Weekend Reading For Financial Planners (June 28–29)

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

NOVEMBER 29, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent study from Cerulli Associates shows that consumer trust in financial services companies has increased significantly over the past decade, with firms that provide a more personalized approach to providing financial (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JULY 11, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that, amidst the growing number of RIAs it supervises, the Securities and Exchange Commission (SEC) is moving ahead with a potential plan to raise the $100 million regulatory assets under management threshold for SEC registration, (..)

Nerd's Eye View

APRIL 18, 2025

Which, according to Kitces Research on Advisor Productivity, can lead to higher productivity for advisor teams (but can require an investment in staffing and higher-end planning services to meet their complex planning needs).

Wealth Management

JUNE 27, 2025

Number 8860726. Mark Evans Artificial Intelligence Conquest Planning Raises $80M to Accelerate US Expansion Conquest Planning Raises $80M to Accelerate US Expansion Jun 23, 2025 Sign Up for Newsletters Sign up to receive the latest insights, trends, and analysis. Registered in England and Wales.

Nerd's Eye View

JANUARY 20, 2025

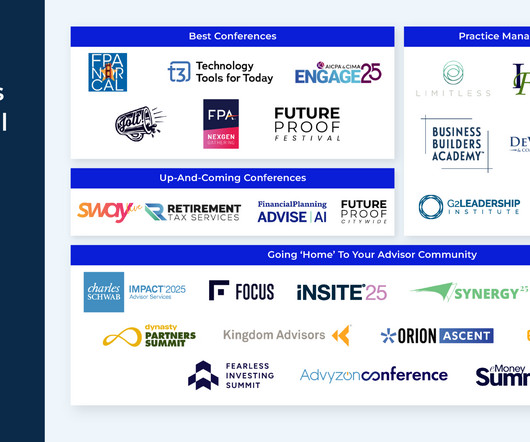

Luckily, alongside the increasing popularity of podcasts on a seemingly infinite range of topics, there is a growing ecosystem of podcasts aimed at financial advisors, covering everything from practice management and career development to technical topics, such as investment, tax, and estate planning.

Nerd's Eye View

FEBRUARY 14, 2025

advanced tax and estate planning) and ensure that both members of client couples remain engaged in the planning process (to encourage a surviving partner to stay with the firm in case of a death of their spouse) could have more durable client satisfaction and, ultimately, higher client retention rates.

Nerd's Eye View

DECEMBER 30, 2024

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Midstream Marketing

DECEMBER 10, 2024

These campaigns help build a strong marketing plan for financial advisors. By adding these campaigns to your plan, you can connect with more clients and increase the number of clients you onboard, growing your business over time. Communicating often helps to build trust with your financial planner.

Indigo Marketing Agency

MARCH 5, 2025

Maximizing Lead Generation From Seminar Marketing for Financial Advisors Capturing Attendee Information Every attendee is a potential client, so its essential to collect their information for follow-ups. What topics should financial advisors cover in a seminar to attract high-quality leads?

Indigo Marketing Agency

JUNE 10, 2025

That’s exactly what’s happening for a fast-growing number of financial advisors in AI searches today. They want answers to queries like: “Top fee-only advisors for doctors in NYC” “Best financial planners for retirement in Seattle” “Who can help with estate planning near me?”

Nerd's Eye View

MARCH 24, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week’s edition kicks off with the news that the CFP Board of Standards launched its 1st ad campaign, dubbed "It’s Gotta Be A CFP", following its transition to a 501(c)(6) organization.

Nerd's Eye View

DECEMBER 1, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the U.S. Supreme Court heard arguments this week in the case of SEC v.

Nerd's Eye View

JUNE 21, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5 million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey.

Nerd's Eye View

JUNE 7, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that recent surveys indicate that consumers continue to trust human financial advisors more than Artificial Intelligence (AI)-powered tools.

