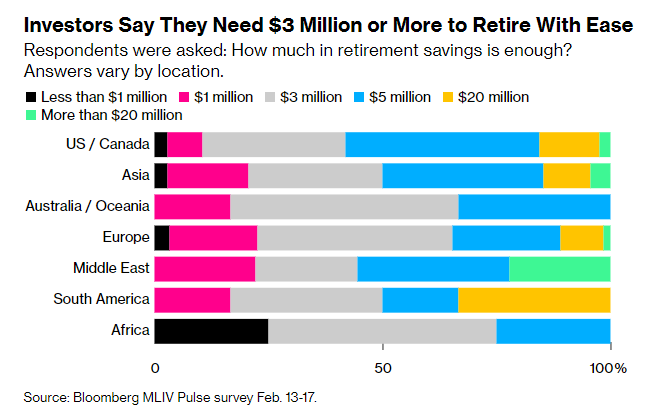

Bloomberg asked investors from around the globe one of the most important questions in all of personal finance:

How much is enough to retire comfortably?

The results were a tad on the high side:

The average number came in somewhere between $3 million and $5 million. One-third of respondents said $3 million while another third said it was closer to $5 million.

You never know with these things.

These numbers could be high because of the survey respondents. Maybe they were all wealthy. Or maybe their expectations are out of touch with reality. Or maybe this is a difficult question to answer for more people.

It’s good to set your sights high and all but it’s also important to be realistic. Unfortunately, most people will never stockpile $3 to $5 million.

If we look at the actual number of households in the U.S. that have $3 million or more, many of these respondents are going to come up short.

DQYDJ ran the data on the number of millionaire households1 in the United States:

- 15.3 million households with $1 million or more (11.9% of all households)

- 8.0 million households with $2 million or more (6.3% of all households)

- 5.7 million households with $3 million or more (4.4% of all households)

- 4.5 million households with $4 million or more (3.5% of all households)

- 3.5 million households with $5 million or more (2.8% of all households)

Fewer than 3% of people in the Bloomberg survey said they would require $1 million or less.

The median net worth in the United States is just over $121,000. There is obviously a wide range around that median but there seems to be a disconnect between the number of people who think they will be millionaires and the actual number of people who can pull it off.

The good news is most people probably overestimate how much money they will actually need for retirement. Most of the people who end up millionaires never come close to spending all of their money anyway.

A 2018 report from EBRI studied income and financial asset data on older Americans to see how much of their nest egg2 they spent during the first 20 years of retirement. After two decades of retirement, most people spend less than you think:

- Individuals with less than $200,000 saved only spent down about a quarter of their assets.

- Those with between $200k and $500k had spent down around 27% of their money after 20 years.

- Retirees with half a million or more just before retirement had only spent down less than 12% of their money.

- One-third of all retirees, no matter their starting amount, had actually increased their nest egg in the first two decades of retirement.

So the people with the most money had the lowest withdrawal rate of their assets.

Averages and medians never tell the whole story since so much of this is circumstantial and preference-based but there are some logical reasons for this outcome.

Some people probably save too much money because there are so many uncertainties involved in the retirement process — longevity risk, rising healthcare costs, unknown future market returns, the path of interest rates, inflation, the economic outlook, etc.

It can be scary to spend down your money when you no longer have a reliable source of income coming in so it makes sense that many retirees are too conservative with spend rates.

There is also the behavioral challenge of going from being a saver to a spender. It’s not easy to flip the switch after decades of slowly but surely accumulating assets.

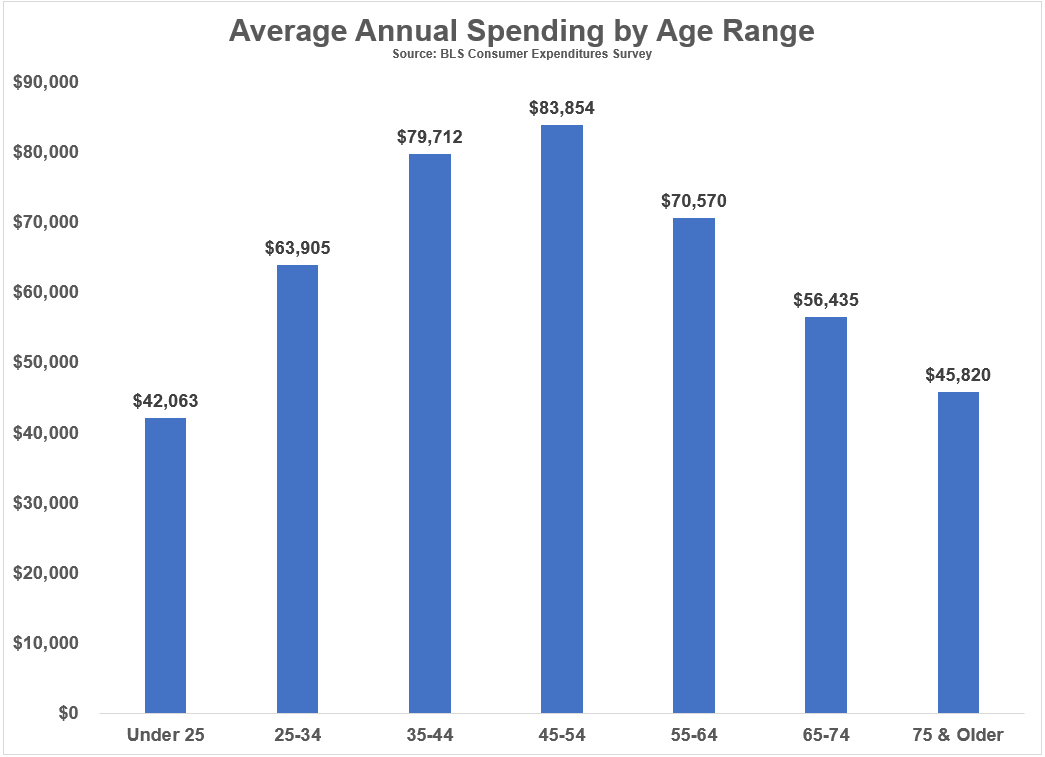

Retirees probably overestimate their spending in retirement as well.

The Bureau of Labor Statistics tracks average consumer expenditures by age. You can see spending levels actually peak before retirement age and only fall from there as you get older:

Now, this could be a chicken or the egg problem.

Maybe people spend less in retirement because they didn’t save enough to cover their previous standard of living. But many retirees overestimate how much they’re going to spend in their non-working years as well.

Retirement is still a relatively new concept. In the past most people simply worked until they dropped dead. And it’s not like you get a lot of practice. Everyone has but one shot at getting this right.

So it makes sense that people would say it will take a number in the high seven figures to make them feel comfortable in retirement.

It also makes sense that many people over-save and under-spend in retirement.

This stuff is not easy because it’s hard to make financial plans that can last for 2-3 decades once you retire.

That’s why retirement planning is a process and not an event.

Over time you’ll be forced to update your priors, make course corrections and recalibrate your expectations based on what life throws at you.

The bad news is this process is never going to be easy.

The good news is it’s OK if you don’t have it all figured out just yet. No one else does either.

Further Reading:

Frugality vs. Extravagance

1It’s important to note these numbers do include primary residence in the calculation. So if we’re talking just portfolios and other liquid financial assets, the numbers would be even lower.

2This one was non-housing assets.