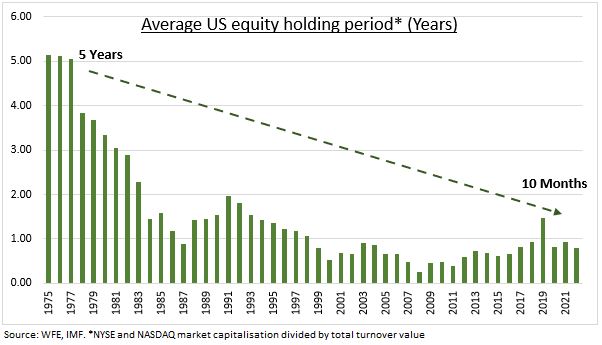

As a staunch proponent of thinking and acting for the long-term as an investor, the following chart from Ben Laidler at eToro cuts deep:

The average holding period for an individual stock in the U.S. is now just 10 months, down from 5 years back in the 1970s.

The average mutual fund holding period is longer at two-and-a-half years but that still feels way too low for my taste.

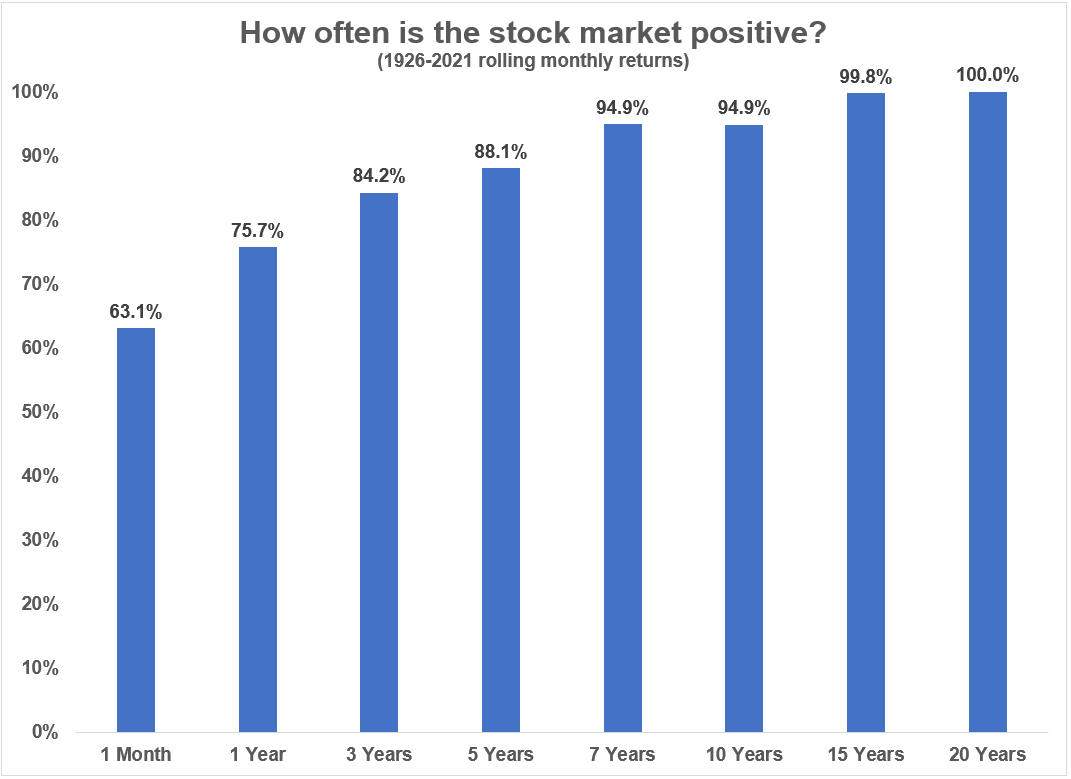

My contention is a long time horizon is your biggest ally as an investor. Historically, the longer your time horizon in the stock market the higher your probability for a positive outcome:

So why are investors trading more frequently?

