Behind the Scenes: The Wealthy Wrap-Up The Year

Written by:

Lea Ann Knight, CFP®

Zoe Network Advisor

Behind the Scenes: The Wealthy Wrap-Up The Year

Written by:

Lea Ann Knight, CFP®

Zoe Certified Advisor

As 2022 draws to a close, do you ever wonder what the wealthy do in times like these? Are they sitting on cash, investing like crazy, or just ignoring their monthly statements like everyone else these days?

As 2022 draws to a close, do you ever wonder what the wealthy do in times like these? Are they sitting on cash, investing like crazy, or just ignoring their monthly statements like everyone else these days?

While the answer is probably all of the above, there are a few actions wealthy investors tend to take towards the end of each year. Considering how unexpected 2022 has been, below are a few steps you might take before kicking off 2023.

The Wealthy Stay Wealthy

Tax-Loss Harvesting

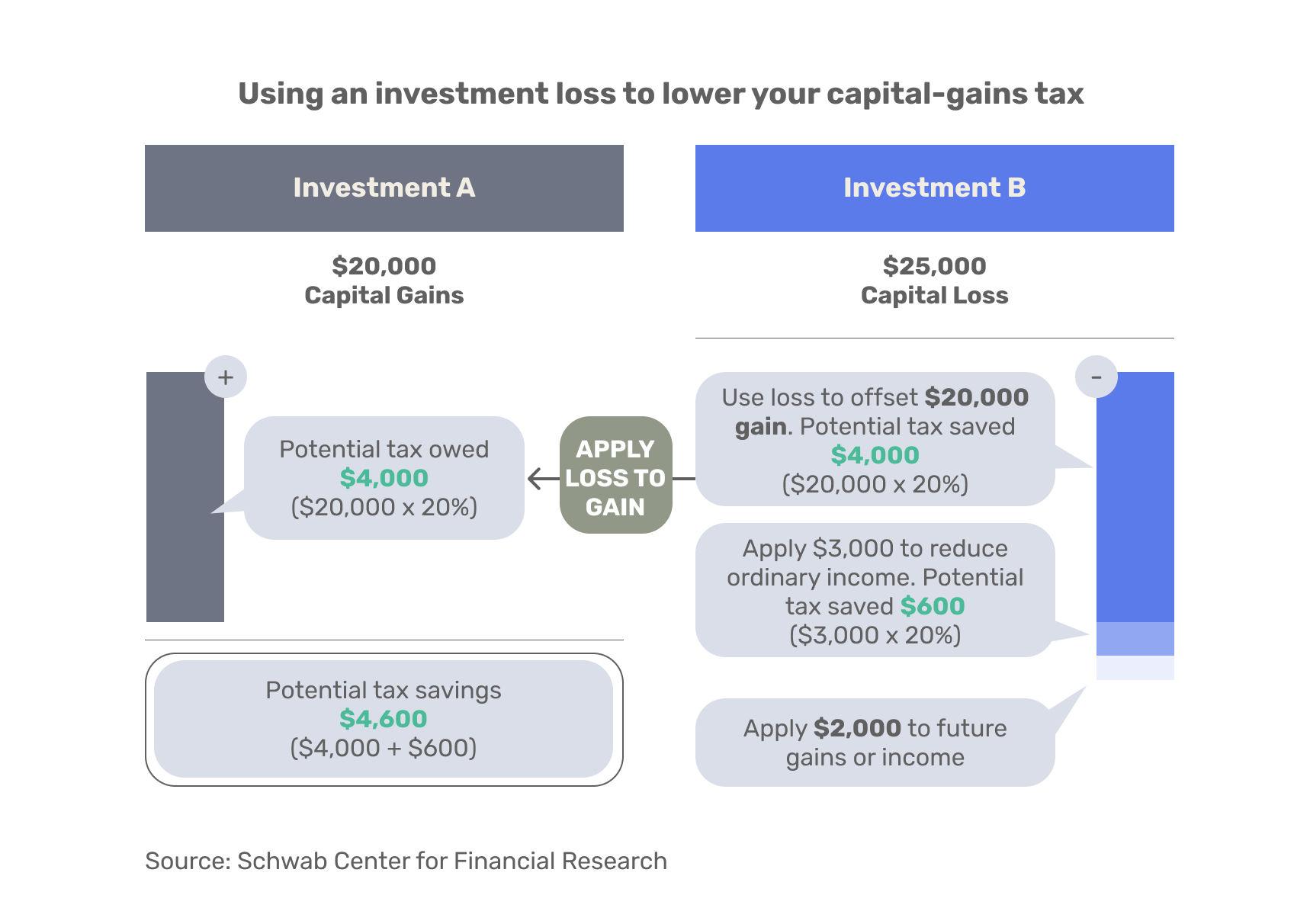

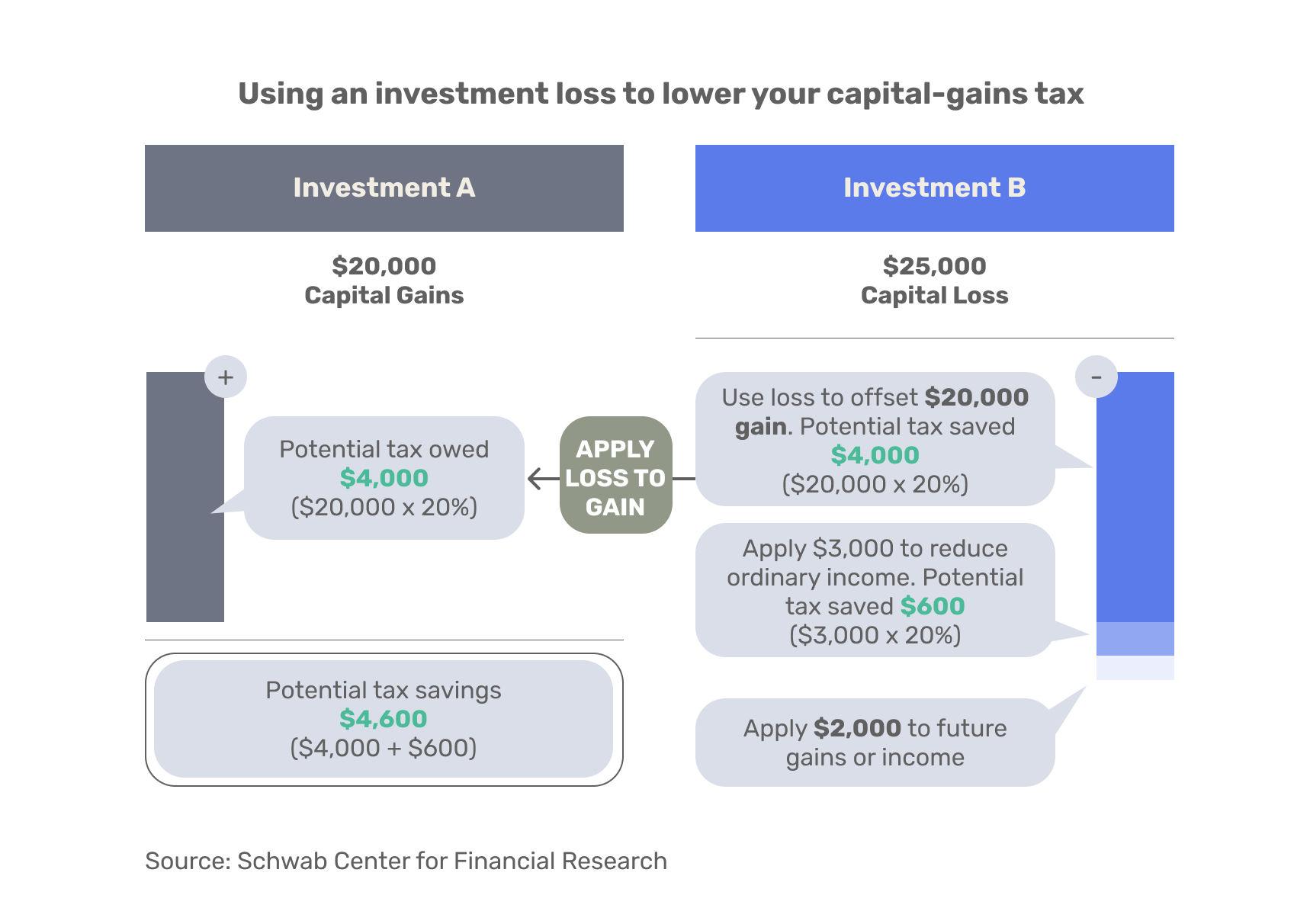

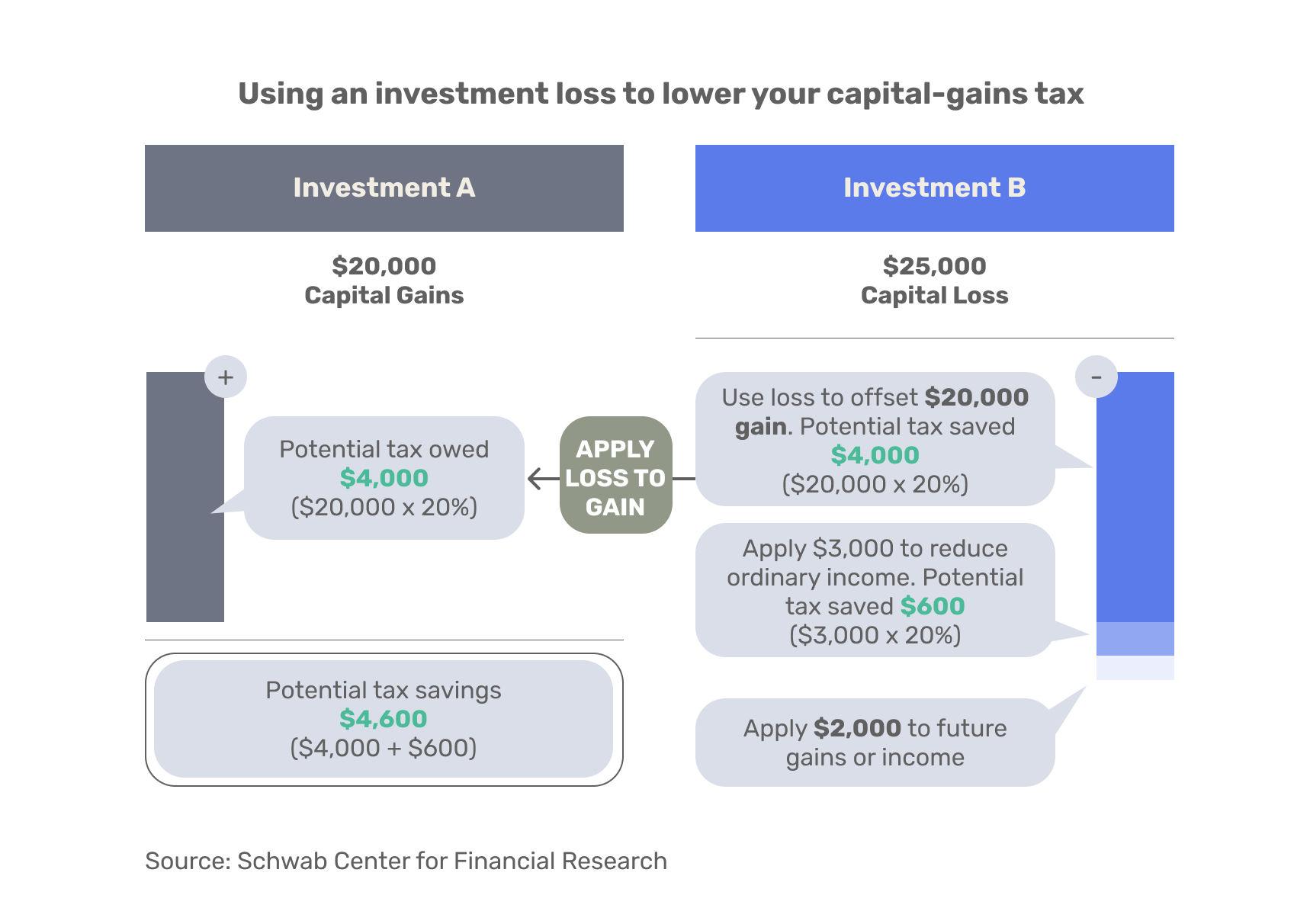

Those with wealth want to be smart about the taxes they pay. They often start with tax-loss harvesting around this time of year.

To implement this strategy, first look at all your investments in your non-retirement accounts. Are any currently sitting at a loss? If so:

- Sell those positions.

- Recognize the losses for your tax return.

- Repurchase them in 30 days to avoid wash sale rules.

Too many investors miss this easy opportunity to reduce taxes. With the year we’ve had, know you can generate some losses to carry forward to future tax years.

Roth Conversion

Another popular strategy this year, especially for those wealthy investors with large IRAs, is to consider a partial Roth conversion. Depending on your wealth type and your marginal tax bracket, converting some of your IRA to a Roth and paying the taxes now can make a lot of sense when stock and bond prices are depressed. Yes, you pay taxes on the conversion now, but you reduce your potential taxes later when taking required minimum distributions (RMD) from that IRA.

