Weekend Reading For Financial Planners (June 28–29)

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Harness Wealth

JULY 14, 2025

These alternative investments can offer distinct advantages in the shape of portfolio diversification and the potential for higher returns, but they can come with equally distinct tax complications that need to be carefully planned for. What are the key tax strategies for alternative investments in 2025?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harness Wealth

APRIL 30, 2025

Without proper planning, taxes can unexpectedly take a large bite out of the proceeds, potentially reducing financial security and the legacy. When you understand various exit strategies and their tax implications early, you position yourself to make informed decisions that maximize after-tax value while ensuring a smooth transition.

Harness Wealth

MARCH 27, 2025

As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed. What are the tax implications of secondary transactions? What are the tax challenges in secondary transactions? What tax strategies optimize secondary investments?

Cornerstone Financial Advisory

NOVEMBER 25, 2024

The content is developed from sources believed to be providing accurate information. Companies mentioned are for informational purposes only. Food for Thought… “Keep some room in your heart for the unimaginable.” – Mary Oliver Tax Tip… Did You Know That You Have the Right to Challenge the IRS?

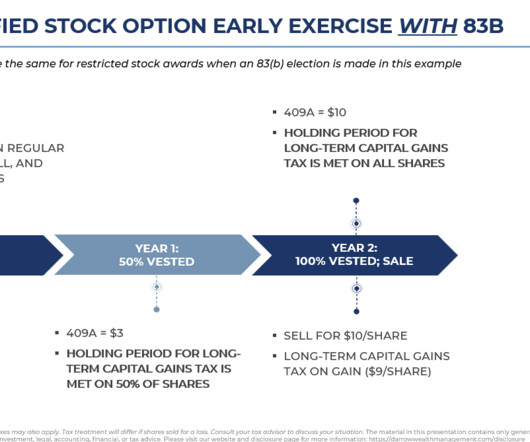

Darrow Wealth Management

APRIL 23, 2025

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. Section 83(b) of the tax code gives individuals the ability to accelerate the taxation of their unvested equity grant. What is an 83(b) election?

Harness Wealth

APRIL 16, 2025

Tax planning serves as the cornerstone of the entire acquisition deal, extending far beyond a simple checkbox. Every element, from structure to price negotiations, hinges on understanding tax implications for all parties involved. Get it right, and you will have set yourself up for a smooth transition and maximized returns.

Cornerstone Financial Advisory

DECEMBER 16, 2024

The content is developed from sources believed to be providing accurate information. Companies mentioned are for informational purposes only. ” – Alfred, Lord Tennyson Tax Tip… Have You Created Your IRS Online Account? This information is not a substitute for individualized tax advice.

Harness Wealth

APRIL 30, 2025

In this article, well examine the nature of IRS audits, the common audit red flags that result in IRS scrutiny, and how professional tax advisors can help reduce the risk of you being audited. An IRS audit is a formal review of your financial records to verify their accuracy and compliance with tax laws.

Cornerstone Financial Advisory

DECEMBER 23, 2024

The content is developed from sources believed to be providing accurate information. Companies mentioned are for informational purposes only. .” ” – Anas Nin Tax Tip… What is the Lifetime Learning Credit? The Lifetime Learning Credit (LLC) is a tax credit for qualified tuition and related expenses.

Cornerstone Financial Advisory

OCTOBER 28, 2024

The content is developed from sources believed to be providing accurate information. BRK.B), Exxon Mobil Corporation (XOM), Chevron Corporation (CVX) Source: Zacks, October 25, 2024 Companies mentioned are for informational purposes only. Taxpayers use Form 3468, Investment Credit, to claim the rehabilitation tax credit.

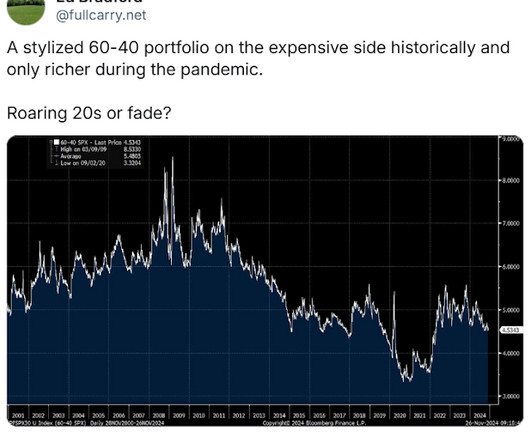

The Big Picture

MARCH 18, 2025

It is about the art of using imperfect information to make probabilistic assessments about an inherently unknowable future. We view valuation as a snapshot in time instead of recognizing how it evolves over a cycle, driven primarily by changes in investor psychology. Be tax-aware.

