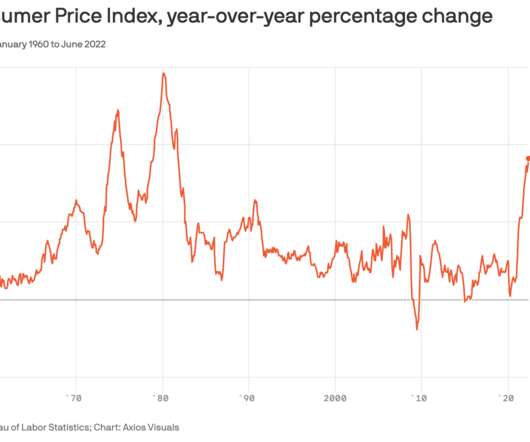

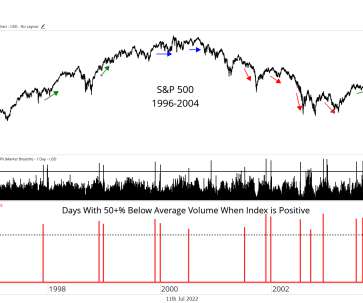

“a mild recession”

The Reformed Broker

JULY 13, 2022

Put this phrase in your vocabulary for the second half of the year because you are going to be hearing it everywhere: “a mild recession.” This is where the puck is going. All of Wall Street’s chief strategists and chief economists are going to be pivoting to this case if they haven’t already. The “soft landing” idea is going to fade away.

Let's personalize your content