Taxpayer Granted Time to Make Alternate Valuation Election

Wealth Management

JUNE 18, 2025

IRS allows estate to make late alternate valuation date election due to reliance on tax professional.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 18, 2025

IRS allows estate to make late alternate valuation date election due to reliance on tax professional.

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Resonant Capital Merges with Tax, Accounting Firm QBCo Wisconsin-based Resonant Capital and QBCo will share clients across wealth and tax in an increasingly popular service model. based QBCo Advisory.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B In 2023, he launched his own firm, Park Hill Financial Planning and Investment Management. “I Resonant Capital Merges with Tax, Accounting Firm QBCo Brennan’s experience is indicative of many young advisors working in the RIA space. Related: $2.2B

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they (..)

Harness Wealth

JULY 14, 2025

These alternative investments can offer distinct advantages in the shape of portfolio diversification and the potential for higher returns, but they can come with equally distinct tax complications that need to be carefully planned for. What are the key tax strategies for alternative investments in 2025?

The Big Picture

OCTOBER 30, 2024

Full transcript below. ~~~ About this week’s guest: Meb Faber is co-Founder and CIO at Cambria Investment Management, as well as research firm Idea Farm. The firm manages numerous ETFs, including those that focus on shareholder yield and is approaching 3 billion in client assets.

The Big Picture

MAY 20, 2025

The transcript from this weeks, MiB: John Montgomery, Bridgeway Capital Management , is below. 00:02:52 [Speaker Changed] Well, the statistical side definitely comes from my degree and then work as a project manager at MIT. First of all, my, some of my co-portfolio managers will bristle if you refer to us as a factor based firm.

Harness Wealth

MARCH 27, 2025

As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed. What are the tax implications of secondary transactions? What are the tax challenges in secondary transactions? What tax strategies optimize secondary investments?

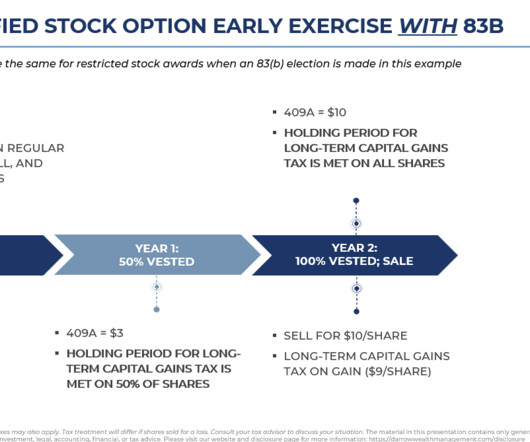

Darrow Wealth Management

APRIL 23, 2025

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. Section 83(b) of the tax code gives individuals the ability to accelerate the taxation of their unvested equity grant. What is an 83(b) election?

Harness Wealth

APRIL 16, 2025

Tax planning serves as the cornerstone of the entire acquisition deal, extending far beyond a simple checkbox. Every element, from structure to price negotiations, hinges on understanding tax implications for all parties involved. Get it right, and you will have set yourself up for a smooth transition and maximized returns.

Cornerstone Financial Advisory

NOVEMBER 25, 2024

Food for Thought… “Keep some room in your heart for the unimaginable.” – Mary Oliver Tax Tip… Did You Know That You Have the Right to Challenge the IRS? This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Diamond Consultants

DECEMBER 16, 2024

By Allie Brunwasser & Jason Diamond Its no secret that the wealth management industry has a major impending crisis: A shortage of quality next gen advisor talent. Said another way, if an advisor were to move to another firm or sell to a firm in the RIA space, it would create competition and likely drive up the valuation of the business.

The Big Picture

NOVEMBER 26, 2024

Full transcript below. ~~~ About this week’s guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. He is the chief investment officer at Bitwise Asset Management, the firm manages over 10 billion in client assets in crypto. All of them.

Cornerstone Financial Advisory

DECEMBER 16, 2024

.” – Alfred, Lord Tennyson Tax Tip… Have You Created Your IRS Online Account? This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional. Indexes do not incur management fees, costs, and expenses. stock market.

Cornerstone Financial Advisory

OCTOBER 28, 2024

This Week: Companies Reporting Earnings Monday: Waste Management, Inc. (WM) Food for Thought… “ Keep your thoughts free from hate, and you need have no fear from those who hate you.” – George Washington Carver Tax Tip… Is Your Office in a Historic Building? The forecasts also are subject to revision.

Cornerstone Financial Advisory

DECEMBER 23, 2024

.” – Anas Nin Tax Tip… What is the Lifetime Learning Credit? The Lifetime Learning Credit (LLC) is a tax credit for qualified tuition and related expenses. The credit is worth up to $2,000 per tax return. This information is not a substitute for individualized tax advice. stock market.

