Fighting the Last Bull & Bear Market

A Wealth of Common Sense

FEBRUARY 12, 2023

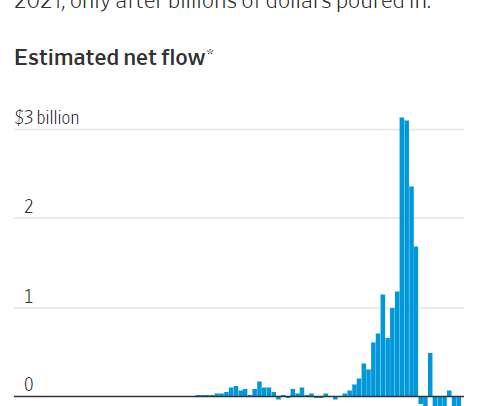

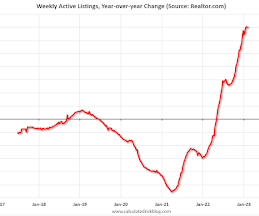

Here is a headline about what happens after a bull market: And here is a headline about what happens after a bear market: Both of these pieces were written by the Wall Street Journal’s Jason Zweig. The bull market piece about ARK came out a little more than a year ago not long after the fund had seen spectacular returns. The bear market piece about covered calls came out this past week after that strategy outperfo.

Let's personalize your content