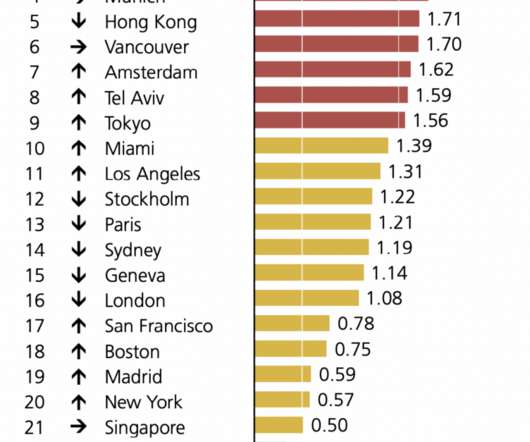

Global Real Estate Bubble Index

The Big Picture

OCTOBER 20, 2022

Which cities have the greatest housing bubble risk? That is the basis of this very interesting graphic from UBS. The full PDF is well worth your time to peruse through – you can find it here: UBS Global Real Estate Bubble Index. Source : UBS Global Real Estate Bubble Index 2022. The post Global Real Estate Bubble Index appeared first on The Big Picture.

Let's personalize your content