When Your Only Tool is a Hammer…

The Big Picture

NOVEMBER 1, 2022

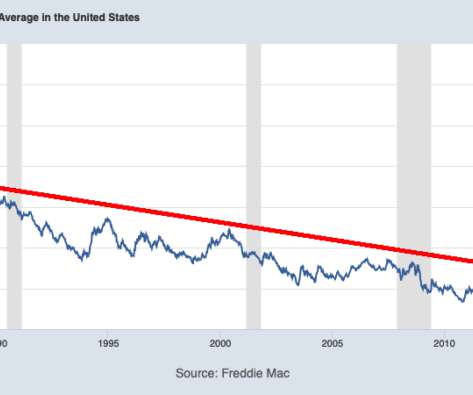

Today and tomorrow the Federal Reserve will hold its 7th Federal Open Market Committee meeting of the year. It is given that we will see a 75-basis point increase Wednesday, but what gets said about the meeting on December 13-14 is even more important. The hopes are the Fed indicates a slower pace of rate increases, perhaps as low as 50 basis points in December.

Let's personalize your content