Some random thoughts about markets and investing I’ve been thinking about lately:

The fear of missing out and the joy of missing out are two sides of the same coin. In bull markets, you feel like an idiot for not going all-in on the highest of high fliers.

In bear markets, that FOMO quickly turns into JOMO (the joy of missing out).

If nothing else, both up and down markets provide reminders that there is rarely an easy stance when investing because everything is cyclical.

Self-confidence as an investor comes from being comfortable with uncertainty. One of the few things we all have in common as investors — everyone from Warren Buffett to the Robinhood noob with $50 — is an irreducible level of uncertainty.

It’s not easy to admit you don’t know what the future holds, but coming to this realization can make your life a whole lot easier since we all have a bunch of other stuff to worry about on a daily basis.

Once you let go of the illusion of control when it comes to the future, you focus on what you can control and let the chips fall where they may.

You never really know when you’re in a bubble but you always know when you’re in a crisis. Sure, there are people out there who call everything a bubble, but there is always a voice in the back of your head saying, ‘But what if this time is different?’ when everyone collectively loses their minds.

Plus, most bull markets last way longer than bear markets. Even if you’re right about a bubble call the timing is always the tricky part.

But everyone knows a crisis when we’re in one.

A bear market, an inflationary spike, a geopolitical conflict, a financial crisis — these things are obvious when they’re happening.

I’m not sure this is helpful, just a thought to ponder.