Cornerstone Financial Advisory

NOVEMBER 11, 2024

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional. Indexes do not incur management fees, costs, and expenses. The information in this material is not intended as tax or legal advice. stock market.

WiserAdvisor

MAY 29, 2025

IRAs offer tax advantages and encourage consistent, long-term investing. The key is to evaluate whether the companys future prospects justify its current valuation. Since index funds dont try to beat the market, they come with lower management fees and typically outperform most actively managed funds over the long term.

The Big Picture

JULY 1, 2025

She runs their private internal fund, about $108 billion that she manages primarily in fixed income, private credit, a variety of other assets. So, so does that create a problem or is it, Hey, we only have so much money to, to do and this is broader than we usually like, or how, how do they manage around that? Barry Ritholtz : Really?

Darrow Wealth Management

JUNE 24, 2025

Tax implications Interested sellers should always consult a tax professional before accepting a tender offer. There are many tax considerations and nuances which can impact the outcome. But in general, the tax consequences are as follows. Speak with your tax advisor and the company to find out more.

Steve Sanduski

FEBRUARY 18, 2025

How advisors can help clients properly value, insure, and document their collections The tax implications of buying, selling, and trading collectibles. Things such as valuation, insurance, storage, and the succession plan. Tom Ruggie and I discuss: The confluence of factors driving the rise in collectibles as investments.

The Big Picture

APRIL 29, 2025

This is Masters in business with Barry Ritholtz on Bloomberg Radio 00:00:17 [Speaker Changed] This week on the podcast, Jeff Becker, chairman and CEO of Jenison Associates, they’re part of the PG Im family of Asset Managements. Jenison manages over $200 billion in assets. Tell us a little bit about that.

Zajac Group

JANUARY 24, 2025

Your advisor should be able to provide you with an updated net worth projection and tax liability projection, as well as take a look at your portfolios overall diversification. The potential tax consequences of selling your shares. Selling during a tender offer may be less tax-efficient, depending on a few key factors.

Cornerstone Financial Advisory

NOVEMBER 4, 2024

This Week: Companies Reporting Earnings Monday: Vertex Pharmaceuticals Incorporated (VRTX) Tuesday: Apollo Global Management Inc. This also includes specific tax advice for military members on combat zone tax benefits, special extensions, and other special rules. Indexes do not incur management fees, costs, and expenses.

Validea

MARCH 7, 2025

Key Criteria for Stock Selection To find small, fast-growing companies, this strategy evaluates stocks based on a diverse set of fundamental metrics: Profit Margins A minimum after-tax profit margin of 7% is required, ensuring the company maintains strong profitability within its industry. annual return (477% cumulative).

Truemind Capital

JULY 18, 2025

Monetary and fiscal policies decisions in the form of the recent rate cuts and budget tax breaks can lift household consumption, especially in the festive season ahead. Elevated valuations on the back of a rebound in investor sentiment also make the market more sensitive to negative surprises. Overall supply is up sharply.

The Big Picture

MAY 22, 2025

Each week, At the Money discusses an important topic in money management. From portfolio construction to taxes and cutting down on fees, join Barry Ritholtz to learn the best ways to put your money to work. And at that point, forget the spreadsheets, forget the like the valuation comps. That is all hard at that point.

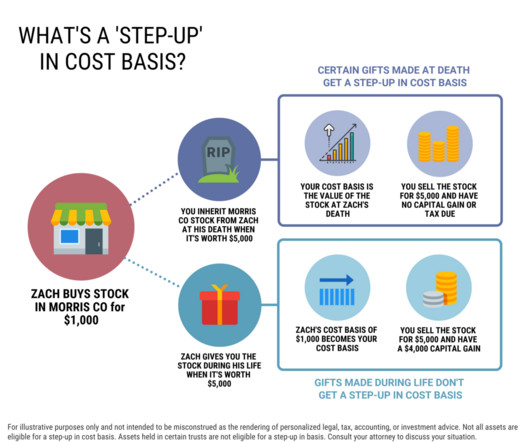

Darrow Wealth Management

JANUARY 16, 2025

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

Harness Wealth

FEBRUARY 4, 2025

However, unlike stocks and bonds, alternative investments, or alts as theyre commonly known, have unique tax treatments and complex reporting requirements that investors should carefully consider before investing. Well also go into some potential strategies to optimize tax efficiency. How Are Alternative Investments Taxed?

Cornerstone Financial Advisory

NOVEMBER 18, 2024

For the past couple of years, inflation has been the focus of the Fed’s efforts to manage rising prices by tightening the money supply. Confident consumers tend to spend money, which may take some pressure off the Fed as it looks to manage economic activity. Indexes do not incur management fees, costs, and expenses.

The Big Picture

JANUARY 21, 2025

The second highest paying job he was offered at 700 pounds a year was as a management trainee for Shell Oil. Barry Ritholtz : You go from Forbes pretty much during the golden era of, of mutual funds and star managers like the eighties and nineties, that was Peak mutual fund. And it was very formulaic.

