is Mr. Market daring Jerome Powell to keep raising rates?

That’s one way to read into today’s surging market — Nasdaq up 2.9%, the Dow tacking on over 800 points (2.6%), and the S&P 500 added 2.5%. Despite the carnage in big-cap tech stocks like Facebook, Amazon and Google, the Nasdaq is up 2% for the past week. The S&P500 has gained nearly 4% for the week, and is up almost 7% for the past 30 days.

What gives?

As evidence piles up that inflation has peaked, the FOMC may have little choice but to slow, then stop the pace of rate increases. Sure, November at 75 bps seems like a lock, but now December is in play, and hopes are it’s more like 50bps — and then done. If that were to happen, the ephemeral “Soft landing” would be possible again.

So far, Jerome Powell keeps talking tough — he likes headlines such as “Fed Seen Aggressively Hiking to 5%, Triggering Global Recession.” But other voting members have already softened their views, especially Fed Vice Chair Lael Brainard and San Francisco Fed President Mary Daly.

Official Fed whisperer Nick Timiraos at the WSJ — he is the direct conduit from Powell to markets — released the most recent inside dope last week, noting “Federal Reserve officials are barreling toward another interest-rate rise of 0.75 percentage point at their meeting Nov. 1-2 and are likely to debate then whether and how to signal plans to approve a smaller increase in December.”

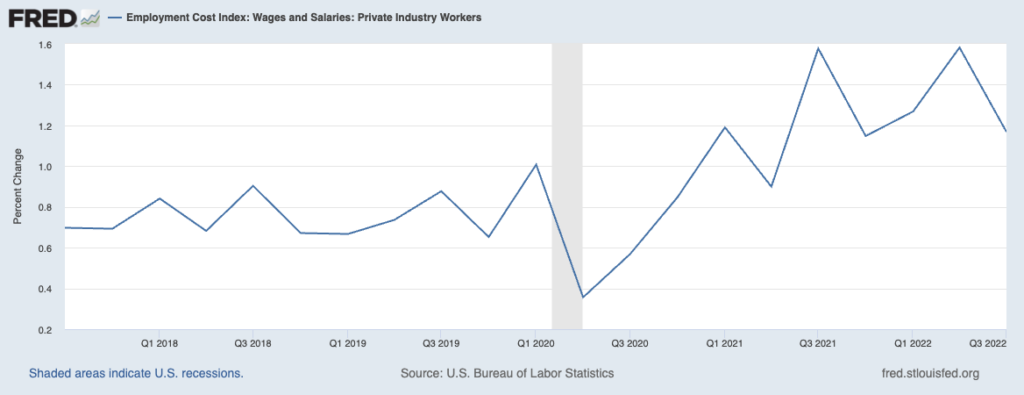

Normally, the Employment Cost Index doesn’t tend to generate fireworks — it comes out quarterly, and we have CPI & NFP if we want to get granular on a monthly basis. But the better-than-expected (read lower) cost of hiring people seems to have awakened the animal spirits in markets.

ECI was a relief. Wage growth slowing, now around 2 percentage points above pre-Covid, suggesting underlying inflation ~4 percent. Consistent with what you get if you replace BLS shelter with new-rent growth in core inflation. We’re not that deep in the inflation hole

— Paul Krugman (@paulkrugman) October 28, 2022

While Goods have been falling in price, Services have remained sticky. Apartment rentals and wages have been a key focus. Decelerating wage gains are not great for workers, but in a high-inflation environment, it is what investors — and the Fed — want to see.

Previously:

Why Is the Fed Always Late to the Party? (October 7, 2022)

Collapse in Prospective Home Buyer Traffic (October 18, 2022)

Revisiting Peak Inflation (June 29, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)