Hollywood Shuts Down & Market Goes Uptown

August 2, 2023 at 8:51 am Leave a comment

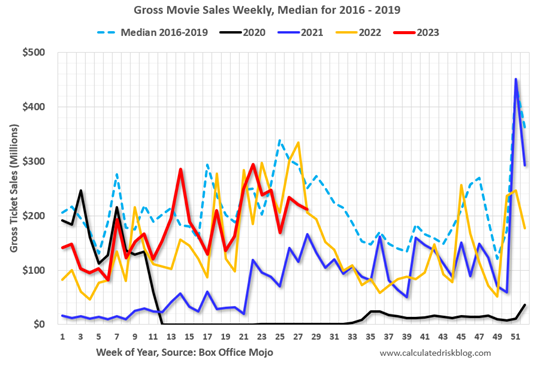

According to scientists, July set a record as the hottest month in 120,000 years. In order to beat the scorching heat, millions of Americans made the pilgrimage to their local air-conditioned movie theaters to watch the combo-blockbuster “Barbenheimer” (Barbie and Oppenheimer), which has raked in sales of more than $1 billion globally in the first two weeks of its release. Thankfully, in the short-run, Barbenheimer has given a shot in the arm to the beleaguered movie industry that suffered dramatically during the pandemic. The chart below (before Barbenheimer) shows industry sales have recovered (red line) somewhat, almost to pre-pandemic averages (dashed light blue line), but still has some ground to gain before industry sales consistently outpaces pre-pandemic levels.

Source: Calculated Risk

Movie Strike Explained

If movies are your gig, you better race to the theaters now because Hollywood has come to a grinding halt, thanks to a dual strike of Hollywood acting unions (SAG-AFTRA) and the Writers Guild of America (WGA) union. The feud between the unions and the movie/television studios centers around demands for higher pay, better working conditions, and protections from AI (Artificial Intelligence) technologies, which could theoretically replace actors and writers. Combined, the unions almost carry an estimated 200,000 members, which means a broad strike like equals no new movies, tv shows, or streaming content. The last time there was a “double strike” like this occurred in 1960 when former President Ronald Reagan was running SAG. Until the dispute is resolved, you better pace your media binging consumption habits because with no new content currently being created, the dispute may begin to eat into your show backlog on Netflix and disrupt your happy couch-streaming time.

Stocks on Fire

But scorching heat and red-hot popular movies were not the only things on fire last month. The stock market continued its fiery, blistering pace with the S&P 500 boiling higher by +3.1%, making the seven-month total gain of 2023 a spicy +20% (see chart below). The Dow Jones Industrial Average joined in on the fun too. Not only did the Dow increase by +3.4% for the month, the index rose for 13 consecutive days, the longest streak of daily advances since 1987. Bubbling up to the top of the performance table, however, is the technology-heavy NASDAQ index (home of the largest Magnificent 7 technology stocks – see also Fight the Fed) with a sizzling +4.1% return for the month, and a scalding +37% rise for the year, so far. The pace of gains is not sustainable forever, so it’s important to have a disciplined process in place to manage the risk of over-extended, over-valued investments, which is exactly what we do at Sidoxia Capital Management.

