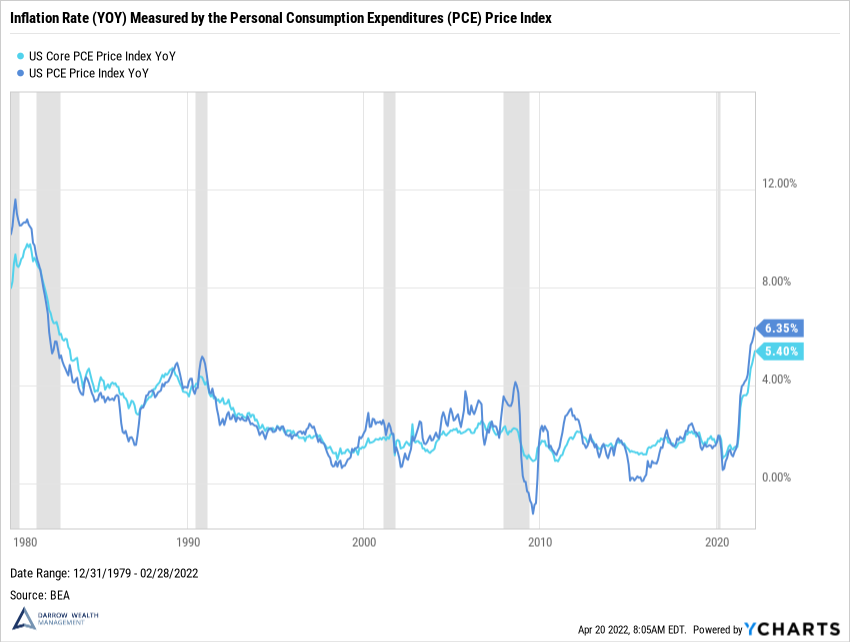

Inflation is at 40-year highs. The Federal Reserve has started raising interest rates to cool the economy and tame inflation. But it won’t be easy. Given the strength of household balance sheets and that the Fed is raising rates from zero, prepare for inflation to stick around.

Taming inflation won’t be easy

The Personal Consumption Expenditures (PCE) measures the change in the prices of goods and services consumed by all households and nonprofit institutions serving households. The Core PCE excludes food consumed in-home and energy prices.

The CPI or Core CPI are the most commonly referred to measures of inflation, but for several very good reasons, the Federal Reserve prefers to use the Personal Consumption Expenditures (PCE) price index instead of CPI. For reference, the latest year-over-year figure for CPI is 8.54% and 6.44% for Core CPI.

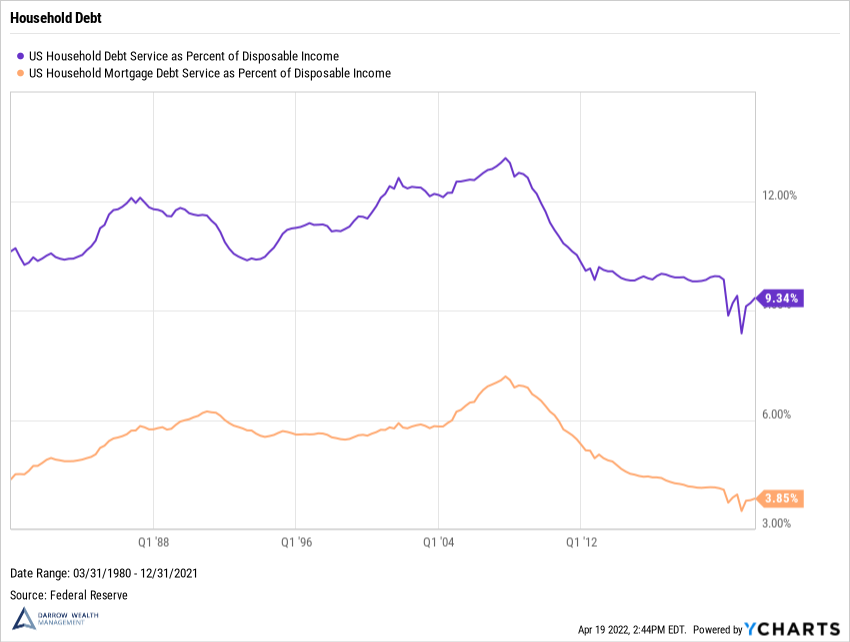

Households are in good financial shape to keep spending

Significant fiscal stimulus, wage growth, asset appreciation, and easy money policy from the Federal Reserve boosted consumers’ savings rates and dependency on credit to make purchases. Refinancing activity flourished, making existing debt loads more manageable, freeing up disposable income in the process. This has all been incredibly inflationary. Inflation is definitely chipping away at household savings. But strong consumer balance sheets will likely provide further support to price pressures.

The US is a consumption-driven economy. According to data from J.P. Morgan, 68% of US GDP is consumption. This is why the Federal Reserve faces such a challenging task: they’re trying to curb American’s favorite pastime (spending money) without crushing it, sending the economy into recession.

Why is Inflation is So High? Here are 4 Reasons.