Cornerstone Financial Advisory

NOVEMBER 11, 2024

The content is developed from sources believed to be providing accurate information. Companies mentioned are for informational purposes only. This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Zoe Financial

MARCH 3, 2025

despite beating earnings expectations, showing high valuation pressure. Andres Disclosure: This material provided by Zoe Financial is for informational purposes only. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation.

WiserAdvisor

MAY 29, 2025

Achieving this goal requires making smart, informed decisions from the start. IRAs offer tax advantages and encourage consistent, long-term investing. The key is to evaluate whether the companys future prospects justify its current valuation. Even $1,000 can set a strong financial foundation and grow significantly over time.

Cornerstone Financial Advisory

NOVEMBER 4, 2024

The content is developed from sources believed to be providing accurate information. Companies mentioned are for informational purposes only. This also includes specific tax advice for military members on combat zone tax benefits, special extensions, and other special rules. The forecasts also are subject to revision.

Zajac Group

JANUARY 24, 2025

Your first move should be simple enoughgather up all the documents and ask all the questions necessary to make an informed decision. With this information, you may next want to reach out to your advisor. The potential tax consequences of selling your shares. How much is the offeror willing to pay per share?

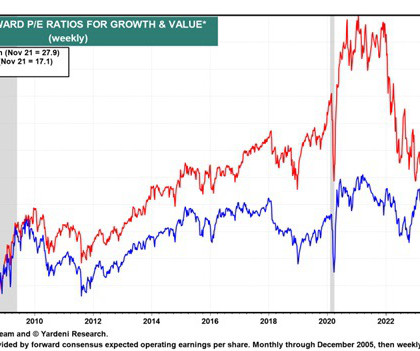

The Big Picture

JULY 1, 2025

So of course, what the Fed will do impacts markets, impacts valuations, impacts interest rates. 00:46:16 [Speaker Changed] I mean, if you look at the, the valuations, if you look at the fundamentals, it is, it’s surprising, right? So there’s still a pretty big valuation gap. So of course we follow it.

Darrow Wealth Management

JUNE 24, 2025

Tender offer rules If you’re approached with a tender offer of your company’s stock, you’ll be given some standard information: Seller eligibility. Tax implications Interested sellers should always consult a tax professional before accepting a tender offer. But in general, the tax consequences are as follows.

Zoe Financial

JANUARY 6, 2025

Will the Federal Reserve continue to lower interest rates, supporting valuations? Andres Disclosure: This material provided by Zoe Financial is for informational purposes only. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation.

Carson Wealth

JANUARY 6, 2025

Another theme we hear is that stock gains have been driven by valuations (multiples growth) where investors are simply willing to pay more for a dollar of profits. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Carson Wealth

NOVEMBER 11, 2024

Stocks Loved the News Optimism over lower taxes, deregulation, animal spirits and improved small business confidence all sparked a huge stock rally the day after the election, with the Dow up more than 1,500 points for the fourth-largest point gain ever, while the 3.6% gain was the best in exactly two years.

Cornerstone Financial Advisory

NOVEMBER 18, 2024

The content is developed from sources believed to be providing accurate information. Companies mentioned are for informational purposes only. Some letters need a response or action item, while some are to keep you informed. Please discuss your specific tax issues with a qualified tax professional.

The Big Picture

MAY 22, 2025

From portfolio construction to taxes and cutting down on fees, join Barry Ritholtz to learn the best ways to put your money to work. But we’re, this is just information gathering. And at that point, forget the spreadsheets, forget the like the valuation comps. It arrives in October, where he discusses just that.

Cornerstone Financial Advisory

DECEMBER 2, 2024

Treasury note yield is expressed in basis points. Tariff Talk Some of the post-election rally has been driven by investor expectations for less regulation and lower corporate taxes proposed by the incoming administration. The content is developed from sources believed to be providing accurate information.

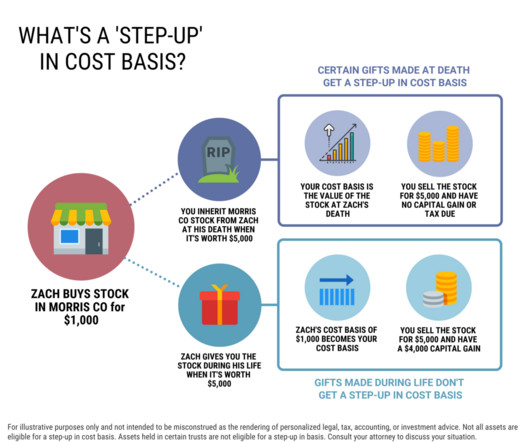

Darrow Wealth Management

JANUARY 16, 2025

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

Harness Wealth

FEBRUARY 4, 2025

However, unlike stocks and bonds, alternative investments, or alts as theyre commonly known, have unique tax treatments and complex reporting requirements that investors should carefully consider before investing. Well also go into some potential strategies to optimize tax efficiency. How Are Alternative Investments Taxed?

