The Crypto Space Plunges Second Day, The Bottom Was Not In for Bitcoin

Mish Talk

NOVEMBER 9, 2022

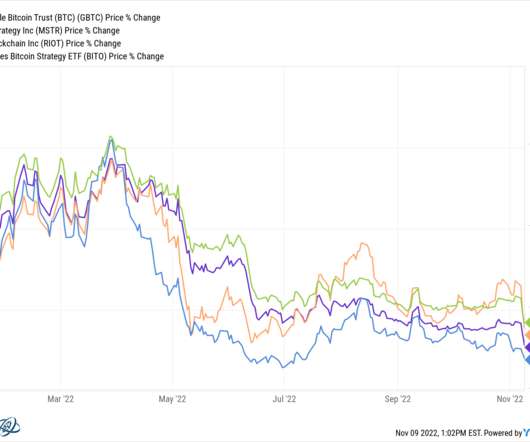

Image from Investing.com yellow highlights and comments are mine. Market Still Reeling From Collapse of FTX Yesterday I noted Crypto Crash Is Led by a Whopping 88 Percent Plunge in FTX Here is the chart I posted yesterday. Today's chart will follow. FTX chart courtesy of CoinDesk. Price points added by Mish. Valuation Plunge The 44 percent rally was due to the announcement of a deal with Binance.

Let's personalize your content