Mr. Money Mustache

FEBRUARY 25, 2025

But if you manage to convince someone to hand over $480,000 for that same house, youve sold at a P/E of 20. For example, if the house brings in $2000 per month ($24,000 each year) and the sale price is $240,000, the next investor is buying a business with a price-to-earnings ratio of 10, because 240k/24k=10.

Investing Caffeine

DECEMBER 2, 2024

For starters, we are coming off a fresh election last month, and the majority of Americans decided to vote for the new administration that has promised additional stimulative tax cuts, and deregulation. This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 2, 2024).

Cornerstone Financial Advisory

DECEMBER 2, 2024

Treasury note yield is expressed in basis points. Tariff Talk Some of the post-election rally has been driven by investor expectations for less regulation and lower corporate taxes proposed by the incoming administration. This information is not a substitute for individualized tax advice. stock market.

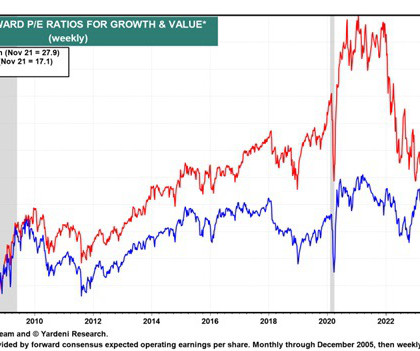

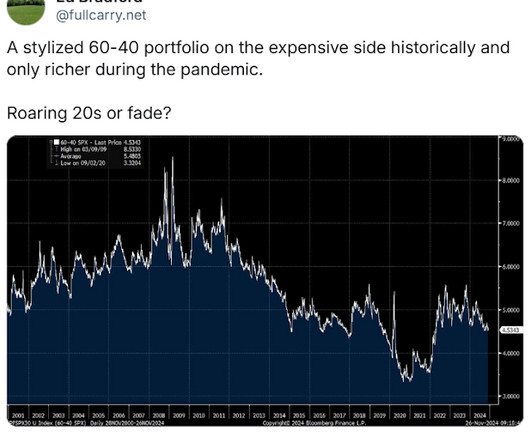

Random Roger's Retirement Planning

NOVEMBER 26, 2024

Krane Shares partnered with Hedgeye Asset Management to list yet another hedged S&P 500 ETF with symbol KSPY. Valuation as a tool for timing anything has a lousy track record. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

Wealth Management

JUNE 9, 2025

trillion and 121 million participant accounts along part of the $37 trillion overall in retirement assets, the pressure is causing many record keepers to dig deep and, for many, reinvent themselves or face exiting the market before their valuations drop even further just as it did for active asset managers years ago.

The Big Picture

APRIL 8, 2025

She was CIO at Merrill Lynch Asset Management, and now CIO at both Morgan Stanley Wealth Management and runs their asset allocation models and their outsourced chief investment officer models. She, she absolutely has a unique background and a unique perch on, on wealth management and what’s going on in the world.

Carson Wealth

APRIL 7, 2025

But what we do know is that with every decline, more risk has already been priced in and stock valuations have become cheaper compared to their longer-term earnings potential. A 40% tariff on their $10 of exports to the US would be $4, although US importers pay the tax.) This brings up an important point. Thats not the case today.

The Big Picture

JULY 15, 2025

Just an incredibly storied career who has managed to put together such a straightforward and intelligent way to approach asset management. And in it was the headhunter letter to the hiring manager. It was, I was, I was, it was like switching managers type thing, and somehow it got, it got put into the wrong file.

The Big Picture

MAY 27, 2025

And I found over the years that, that when I was doing business, I brought a strategic or political context to it when I was doing politics or political campaign management. And I was able to tax campus co-op. I taxed the student body. I learned, I was a district manager. It was a business. The election day. I built it.

The Big Picture

FEBRUARY 4, 2025

I found this to be absolutely fascinating and I think you also, with no further ado, my discussion with Apollo Global managements to in Slack. That’s why marginal tax rates in Denmark are 55%. Barry Ritholtz : But you left before you had to pay those 55% tax rates. Barry Ritholtz : That’s right.

Validea

MARCH 21, 2025

This Weeks Featured Strategy: Martin Zweig Growth Investor Model This week, we spotlight the Martin Zweig Growth Investor Model , a strategy that seeks to balance the aggressive pursuit of growth with a conservative attention to risk management. The top performing Zweig-inspired portfolio on Validea is the 20 stock, tax efficient portfolio.

The Big Picture

MARCH 25, 2025

O’Shaughnessy Asset Management, became a leader in direct indexing, eventually was bought by Franklin Templeton, leading him to launch O’Shaughnessy Ventures, O’Shaughnessy Fellowships, infinite Loops podcast, just so many different things. Valuations tended to crash and burn very, very cheap valuations tended to do well.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content