Labor Day Weekend Employment Charts

The Big Picture

SEPTEMBER 6, 2022

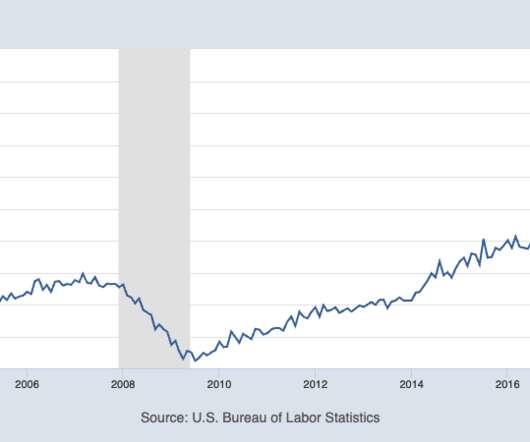

So, it was just Labor Day Weekend, and while we all should be out NOT laboring, I spent part of the long holiday weekend thinking about a few of my favorite FRED charts. Rather than include all of my favorites, I set a challenge for myself: Limit the list to the three most telling charts: U3 Unemployment Rate : When has unemployment been lower than today?

Let's personalize your content