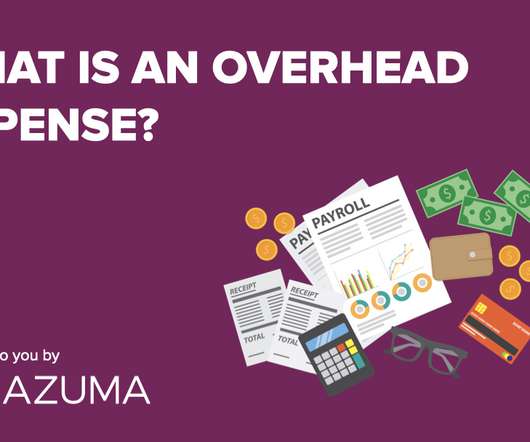

Dangers of DIY Accounting

MazumaBusinessAccounting

APRIL 10, 2021

It can be tempting to cut corners when laying the foundation of your business. Most new business owners try to pinch pennies where they can—even in areas they shouldn’t. For almost all businesses, making money is a priority, but how you manage that money is equally important. When you try to manage the accounting and bookkeeping for your business yourself, you may run into trouble.

Let's personalize your content