Park Place Financial

NOVEMBER 29, 2022

Estates Estate Planning in this Economic Climate Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. If you are in the middle of estate planning , consider the following strategies to develop a sound plan amidst widespread economic challenges. . Create a Trust .

eMoney Advisor

APRIL 4, 2023

2 Begin by understanding that the challenges in managing inherited wealth are not just about the numbers. Earning your own money instills confidence and those receiving an inheritance may need help building their own financial confidence. After all, 91 percent of clients want their advisor’s estate planning advice.

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” Well, the numbers are only slightly better for high-net-worth families, with just over 50% as reported by Think Advisor. What do these numbers tell us?

Clever Girl Finance

DECEMBER 1, 2022

It's simply a structured approach to help you reach your financial goals. It details your current money situation, as well as your financial system, including things like investing, saving, retirement, and estate plans. So what is a financial plan in simple terms? You should also go over the numbers.

Harness Wealth

JUNE 30, 2023

In this article, we’ll dive into the many tax and financial considerations of buying and selling real estate, how real estate fits into estate planning, and the role that a wealth manager or financial planner can play in guiding your decision-making. and Financial Planning for Estate Planning.

Integrity Financial Planning

MARCH 1, 2023

There are a number of common questions that come up around owning a home. You may be surprised to learn how important your tax strategy is when it comes to real estate investments. We also talk about what happens after someone becomes a widow and the financial decisions that come into play.

Harness Wealth

JUNE 9, 2023

Table of Contents What is a Financial Plan? Why is Financial Planning so Important? Crafting Your Personalized Financial Plan: A Step-by-Step Guide The Role of a Wealth Manager or Financial Planner Harness Wealth Can Help What is a Financial Plan?

WiserAdvisor

SEPTEMBER 1, 2022

A well-planned budget will highlight your fixed expenses and will also factor in important expenses like medical bills, rent, etc. You should regularly meet with your financial planner to budget and manage your finances as per your present and future needs. You need to review your financial plan at regular intervals.

International College of Financial Planning

MAY 29, 2023

The scope of wealth management goes beyond traditional financial planning and investment advisory services, encompassing a more holistic approach to personal finance. Wealth managers collaborate with their clients to develop customized strategies for asset allocation, tax planning, estate planning, and risk management.

International College of Financial Planning

AUGUST 3, 2024

Helping People Secure Their Future A career in insurance planning is not just about numbers and policies; it’s about helping people protect their futures. By guiding clients through the complexities of financial planning, you can play a crucial role in their financial well-being.

International College of Financial Planning

AUGUST 2, 2021

The simplest definition of the role of a financial advisor would of that of a person who helps individuals, families, and organizations make decisions related to their investments, taxes, insurance planning, retirement planning, estate planning, and money management. CFP ( Certified Financial Planner ).

Clever Girl Finance

MARCH 19, 2024

It’s simply a structured approach to reach your financial goals. It details your current money situation and financial system, including investing, saving, retirement, and estate planning. So, what is a financial plan, in simple terms? You should also go over the numbers.

Bell Investment Advisors

JUNE 16, 2022

For example, an estate planning goal of reducing your net worth may call for a lump-sum gift. There’s no end to the number of ways you can share your wealth, and its benefits, with your family. So keep it simple, or work with a financial planner to help keep it all straight. Your family will thank you!

Carson Wealth

JULY 26, 2023

There are multiple alternatives with different benefits, which is why it’s critical to discuss the pros and cons with a financial planner. One popular option is setting up an employee stock ownership plan (ESOP), where employees are technically buying equity in the business through a retirement plan.

Nerd's Eye View

AUGUST 9, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent survey indicates that clients of financial advisors are more confident than others about their financial preparedness for retirement and are more likely to have a financial plan in place that can weather the ups (..)

International College of Financial Planning

OCTOBER 5, 2021

In short, if you don’t have an analytical mind, you are unlikely to succeed in this profession.Investment planning, retirement planning, tax planning, and estate planning require you to dig deep into numbers and make information out of the raw data at hand.

