in to make everyone right or wrong along the way) While we’re hopefully wrong, thus far it’s playing almost exactly to a script and movie we’ve seen several times before.

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” -Peter Lynch