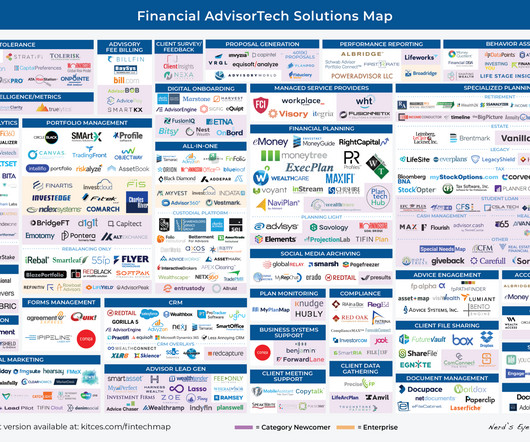

The Latest In Financial #AdvisorTech (May 2023)

Nerd's Eye View

MAY 1, 2023

Welcome to the May 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that robo-advisor Betterment entered into a $9M settlement with the SEC for misrepresenting its tax-loss harvesting practices in its client agreements and marketing materials compared with its actual practice

Let's personalize your content