Twitter is cigarettes

The Reformed Broker

NOVEMBER 8, 2022

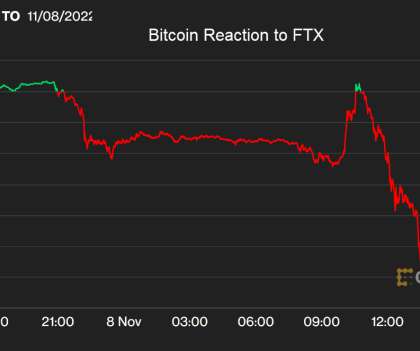

A lot of reporters and public intellectuals were writing their obituaries for Twitter this weekend. First, we saw the revolt of the Blue Checkmarks. Then, the first inklings of an advertiser exodus. The timing of all this – on the eve of a midterm election that will determine whether or not Americans actually care about democracy – could not have been more ominous.

Let's personalize your content