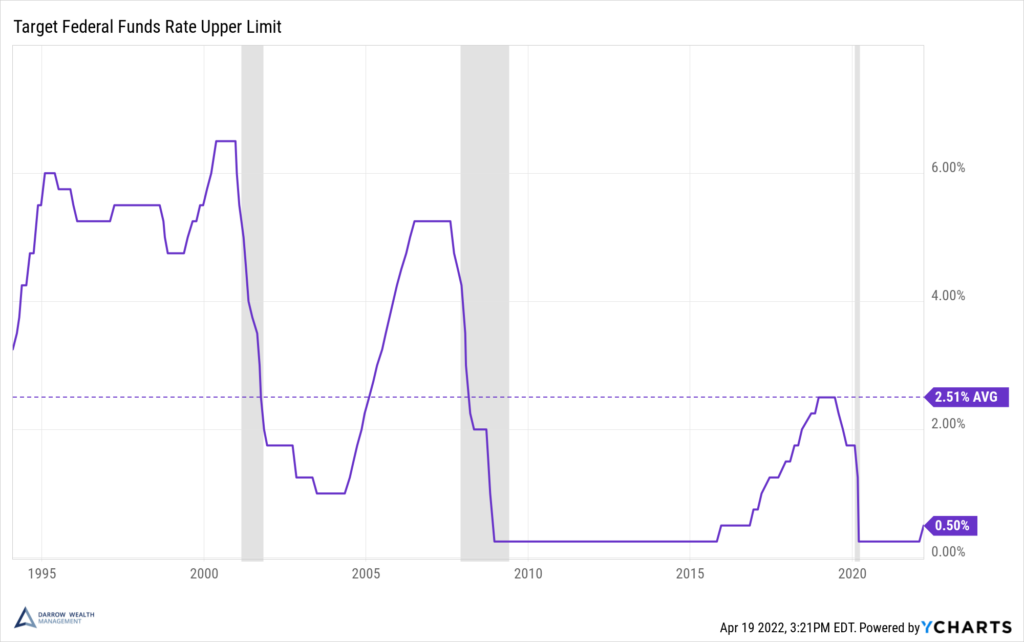

Monetary policy is still far from restrictive

Yes, the Fed is tightening to try and control inflation. But there is still a ways to go before monetary policy actually gets tight. This brings a mix of good and bad news. First the bad. One central risk is that the Fed will need to tighten rapidly to see any impact on inflation. Fed guidance has pretty much made this a certainty. After announcing the first increase at the March meeting, Chairman Powell said they expect to hike six more times in 2022 to get to 1.9% by end of year and 2.8% by the end of 2023. For reference, the long-term target average Federal Fund rate is between 2.3% – 2.5%.

If the Fed doesn’t get the results it wants, they may turn more hawkish to tame inflation, which has implications for markets and the economy.

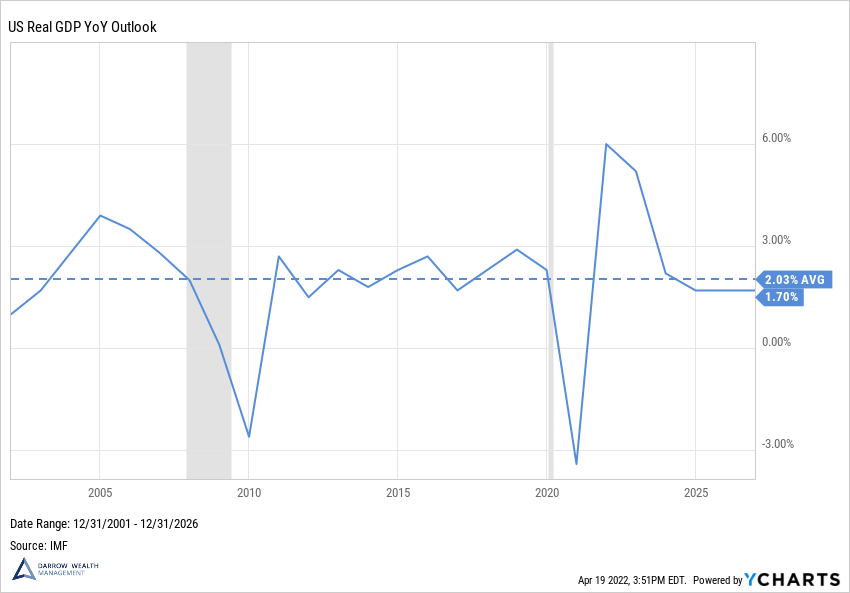

The good news is that the US economy is in pretty good shape. Pend-up demand, reopening, healthy corporate and consumer balance sheets, and relatively low tax rates, have economists forecasting real GDP slightly under the long-term average of 2% through 2026. Remember, the Federal Reserve is actively trying to slow the economy by raising rates.

US real GDP and forecast

What should you do until inflation subsides?

Inflation is one of many challenges investors face in the current environment. Among the top risks: an aging population and lack of replacement workers, growing Federal deficit facing higher borrowing costs, concentration in the largest US companies, and massive appreciation in asset prices leading to a doubling of the S&P 500 between 2019 – 2021 have all contributed to the current situation. In March, US consumer confidence dipped to levels not seen since 2011. Sometimes expectations of inflation can be self-fulfilling, an outcome the Fed seeks to avoid.

For investors, challenging times can pose emotional and financial hurdles. From a financial perspective, the current climate emphasizes the importance of controlling fixed costs. Maintaining your lifestyle throughout life is perhaps more about how much income you’ll need in retirement versus the size of your portfolio. You can only spend a dollar once.

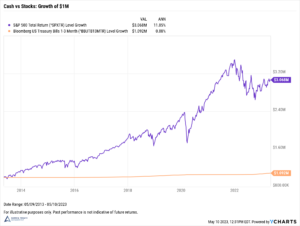

From an investment standpoint, less is often more. People often feel compelled to act when weighing the likelihood of negative outcomes. Peter Lynch once said: “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

At any life stage, the thought of a market downturn or recession is unnerving. But it’s important to try and focus on your time horizon and remember that unpleasant events are part of it. Rather than trying to prepare for the next recession or downturn, take steps to plan for any type of personal financial crisis. The economy goes through the business cycle at different paces, just like markets will experience different rotations and investing environments. While you can’t time or control it, you can change how prepared you are, which includes diversification and maintaining flexibility with expenditures. Especially during periods of high inflation.