Nerd's Eye View

OCTOBER 25, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study by Cerulli Associates and Osaic found that at a time when consumers are increasingly seeking comprehensive planning relationships with their financial advisors, many advisors appear to be overestimating the comprehensiveness (..)

WiserAdvisor

AUGUST 8, 2022

Chartered Financial Consultant (ChFC). Certified Financial Planner (CFP). Further, it helps to check the number of clients the manager is attending to at a time. Life insurance is also helpful in lowering the tax and can be a fantastic estate planning tool. Certified Private Wealth Advisor (CPWA).

Sara Grillo

DECEMBER 12, 2022

Just because you can put numbers on a piece of paper, doesn’t mean you’re providing value.” Doug Twiddy has spent 15-years assisting financial planners and wealth advisors with guidance on proper planning strategies for their clients. Doug Twiddy. I really don’t.” – Derek Robinett. Matt Pruitt, CFP®, CFA®. Doug Twiddy.

Sara Grillo

APRIL 11, 2022

And that’s why I’m writing this blog; because I feel that financial advice rendered by the hour is a great thing for the American public (for the reasons we’re going to discuss below). But the idea of becoming an hourly financial planner is met with such resistance you would think you told people to saw off their left arm.

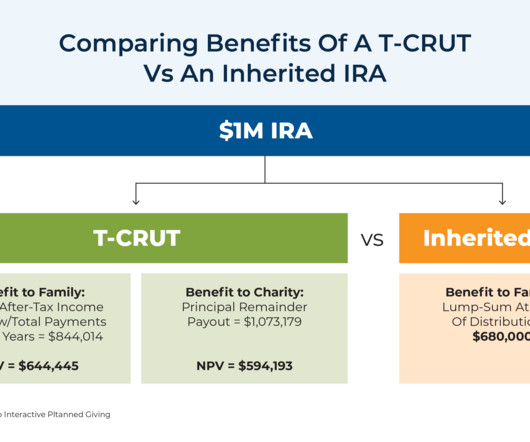

Nerd's Eye View

JANUARY 31, 2024

First is that the underlying vehicle is a Charitable Remainder UniTrust (CRUT), which pays a fixed percentage of the trust's value for either a specified number of years (not to exceed 20) or through the lifetime of the beneficiary. Second is that the CRUT is testamentary (i.e., Read More.

Harness Wealth

JUNE 23, 2023

Estate planning is a critical component of a comprehensive financial plan. Furthermore, estate planning includes aspects such as tax minimization strategies, asset protection, and charitable giving. There are many different types of trusts, each designed to address specific estate planning needs.

The Big Picture

OCTOBER 19, 2022

RAMPULLA: I went to Drexel part time while I was at Vanguard, did that commute down to Philadelphia from the suburbs, you know, three times a week for a number of years. I was employee number one in London. So there’s the, “Hey, I’ll work with you and we’ll develop goals and a plan how to get there.”

WiserAdvisor

JULY 24, 2022

Hiring reputable and experienced high-net-worth financial planners can benefit high-income groups and help them lower taxes. Financial planners employ different approaches to save tax. For instance, financial planners may recommend turning your traditional retirement accounts into Roth accounts to lower your tax burden.

Carson Wealth

DECEMBER 20, 2022

When you work with a qualified financial advisor, you can begin to lay the groundwork to protect yourself from more common, sudden transitions. Having proper estate planning documents can help ensure your assets pass where, when, and how you want them to. Include retirement plan statements you may have with old employers.

Park Place Financial

APRIL 26, 2022

For many people, making sure their loved ones will be financially secure after they’re gone is a primary objective and a trust fund can help achieve this goal. Trust funds are common estate planning tools that help high-net-worth individuals pass an inheritance to their children and grandchildren. Insurance trusts.

Sara Grillo

APRIL 10, 2023

What we’ve seen in 2022 is that there were a number of hacks. Joshua Gonzalez As a Financial Adviser, Josh provides a wide range of personalized, comprehensive financial planning services to his clients, including retirement planning, investment advice, and estate planning.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content