Tuesday links: the tragedy of DeFi

Abnormal Returns

NOVEMBER 15, 2022

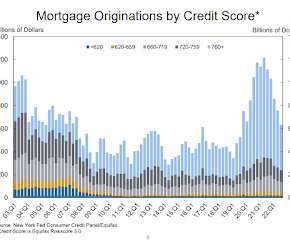

Bonds Mortgage bond buyers are on strike. (wsj.com) After the sell-off, how attractive are muni bonds? (morningstar.com) Liquidity in the U.S. Treasury bond market has dried up. (ft.com) Strategy Rubin Miller, "Nothing about being a great investor requires imagination." (fortunesandfrictions.com) Ben Carlson, "You’re never going to get caught up in a Ponzi Scheme investing in a total stock market index fund.

Let's personalize your content