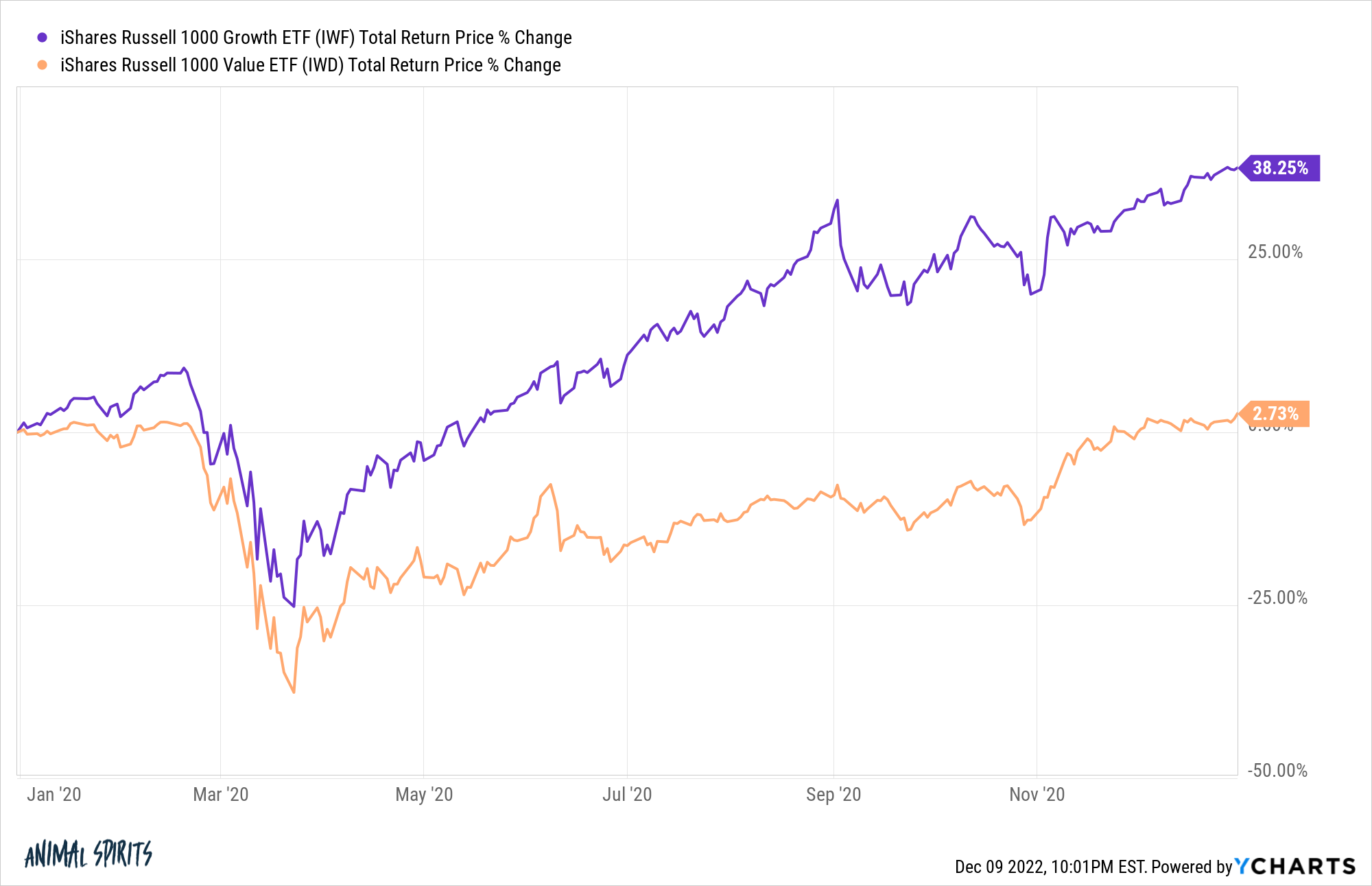

Outperformance feels better when the market is up. In 2020, growth stocks blasted value stocks:

In an up year for the markets, being left behind in boring old value stocks felt like you left something on the table.

