What’s Ailing Tesla’s Stock?

The Big Picture

OCTOBER 17, 2022

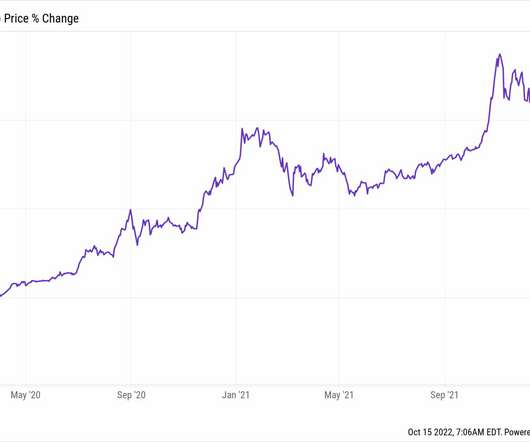

US equity markets are off about 25% YTD; Tech-heavy Nasdaq is off 32%; But the poster child for the past few years has been Tesla (TSLA), which is down 38.5% YTD and is 46.9% off of its 2021 highs. From a fundamental perspective, Tesla is doing quite well: In the third quarter, Tesla sold a record 343,000 vehicles. They also have an advantage over traditional automakers: An ability to quickly reprogram the firmware of chips.

Let's personalize your content