This paper explores the question of option momentum by examining what the research says about the performance of option investments across different stocks.

Option Momentum

- Heston, Jones, Khorram, Li and Mo

- Journal of Finance, December 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Several studies show momentum works in global equities, corporate bonds, currencies, and commodities. This paper asks the following research question:

- Does momentum work within option markets?

What are the Academic Insights?

By focusing on the returns of delta-neutral straddles (from 1996 to 2019) on individual equities to form a strategy whose returns are approximately invariant to the performance of the underlying stock, which implies that the performance of a straddle-based momentum portfolio will be essentially unrelated to any momentum in the underlying stocks, the authors find:

1. Momentum (6 to 36 months) is a far stronger phenomenon in options than in other asset classes, with a pre-cost Sharpe ratio at least three times higher than the standard cross-sectional momentum strategy for stocks. Additionally, it is present whether it is measured on a relative basis (“cross-sectional momentum”) or an absolute basis (“time series momentum”)

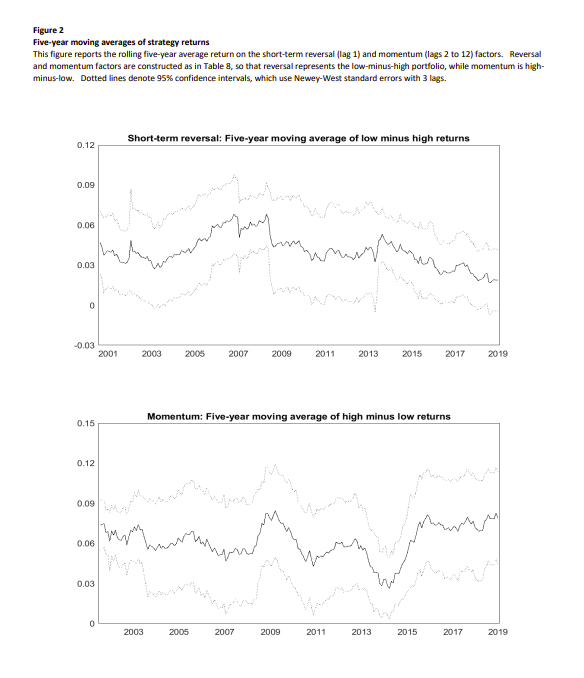

2. Similar to stocks, one-month returns tend to reverse over the following month, though this result is less robust than different methods for computing option returns. In contrast to stocks, there is no evidence of a long-term reversal in option returns

3. Transaction costs lower the performance of the momentum and reversal strategies, but both remain profitable under reasonable assumptions if strategies are modified to reduce the effects of these costs. These modifications include forming portfolios from straddles with more extreme past returns (deciles rather than quintiles), discarding straddles constructed from options with large bid-ask spreads, and combining the momentum and reversal signals into a single composite strategy

4. There is no relation between the strength of the momentum effect and the bid-ask spreads of the firm’s options

5. There is no evidence of crash risk or negative skewness in momentum returns.

Why does it matter?

This study serves to further the rich academic literature on the momentum anomaly.

The Most Important Chart from the Paper:

Abstract

This paper investigates the performance of option investments across different stocks by computing monthly returns on at-the-money straddles on individual equities. It finds that options with high historical returns continue to significantly outperform options with low historical returns over horizons ranging from 6 to 36 months. This phenomenon was found to be robust, as the authors tests included out-of-the-money options or delta-hedging the returns. Unlike stock momentum, option return continuation is not followed by long-run reversal. Significant returns remain after controlling for implied volatility and other characteristics. Abnormal returns also survive factor risk adjustment. Average option momentum returns are close to zero after paying the full bid-ask spread for options with below-median bid-ask spreads. Across stocks, trading costs are unrelated to the magnitude of momentum profits.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.