Equity Market Insights:

Where is the recession? Despite being widely expected for many months, the recession has yet to materialize in the US and other developed economies. The interesting question is why the recession has yet not occurred even after one of the fastest increases in interest rates in history by all the major Central Banks in a very short span of time.

Here lies the answer as per the report from UBS:

- Monetary policy is not restrictive enough to cause a recession

- Fiscal policy is marginally expansionary and fuelling investment

- Strong household balance sheets are supporting spending

- Credit conditions have tightened, but they are not overly tight

- Labour demand and supply dynamics are keeping the market tight

With the see-saw of expectations from soft landing to slower growth along with expectations of early reversal of credit tightening, markets made strong upward movement. Sensex went up by 9.5% over the Apr-June quarter whereas BSE Mid and Small Cap index rose by 19% and 20% respectively. All the sectors went up with major sectoral growth seen in auto (up 22%), realty (up 33%), and consumer durables (up 13%) on the back of an improving economic outlook. India being highlighted as a beneficiary from the shift in Global equations along with the expected highest economic growth among major economies has attracted strong flows from the FIIs lifting overall market sentiments.

The recent rally in the market has made the valuations more expensive compared to historical standards. There is little doubt that India’s story is strong and would sustain for the next decade or two given the demographic advantage and favorable Global situation. However, heightened valuations do not provide comfort in replicating higher returns of the past in the medium term. Unresolved Global uncertainties can produce a black-swan event which may suddenly shift the perception from boom to gloom. Valuations across all sectors do not offer any margin of safety. We believe the markets will be more volatile over the next 1 year than they have been in the last 7 years. Higher volatility would throw more opportunities for long-term value investors.

We continue to stay under-allocated to equity (check the 3rd page for asset allocation) at the current valuation levels. The sectors we like are energy, pharma, and value stocks in large-cap space. At this stage, we strongly recommend minimizing exposure to small & mid-cap portfolios on the back of excessive valuations driven by the retail craze.

We are maintaining 5-10% portfolio exposure to Asian stocks (China, Singapore, Taiwan, etc.) on the back of valuation comfort and for diversification purposes.

Debt Market Insights:

The debt yields for the shorter duration came down a bit owing to expectations of relaxed monetary conditions with a better-than-expected decline in inflation numbers. Year-on-year declines in energy prices were the major contributor to overall inflation numbers across developed economies.

Long-duration yields remained elevated after a brief decline on the back of rising yields in the US market after the FED’s commentary on higher interest rates for a longer time. The pause in rate hikes by the FED and RBI in the last quarter resulted in range-bound yield movements. The upside risk on inflation remains in the US due to higher wage growth resulting in sticky core inflation. In India, monsoons can play a spoilsport resulting in higher prices of food which would keep the RBI on tenterhooks. Any spurt in energy prices would further deteriorate the inflation outlook.

We continue to believe that the reversal in interest rates may take some time since US Fed has clearly indicated that they will be data dependent and reading on core inflation is not falling fast enough which could warrant a change in stance.

We continue to prefer a portfolio duration of around 1-1.5 years with preferably floating rate instruments owing to volatility in the interest rate scenarios. Commitment to long-term maturity papers should be avoided since the odds of lower interest rates for a longer time are still not very strong.

Other Asset Classes:

After a strong rally, Gold cooled off in Q1FY24 on the back of profit booking and shifting focus towards equity. Gold continues to be represented in all our client portfolios with an allocation of 10-20% depending upon risk profile and equity exposure. Although there has been no major disturbing news Globally in the last quarter, we believe Global uncertainties are here to stay due to the tug-of-war on shifting Global economic power center.

Real estate prices in India have seen a jump in a few regions after a lull period from 2014 to 2021 on the back of rising income levels and the increasing appetite of investors to park surpluses. Any further upside may not be as strong as seen in the last 2 years. Overall, we continue to recommend sticking to asset allocation with discipline. This will ensure higher risk-adjusted returns over the long term with lower portfolio volatility and peace of mind.

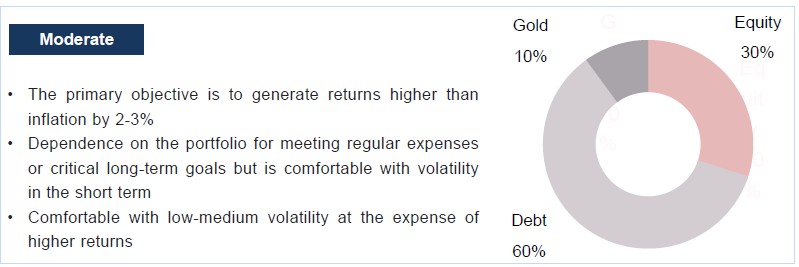

TRUEMIND’S MODEL PORTFOLIO – CURRENT ASSET ALLOCATION

Truemind Capital is a SEBI Registered Investment Management & Personal Finance Advisory platform. You can write to us at connect@truemindcapital.com or call us at 9999505324.