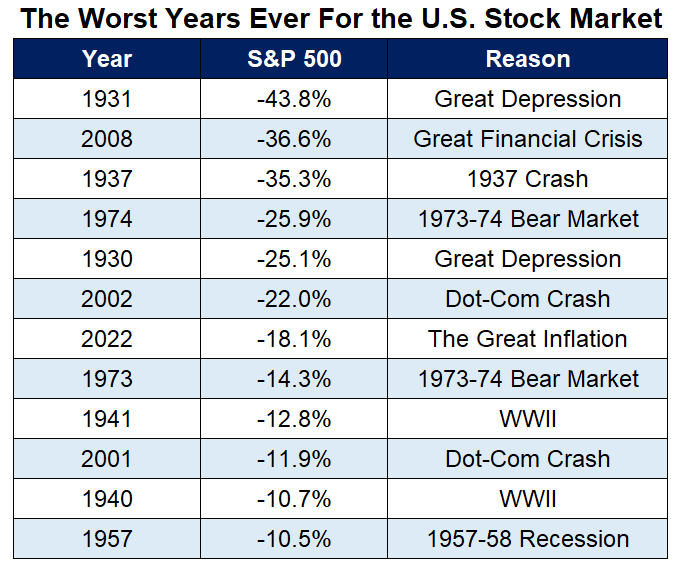

Earlier this year I looked at the worst years ever for the U.S. stock market.

Well, things didn’t get much better from there.

Here’s the updated list:

This past year’s 18.1% loss was the 7th worst loss since the 1920s.1

The bond market also had one of its worst years in history.

It was easily the worst year ever for the Bloomberg Aggregate Bond Market Index, which dates back to 1976.

In the 40+ years of calendar year returns there were only four down years before 2022:

- 1994 -2.9%

- 2013 -2.0%

- 2021 -1.5%

- 1999 -0.8%

The total return of -13% in 2022 was far and away the worst loss ever for this total bond market index.

There has only been one double-digit calendar year loss for 10 year U.S. treasuries since the 1920s. That was an 11.1% loss in 2009. Now we have two.

The benchmark U.S. government bond was down more than 15% in 2022, making it the worse year ever for bonds.

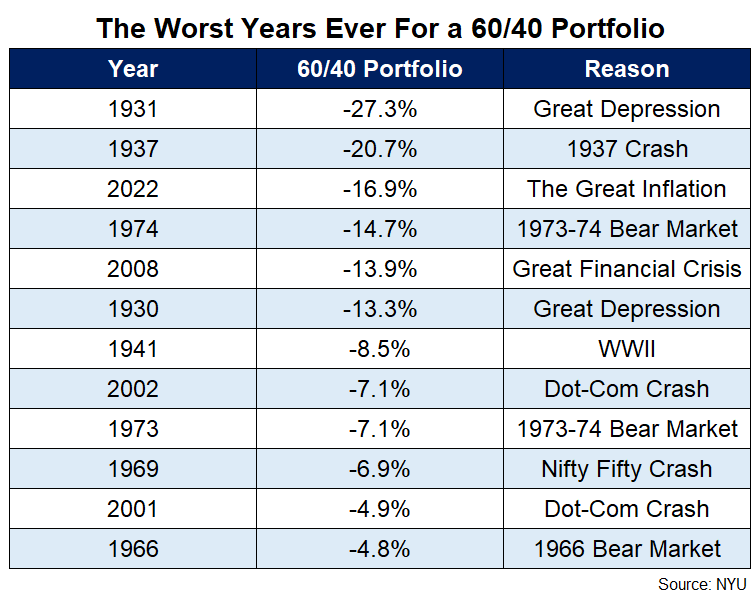

Add it all up and a 60/40 portfolio of U.S. stocks and bonds was down more than 16% in 2022. With both stocks and bonds down big this ended up being the third worst year ever for a diversified portfolio:

There’s no sugar-coating it — if you had money invested in the financial markets in 2022 it was a tough year, possibly one of the worst we will ever see as investors.

I try to look at losses like this as sunk costs. They already happened. You can’t go back and change things now.

All that matters is what happens from here, not what happened in the past.

The beatings could continue until morale improves. There’s nothing that says markets will all of the sudden get better just because it’s a new year.

If you’re the type of person that likes to look for a silver lining in these things, there is some good news for investors going forward.

The losses from 2022 have added yield to your portfolio.

The global stock market is now sporting a dividend yield of around 2.2%. Yields for short-to-intermediate-term bonds are now in the 4-5% range.

That’s good enough for a yield of more than 3% for a diversified portfolio of stocks and bonds.

Coming into 2022, that yield was more like 1.5%. Going into 2021, it was closer to 1%.

Losses are no fun but down markets lead to higher dividend yields, more bond income and lower valuations.

Expected returns are now higher.

I don’t have the ability to predict the timing or magnitude of those higher expected returns but there is now a much bigger cushion for investors than there has been in years as far as yields are concerned.

The other good news is every time we’ve ever had bad times in the past they turned out to be wonderful opportunities for long-term investors.

There are no guarantees but things should be better for investors in the future as long as you have enough patience and perspective.

Further Reading:

Why Should You Invest in the Stock Market?

1I’m trademarking The Great Inflation for 2022 until someone comes up with a better name. Maybe the Fed’s revenge?