According to John Kenneth Galbraith, a record 5 million shares traded hands on the U.S. stock market in June of 1928. This shattered the record of 4.7 million share from March of that year.

The average daily volume for Tesla Shares alone today is 160 million shares traded.

The New York Stock Exchange averages well over a billion shares traded every day.

Markets are bigger. There are more players. They are more institutionalized. There are hedge funds, ETFs, mutual funds, high-frequency traders, pensions, endowments, foundations, family offices and retail traders.

During the Great Depression, just 1% or so of Americans even owned shares in stock in some form. That number is now more like 50%.

The barriers to entry have also fallen precipitously.

Trading costs were much higher back in the day. They’re now zero.

People used to place trades with a broker where they had to call them on a landline telephone. Investors rarely had access to up-to-the-minute stock price information. Opening an account required paperwork and going to someone’s office. You had to write a check to fund your account.

Now you can open an account on your handheld super computer immediately, link your bank account, fund your portfolio and be trading within minutes. The investment options today are seemingly endless.

Index funds were new in the 1970s. ETFs didn’t exist yet. Neither did 401ks or IRAs or Robinhood or Reddit or fractional shares or 24 hour business television or social media or immediate access to more information about investments than you could hope to read in a lifetime.

Cutting down on these frictions is both good and bad.

It’s good in the sense that it’s never been easier for individual investors to invest in the markets.

It’s bad in the sense that it’s never been easier to turn over your portfolio with the click of a button and trade yourself into submission.

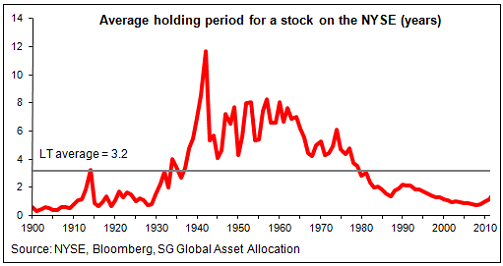

But it’s also true that short-term speculation is nothing new. SocGen has data on average holding periods for a stock going back to 1900:

Holding periods were even higher in the 1940s, 50s and 60s than the 70s but look at the data from 1900-1930.

There was no such thing as fundamental analysis back then. People traded in bucket shops. The stock market for retail traders was no different than someone opening up a Fan Duel account and doing parlays all day.

Much like the stock market itself, averages can be misleading.

Not every investor these days is some sort of degenerate gambler.

Sure, many investors trade more often than they probably should. But there are plenty of investors who are more well-behaved.

Long-term investing is not dead.

Vanguard’s annual report called How America Saves looks at their 5 million participants in defined contribution retirement plans.

Vanguard investors don’t trade all that much:

During 2021, 8% of DC plan participants traded within their accounts, while 92% did not initiate any exchanges. On a net basis, there was a shift of 3% of assets to fixed income during the year, with most traders making small changes to their portfolios. Over the past 15 years, we have observed a decline in participant trading. The decline in participant trading is partially attributable to participants’ increased adoption of target-date funds. Only 3% of participants holding a single target-date fund traded in 2021.

The average account balance for these plan participants is a little more than $141,000.

You don’t have to manage millions or billions of dollars to succeed as an investor.

You just need to combine good saving habits with an investment plan that relies on patience and a long time horizon.

Does this mean everyone has to be a buy & hold investor? Of course not. Do what works for you.

Would more investors experience better performance if they practiced buy & hold and simply increased their holding period?

Yes, I wholeheartedly believe that.

Michael and I spoke about time horizons, buy & hold and much more on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Time Horizon is Everything For Investors

Now here’s what I’ve been reading lately:

- The importance of magical places (Our Built Environment)

- In defense of the 401k loan (Belle Curve)

- American cars are getting too big for parking spaces (Vice)

- Is $200k a year a good income? (Dollars & Data)

- From Bing to Sydney (Stratechery)

- U.S. stock market returns from the 1870s to 2022 (Measure of a Plan)

- What does upper middle class actually look like? (Young Money)