Steve Jobs Archive

The Big Picture

SEPTEMBER 12, 2022

The Steve Jobs Archive is now up and running. I have been playing about it a bit, there is a lot to explore. The post Steve Jobs Archive appeared first on The Big Picture.

The Big Picture

SEPTEMBER 12, 2022

The Steve Jobs Archive is now up and running. I have been playing about it a bit, there is a lot to explore. The post Steve Jobs Archive appeared first on The Big Picture.

Nerd's Eye View

SEPTEMBER 12, 2022

For many financial advisors, choosing their profession was based on a genuine desire to help others achieve their financial goals. Yet, while these advisors recognize the importance of business development to grow their firms, they are also very often intimidated by the process of adopting sales techniques to convert leads to clients. It can feel stressful at best and disingenuous at worst.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

SEPTEMBER 12, 2022

Top clicks this week What to read instead of "Rich Dad, Poor Dad" or "The Millionaire Next Door." (impersonalfinances.com) The performance of major asset classes in August 2022. (capitalspectator.com) There are two kinds of happiness. Choose wisely. (humbledollar.com) Jason Zweig, "We need to realize, though, that when we look back at the past, we don’t recapture it; we reconstitute it.

Calculated Risk

SEPTEMBER 12, 2022

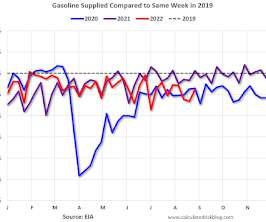

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. -- Airlines: Transportation Security Administration -- The TSA is providing daily travel numbers. This data is as of September 11th.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Abnormal Returns

SEPTEMBER 12, 2022

Podcast Daniel Crosby talks authenticity and marketing with Taylor Schulte of Define Financial. (rationalreminder.libsyn.com) Michael Kitces talks with Andy Panko owner of of Tenon Financial about leveraging Facebook to grow a practice. (kitces.com) Thomas Kopelman and Treyton DeVore talk about the first year of AllStreet Wealth. (open.spotify.com) The biz A growing number of buyers are keeping the RIA market strong.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 12, 2022

Today, in the Real Estate Newsletter: Mortgage Equity Withdrawal Still Strong in Q2 Excerpt: Here is the quarterly increase in mortgage debt from the Federal Reserve’s Financial Accounts of the United States - Z.1 (sometimes called the Flow of Funds report) released on Friday. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.

Wealth Management

SEPTEMBER 12, 2022

The Russia-Ukraine War has taken a toll on the European data center industry, reports Bisnow. Climate change could threaten $34 billion in coastal U.S. real estate, according to a new study. These are among today’s must reads from around the commercial real estate industry.

Mullooly Asset Management

SEPTEMBER 12, 2022

If you want an efficient way to save for future medical bills, look no further than a health savings account. We always talk about our buckets approach. The idea is you mentally (or physically) separate your money into buckets, depending on what they will be used for. Most folks will have a checking/spending bucket, an […].

Wealth Management

SEPTEMBER 12, 2022

Tech leaders at a variety of firms also discussed cybersecurity, artificial intelligence and the benefits of competition during a panel discussion in conjunction with the annual WealthManagement.com Industry Awards.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Prosperity Coaching

SEPTEMBER 12, 2022

Marketing and prospecting are the twins of financial advisor success. Unfortunately many advisors don’t actively market and promote their businesses. They rely on the tortoise approach to growth: 2-3% annually by sheer luck. This is the 5th installment in my series about financial advisor marketing mistakes in which I detail […]. The post Mistake 5: Financial Advisors Fail to Sell the Dream appeared first on The Prosperous Advisor Coaching Blog.

Wealth Management

SEPTEMBER 12, 2022

California’s extreme heat is threatening operations at its data centers, reports CNN Business. Traffic in U.S. downtowns rose in August, according to Chain Store Age. These are among today’s must reads from around the commercial real estate industry.

Calculated Risk

SEPTEMBER 12, 2022

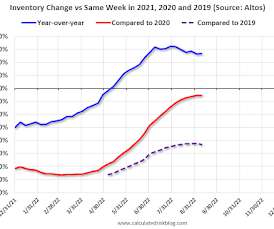

Active inventory decreased 1.0% last week. Here are the same week inventory changes for the last four years (the increase in 2019 was a one-week surge): 2022: -5.4K 2021: -6.2K 2020: -5.0K 2019: +7.2K Inventory bottomed seasonally at the beginning of March 2022 and is now up 127% since then. More than double! Altos reports inventory is up 26.9% year-over-year.

Wealth Management

SEPTEMBER 12, 2022

Publicly-traded REIT funds from operations hit a new record at $19.6 billion in the second quarter and are now 22 percent higher than pre-COVID levels.

Speaker: Joe Buhrmann, MBA, CFP®, CLU®, ChFC® Senior Financial Planning Practice Management Consultant eMoney Advisor

During an era of evolving consumer preferences, the banking sector is undergoing a profound shift. As customers continue to broaden their perspectives, banking professionals must support their customers' financial wellness by providing holistic financial advice that aligns with individual goals and circumstances. Without adapting, financial institutions will find that loyalty may crumble amid uncertainty.

