Cyber Threats To Client Wealth And Well-Being: Why And How Wealth Managers Will Soon Play A Key Role In Managing These Risks

Nerd's Eye View

MARCH 15, 2023

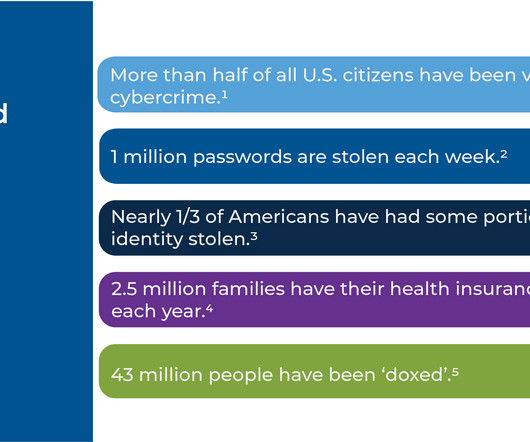

Risk management is a key part of many financial advisors’ value propositions. For instance, ensuring clients maintain the proper insurance coverage based on their needs is an important part of the financial planning process. stealing a client’s financial assets that are accessible online), identity theft (i.e.,

Let's personalize your content