Is Private Debt Worth Considering As An (Alternative) Asset Class In Client Portfolios?

Nerd's Eye View

JANUARY 18, 2023

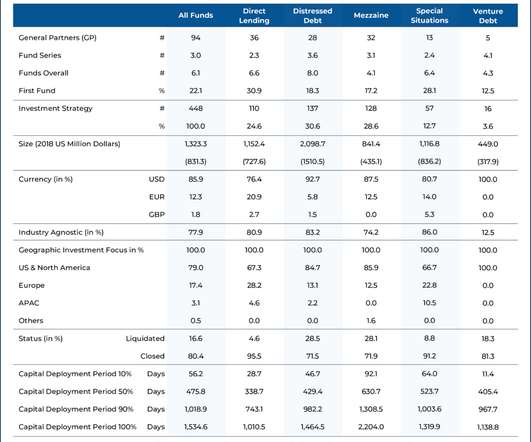

Many investors are familiar with private equity as an alternative asset class, which is popular with certain high-net-worth and institutional investors as a vehicle for diversification and a source of potentially higher risk-adjusted returns than what is available on the public market. However, less well-known is the related but distinct asset class of private debt, which, like private equity, focuses on opportunities outside of what is traded on the public market but deploys its capital in the

Let's personalize your content