Creating A (Just In Case) Game Plan For Clients Facing Layoffs

Nerd's Eye View

JANUARY 25, 2023

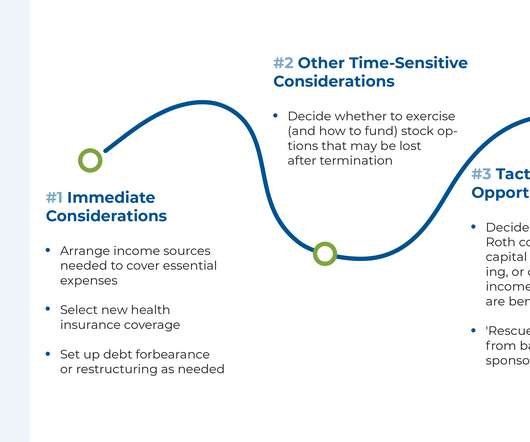

With the U.S. economy predicted by many experts to slow down in the near future, many people’s thoughts have turned to the prospect of a recession. And along with those expectations may come concerns for those still in the workforce about the possibility of layoffs, and needing to get by without income for an unknown period of time. Such periods can be fraught with anxiety, since beyond 'just' the fear of losing one’s livelihood is the realization that there is little way to control

Let's personalize your content