My mid-week morning train WFH reads:

• What to Know About TurboTax Before You File Your Taxes This Year: Don’t get tricked into paying for tax prep if you don’t have to. Learn how the biggest tax preparation companies have suppressed free filling options for years. (ProPublica)

• The Bloomberg Terminal Just Got a ChatGPT-Style Upgrade: The new technology is designed to make searching the terminal simpler. (Institutional Investor) see also How Will AI Change Investing? I Asked a Chatbot: Are analysts toast? Will opportunities to find mispriced securities disappear? Is my fund bloated? ChatGPT kisses and tells. (Morningstar)

• Investors Sold REITs in Response to the Banking Crisis. They May Have Overreacted. “We are less focused on the risks to REITs and more focused on where private market property valuations are going,” says Cohen & Steers’ Rich Hill. (Institutional Investor)

• There’s Exactly One Good Reason to Buy a House: Owning a home won’t make you happy. Filling it with love will. (The Atlantic)

• How You Can Grab a 0% Tax Rate: The zero rate on investment income is often overlooked. Make sure it’s in your tax tool kit. (Wall Street Journal)

• Not even wrong: predicting tech: “That is not only not right; it is not even wrong” – Wolfgang Pauli. (Benedict Evans)

• Trump’s Net Worth Plunges $700 Million As Truth Social Flops: The former president’s fortune dropped from an estimated $3.2 billion last fall to $2.5 billion today. The biggest reason? His social media business, once hyped to the moon, has come crashing down, erasing $550 million from his net worth—so far. (Forbes)

• All the Big (and Small!) News From Watches & Wonders Geneva 2023: 2023 (Bloomberg) see also The Best New Watch Designs of 2023: Here are the top timepieces from the annual Watches and Wonders trade show in Geneva. (Wall Street Journal)

• FLASHBACK: When right-wing pundits thought political hush money payments were a crime: “The facts are that he broke campaign finance laws and that he lied to cover it up,” Fox News’ Sean Hannity said. (Popular Information)

• A Collection of Cherry Blossoms: Spring started a little more than a week ago, and the Northern Hemisphere has begun to warm; flowers and trees are blooming. Gathered below are some recent images of people enjoying themselves among groves of flowering cherry-blossom trees in Tokyo; Munich; Washington, D.C.; and more—signs of warmer days to come. (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Ken Kencel, founder and CEO of Churchill Asset Management. The private credit firm manages $46 billion in private capital and is an affiliate of Nuveen, the $1.1 trillion asset manager of TIAA. Churchill was the top U.S. private equity lender in 2022 and was “Lender of the Year” according to M&A Advisor. Kencel was named one of private credit’s 20 power players.

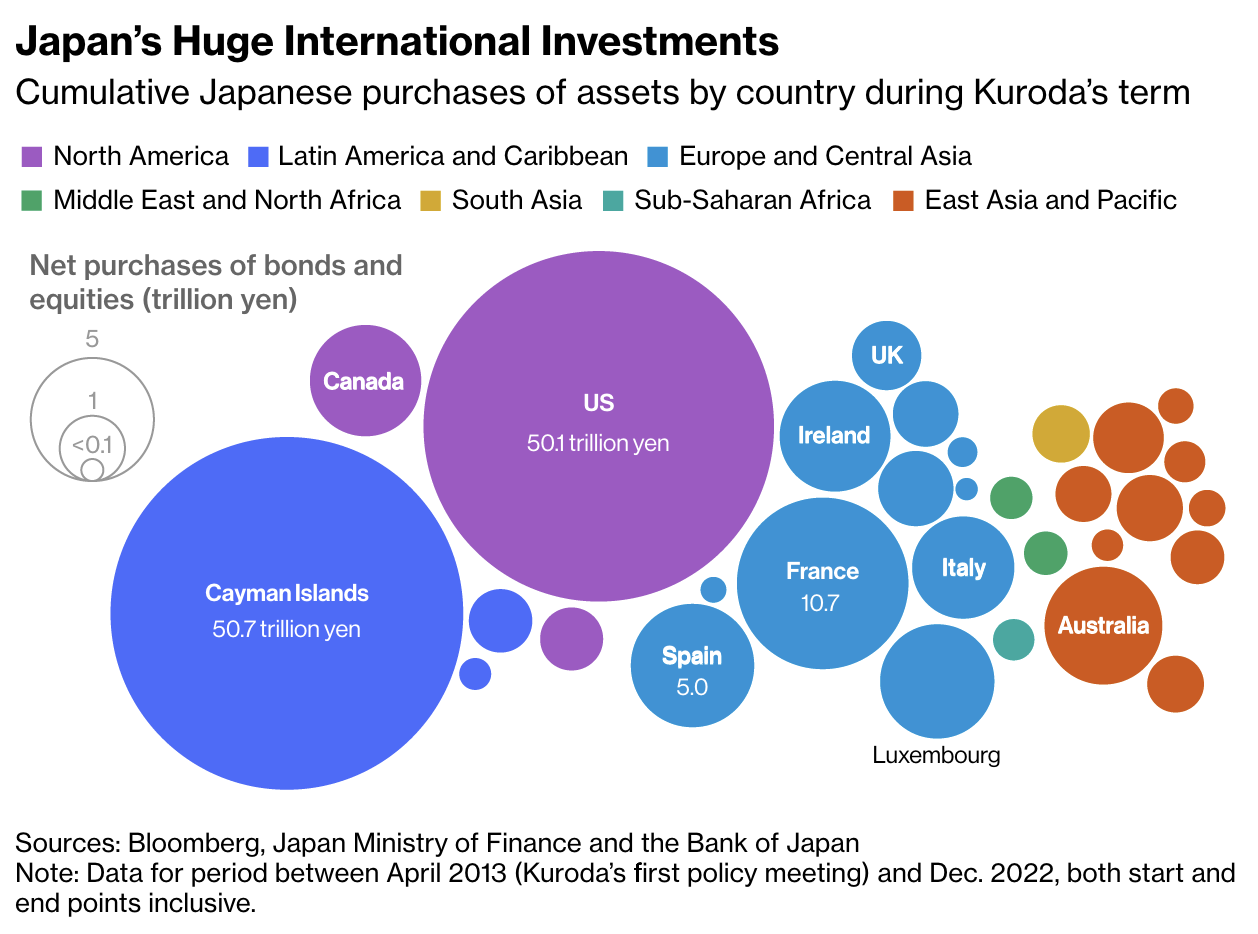

A $3 Trillion Threat to Global Financial Markets Looms in Japan

Source: Bloomberg

Sign up for our reads-only mailing list here.