Alpha Architect

SEPTEMBER 12, 2022

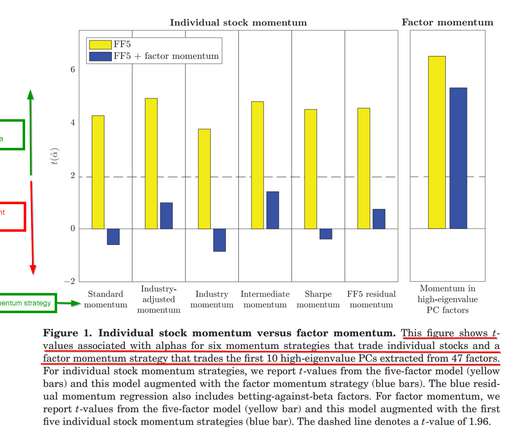

We find that factor momentum concentrates in factors that explain more of the cross section of returns and that it is not incidental to individual stock momentum: momentum-neutral factors display more momentum. Is Momentum a Separate Factor? was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

SEPTEMBER 12, 2022

As rates rise and economic growth projections get murkier, what are commercial real estate investors doing to raise capital and reach their desired returns?

XY Planning Network

SEPTEMBER 12, 2022

6.5 MIN READ. Discover the best new advice-centric tech. The seven finalists of the AdvisorTech Expo have been selected, and we can't wait for you to see the advice-centric tech they're set to show off at #XYPNLIVE! This year's #XYPNLIVE AdvisorTech Expo is all about advice engagement and showcasing some of the most innovative new technology that empowers clients to meaningfully engage with their advisor’s advice.

Wealth Management

SEPTEMBER 12, 2022

Setting big goals is wonderful, but without strategy and execution, your chances of achieving them are left much more to chance and luck.

Advertisement

Digital platforms can provide you with plenty of solutions, yet many are still intimidated by them. It's time to end that worry and embrace what could make a major difference for your bank. Understanding how they work and how to best utilize them for your banks is key toward success. In this article, Biz2X breaks down all things digital platforms, including the many advantages of embracing them.

The Irrelevant Investor

SEPTEMBER 12, 2022

Today’s Talk Your Book is brought to you by Direxion: On today’s show, we spoke with David Mazza, Head of Product at Direxion about single stock, leveraged, and inverse ETFs. On today’s show we discuss: What these products should be used for How these products are structured Differences between US exchanges and International exchanges How Direxion is seeing these products being traded The ideal holding period.

Integrity Financial Planning

SEPTEMBER 12, 2022

Saving for retirement is a long-term endeavor. It’s not about finding the next hottest stock or trying to get rich quickly. It requires a different perspective on your wealth and income that accounts for your needs in different stages of your life, from the beginning of your working years through your retirement. These five key components will help simplify the bucket strategy so you can understand it and apply it to your retirement strategy.

A Wealth of Common Sense

SEPTEMBER 12, 2022

Today’s Talk Your Book is brought to you by Direxion: On today’s show, we spoke with David Mazza, Head of Product at Direxion about single stock, leveraged, and inverse ETFs. On today’s show we discuss: What these products should be used for How these products are structured Differences between US exchanges and International exchanges How Direxion is seeing these products being traded The ideal holding period.

Wealth Management

SEPTEMBER 12, 2022

When the thought of making a move “gets real,” there’s another level of due diligence that advisors should embark upon.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Million Dollar Round Table (MDRT)

SEPTEMBER 12, 2022

By Shane E. Westhoelter, AEP, CLU Some things are so old that they are new again. For instance, vinyl record players, once considered outdated technology, are making a comeback in the modern music scene. The same is true in our profession. We still do client events but with a new twist. We still do radio shows and educational workshops but with a new twist.

Wealth Management

SEPTEMBER 12, 2022

Yet when demanding a return to the office, leaders should be honest about the flexibility they have enjoyed themselves.

Your Richest Life

SEPTEMBER 12, 2022

September is here, which means it’s time again to start thinking about end-of-the-year expenses, savings and to-dos. But this year, things are a little different. Due to high levels of inflation, market turbulence and global issues, your year-end checklist might require some additional prep and planning. 2022 Fall and Winter Travel Prep. Higher costs of fuel, personnel shortages and overall inflation rates have led to more expensive flights, hotel stays and dining out. .

Wealth Management

SEPTEMBER 12, 2022

Companies focused on reducing risk and restoring communities after disaster strikes stand to grow.

Advertisement

Creating a winning digital lending experience requires plenty of focus on the needs of customers and more. Biz2X Chief Product Officer Aaron Traub covers everything from how to create such an experience, areas to hone in on, pitfalls to avoid, and plenty more in this insightful article. Discover how to utilize new technology without alienating existing customers, what to emphasize when working on your platform, and how to utilize the data at your disposal while not becoming overly reliant on it.

Validea

SEPTEMBER 12, 2022

Readers who read investment books aren’t looking for the twists and turns of a mystery novel; they want advice and ideas on how to become better investors. David Rubenstein’s “How to Invest: Masters on the Craft” is filled with interviews from a handful of the smartest and most successful investors in recent decades, but offers relatively few “practical takeaways,” according to a review of the book in The Wall Street Journal.

Wealth Management

SEPTEMBER 12, 2022

Observations from attendees of the RPA Edge Record Keepers Roundtable and Think Tank.

Validea

SEPTEMBER 12, 2022

Houston-based Bridgeway Capital, founded in 1993 by MIT graduate John Montgomery, has always used number-crunching as a fundamental, well before ETFs began relying on computer algorithms to select value or growth stocks. That foundation could be one reason why its $504 million Bridgeway Small-Cap Value fund has beat 99% of Morningstar’s Small Value Category with a 14.9% in the last 5 years, according to a profile on the firm in Barron’s.

Let's personalize your content