Zoe Financial

DECEMBER 9, 2024

Market Valuations : Multiples are no longer considered cheap. Andres Disclosure: This material provided by Zoe Financial is for informational purposes only. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation.

Mr. Money Mustache

FEBRUARY 25, 2025

I decided to try this for precisely the reasoning above: by allocating money across more categories than just US stocks and automatically rebalancing, we should be able to see slightly higher returns with slightly lower volatility, and some tax advantages as well.

The Big Picture

JANUARY 21, 2025

Tell us a little bit about why you did that, which turned out to be the right call, and how you shared that information with your readers. I think it’s very hard to say stocks are objectively cheap because all of these valuation metrics have, have become unreliable over the decades as the nature of the stock market has changed.

Random Roger's Retirement Planning

NOVEMBER 26, 2024

Valuation as a tool for timing anything has a lousy track record. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. I saw a reference to HELO being identical to Simplify Hedged Equity (HEQT).

Investing Caffeine

DECEMBER 2, 2024

For starters, we are coming off a fresh election last month, and the majority of Americans decided to vote for the new administration that has promised additional stimulative tax cuts, and deregulation. If these promises come to fruition, these changes could augur well for corporate profits and a rising stock market. Time will tell.

Carson Wealth

APRIL 7, 2025

But what we do know is that with every decline, more risk has already been priced in and stock valuations have become cheaper compared to their longer-term earnings potential. A 40% tariff on their $10 of exports to the US would be $4, although US importers pay the tax.) This brings up an important point. Thats not the case today.

The Big Picture

APRIL 8, 2025

And then the next step up seems to be full on wealth management, where you’re dealing with philanthropy, generational wealth transfer, a lot of bells and whistles including estate planning tax. It’s one thing to have a policy and say, okay, we’re deregulating X or here’s the new tax policy for the next four years.

The Big Picture

JULY 15, 2025

And then number three is gonna be sentiment and valuation. Now, sometimes people say sentiment and valuation, why are they together? My answer is that valuation is a reflection of sentiment 00:30:11 [Speaker Changed] Has to be, 00:30:12 [Speaker Changed] Yeah. So, so valuation is going to reflect sentiment.

The Big Picture

APRIL 29, 2025

We learned everything, you know, across from accounting to auditing to, to tax and valuation. I ended up in what was called the valuation services group, where we valued real estate and businesses either for transactions or for m and a activity. You know, in those days these companies hired, you know, crops of undergrads.

The Big Picture

MAY 20, 2025

What do you do with all of that information once you’ve documented a war crime in Ukraine? It’s been helpful for the after-tax return of the shareholders. I mean, and I immediately got the 80 20 rule. 00:04:40 [Speaker Changed] So you’ve previously discussed the epiphany you had at Harvard Business School.

The Big Picture

FEBRUARY 4, 2025

That’s why marginal tax rates in Denmark are 55%. Barry Ritholtz : But you left before you had to pay those 55% tax rates. I think everybody who’s listening is probably familiar with the Daily Spark, which is sort of your chart of the day, which is always fascinating and niche and chockfull of information.

Cornerstone Financial Advisory

DECEMBER 9, 2024

The content is developed from sources believed to be providing accurate information. Companies mentioned are for informational purposes only. ” – Helen Keller Tax Tip… Beware of the Fake Charity Scam There are so many scams out there. You may even be able to claim a deduction on your tax return.

The Big Picture

MAY 27, 2025

And I was able to tax campus co-op. I taxed the student body. But it was a paradigm that informed a whole new category when people said you couldn’t do this. I mean, we’ve, we’ve had valuations of 30 to $40 million of restaurant. And I came back to campus and I said, you know what? I built it.

Random Roger's Retirement Planning

JULY 11, 2025

The valuation of CRCL might be a little bit stretched, it's also more than 20x revenue. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. Its stablecoin is USDC which is the second largest after Tether.

Cornerstone Financial Advisory

DECEMBER 30, 2024

The content is developed from sources believed to be providing accurate information. Companies mentioned are for informational purposes only. ” – Leo Tolstoy Tax Tip… Do You Have to Pay Taxes on Your Hobby? Does your kids’ lemonade stand need to pay taxes?

The Big Picture

MARCH 25, 2025

Valuations tended to crash and burn very, very cheap valuations tended to do well. And then when we saw that the customization that the tax management, that all of that would be really appealing to not only our advisors but to our advisors clients. The, the tax side of it was a game changer. Right, right.

Nerd's Eye View

MAY 16, 2023

What's unique about Jim, though, is how he has scaled his retainer-based boutique firm to more than $7 million in revenue, a $31 million enterprise valuation, and is growing organically at a 40% growth rate, by providing a high-touch comprehensive advice offering for his business owner niche clientele.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content