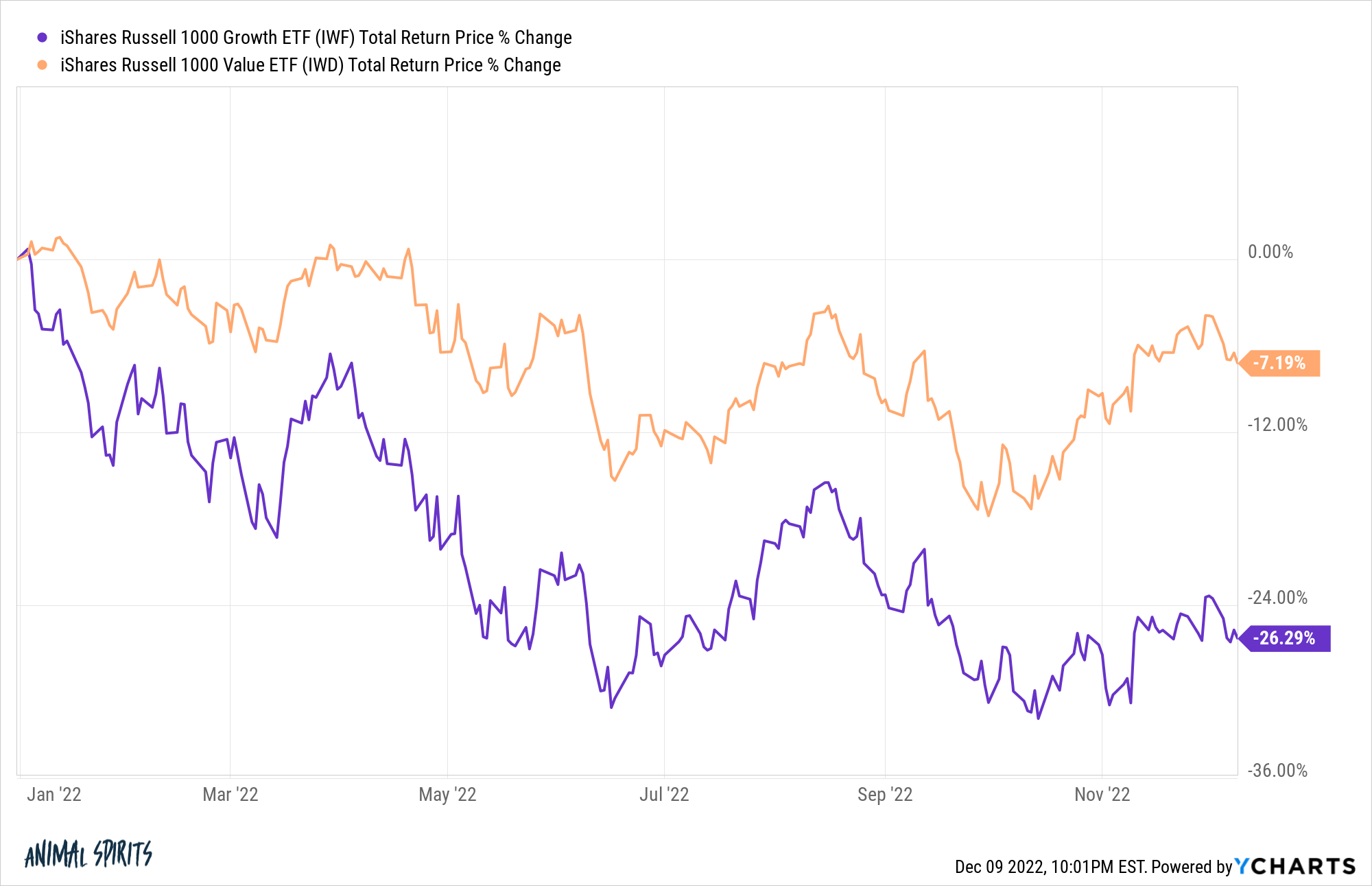

This year, value stocks are destroying growth stocks:

It’s been wonderful year for value stocks relative to the previously high fliers.

So which situation makes you feel better as an investor?

I don’t have a textbook psychological definition to explain this, but outperforming when markets are down doesn’t feel as good as when markets are up.

Maybe it’s just me.

There is a thin line between genius and idiot. Geniuses are crowned during up markets. Idiots are revealed during bear markets.

Sometimes it happens to the same people.

It’s important to remember that bull markets don’t make you more intelligent just like bear markets don’t make you stupider.

They just make you feel that way. The truth is usually somewhere in-between.

There are different kinds of investor intelligence. I used to work for a guy who had an Ivy League education. He created some of the most beautiful discounted cash flow models you’ve ever seen.

It took me weeks to figure out how every cell was connected or impacted by the different inputs.

This guy had textbook financial intelligence, which is important for investment success.

Yet spreadsheets and math alone are not enough to succeed as an investor.

You also have to understand how the markets work, with a firm grasp on financial market history, from booms to busts and everything in-between.

But even if you’re the smartest person in the room and read every book about market history, it doesn’t matter if you don’t have the requisite emotional intelligence to stick with your strategy without fail.

Temperament is more important than IQ but it’s really hard to learn.

Sometimes solid investment advice doesn’t work. Buy-and-hold is a marvelous investment strategy when applied to the right asset classes and securities.

But there are plenty of investments where a buy-and-hold strategy would be a terrible idea.

The Russell 3000 is a good proxy for the overall U.S. stock market (ex-some micro cap stocks). Nearly 20% of this index are currently in a drawdown of 80% or worse from their all-time highs.

Almost 1 in 10 are in a drawdown of 90% or more.

Some of these companies could prove to be diamonds in the rough but the majority of them will never return to their previous highs.

There are always exceptions to the rule.

Buy-and-hold has a higher probability of working for index funds than individual stocks.

Intuition is like a lottery ticket — memorable when it pays off but quickly forgotten when it doesn’t work. It’s human nature to attribute success in the markets to your prowess as an investor and mistakes to some external factor that’s beyond your control — the Fed, interest rates, inflation, the economy, etc.

George Soros might be able to use his back pain to make portfolio changes but most of us normal investors are probably better off automating our investment decisions and taking gut instinct out of the equation.

Bear markets are temporary in hindsight but feel like they’ll last forever when they’re happening. Every bear market in the history of U.S. stocks has resolved to all-time highs at some point.

Some take longer than others. But patience has been rewarded if you’re willing to deal with the uncomfortable times in the stock market.

Nothing is ever guaranteed and there is always the outside possibility that the entire world collapses and the stock market does too.

But are your investments even going to matter if that actually happens?

Investing in stocks when they are down is a bet on humanity figuring things out.

There are no sure-things but that’s a wager I’m willing to make.

Further Reading:

In the Markets Nothing is as Dependable as Cycles