Source: TradingEconomics.com

Inflation Moving in the Right Direction

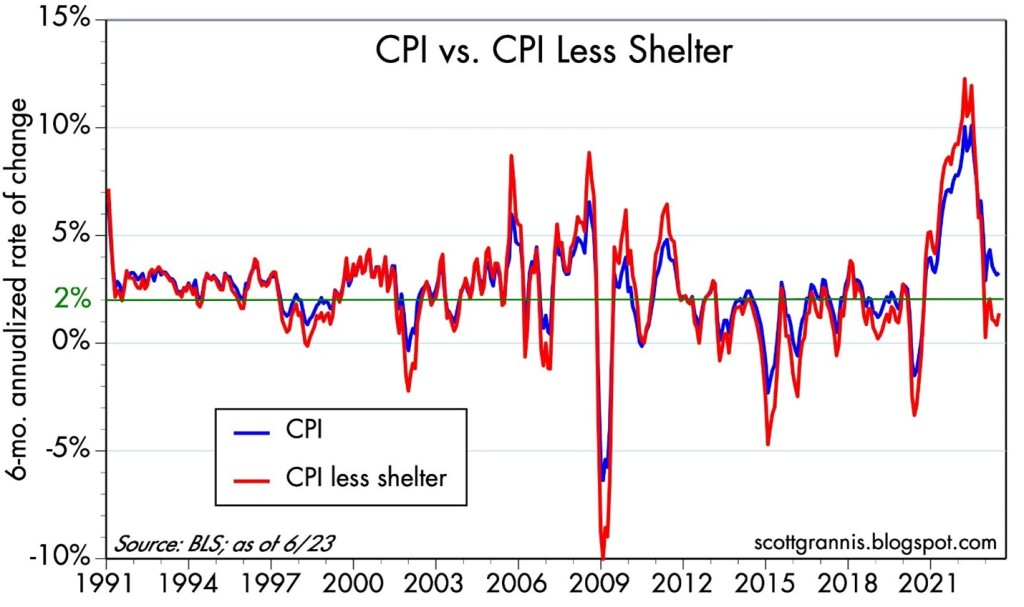

After such a lousy 2022 in the financial markets, why such a searing return for 2023? The biggest reason can be summed up with three words: inflation, inflation, and inflation. More specifically, it’s the pace of “disinflation” we are witnessing that is getting people so excited. As you can see from the chart below, annualized inflation as measured by the Consumer Price Index (CPI) has declined dramatically to 3.3% (blue line), while CPI less shelter (red line) has dropped to 1.4%, which is below the Federal Reserve’s 2% target (green line). These trends have gotten investors excited because they believe Jerome Powell, the Fed Chairman, is closer to ending this year-and-a-half long interest rate hiking cycle. In fact, investors are currently betting for multiple interest rate cuts in 2024.

Source: Calafia Beach Pundit

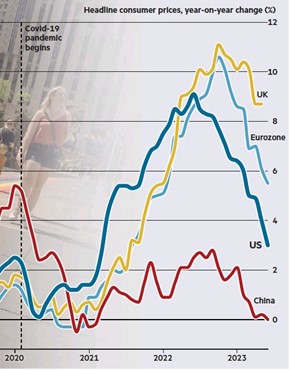

And the disinflation phenomenon is just not limited to U.S. borders – we are witnessing the same disinflationary trends across our borders (see chart below).

Source: The Financial Time (FT)

Confident Consumers

While many economists and traders have incorrectly been calling for a recession for some two years, a more resilient U.S. economy just reported better-than-expected growth for the 2nd quarter (+2.4% – Gross Domestic Product [GDP] growth). The stronger economy along with the improving inflation dynamics mentioned previously have buoyed Consumer Confidence too, as you can see from the chart below.

Source: Calafia Beach Pundit

Everything isn’t perfect (it never is). We continue to experience geopolitical risk as a result of the destabilized war between Russia and Ukraine; growth in China has stalled and not recovered from the pandemic; complacency is beginning to filter into investor attitudes; and we live with a dysfunctional Washington political process. But the economy remains strong, inflation appears to be cooling, and short-term interest rates could be close to peaking. Your air-conditioning bill may be going up this summer, but so will your stock market portfolio, if your investments are being properly managed.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (August 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Entry filed under: Earnings, economy, Education, Financial Markets, Fixed Income (Bonds), Government, inflation, Interest Rates, Stocks. Tags: bonds, consumer confidence, CPI, economy, Federal Reserve, inflation, interest rates, investing, Politics, Sidoxia, stock market, Stocks, strike, Wade Slome.

Trackback this post | Subscribe to the comments via RSS Feed