This Is What We Call Successful Distribution

Speaking of RMDs, many wealthy investors who are 72 and older use that RMD to make Qualified Charitable Distributions (QCD). This strategy allows them to make charitable gifts using their IRA without paying income taxes on the withdrawals. QCDs are especially helpful when you can’t itemize your charitable deductions. And, if you are between 70 and 72, you don’t yet need to take RMDs, but you can still take advantage of QCDs and reduce that IRA balance.

For those facing high taxes this year, there is no better way to reduce those taxes than to set up a Donor Advised Fund. In the old days, wealthy families often set up charitable Foundations to handle their charitable intent. These days, donor-advised funds make it much easier to take a large charitable deduction in a year of high income and then parse out the giving for years to come.

Building a Legacy

What about giving to family? Family gifting is another important year-end focus for many of my wealthy clients. While the Federal estate tax exemption is currently relatively high ($12.06 million in 2022), that limit is expected to decrease significantly in 2025. If that happens, many wealthy investors will be handing their heirs a hefty estate tax when they pass away. This is where annual gifting to loved ones (children, spouses of children, grandchildren) becomes a great way to reduce that future estate tax. If you live in a state with lower estate tax limits or worry you will be subject to future estate taxes, you can give up to $16,000 per person each year without filing a gift tax return. If you know you will be financially secure, don’t wait to share some of that wealth with your children. Many adult children have said they wished their parents had shared some of their wealth when they needed it most, not after becoming financially secure.

And even though there may be plenty of money for kids’ and grandkids’ college education, wealthy investors know to take advantage of the five-year accelerated gifting to a 529 college savings plan. For a couple considering funding a plan, you could put as much as $160,000 in one year into a plan that will grow tax-free and come out tax-free for educational purposes. Of course, you can’t contribute to that plan for the next four years, but you might not need to if a child or grandchild is young enough to benefit from years of growth before college.

Everything You Protect Will Grow

The wealthy may have plenty of money but are also savvy about protecting it. With the ups and downs in the property markets these days, the coverage on primary and vacation homes and rental properties may have changed significantly since the last time you updated your insurance coverage. So the question you should ask before making any decisions is, “can you replace the property at the current construction costs?”

Another key insurance coverage every wealthy investor has is umbrella insurance. If something catastrophic occurs in your car or at your properties, your auto or homeowner’s insurance will likely not completely cover the damages or ensuing lawsuits. Protecting it from a lawsuit should be your number one focus if you’ve accumulated wealth or even come into a significant inheritance. Umbrella insurance is inexpensive but critical to protecting wealth. Any net worth of $1 million or more should have umbrella coverage.

And what about life insurance? If you’re wealthy, do you need any life insurance? The answer might be a surprising yes – if you want to help your heirs with estate taxes. You might not need it to replace income, but the correct type of coverage could give your heirs the money they need to pay any taxes on their inheritance. Be sure to put those policies in an Irrevocable Life Insurance Trust, so the death benefit doesn’t get counted in your estate.

Purchasing Property/Taking on Debt

With post-COVID property valuations starting to soften and digital nomads called back to the office, some wealthy investors are considering purchasing a new home. Cash deals are all the rage, but not always the smartest move when you must liquidate stock or bond holdings to do it. Holding onto significant amounts of cash in a high inflationary environment means you are losing considerable purchasing power, while raising cash from a stock or bond portfolio may mean you are locking in permanent losses. If you are selling a property and buying a new one, but the purchase timing occurs before the sale, taking out a margin loan on your portfolio or securing a bridge loan from your bank for a brief time may make the most sense.

Knowledge Is Inherited If Done Right

And finally, the savviest wealthy investors take time over the holidays to talk to their children and loved ones about their financial situation. They feel it is a responsibility to ensure those who will be inheriting and/or managing their estate know their wishes, obligations, and values. Conversations are age-appropriate but start now with giving your loved ones the best gift – financial knowledge. It’s the best way to preserve your wealth even after you are gone.

The year-end comes with many reflections. As you think about your finances, remember your wealth should not be a burden. Proper financial planning lets you have peace of mind and enjoy the life you’ve worked hard for. Now that you know how to revise your financial plan as 2022 ends, you can sit back and enjoy your holidays.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners