Understanding Long Term Moves in Gold, What's Going On?

Mish Talk

DECEMBER 19, 2022

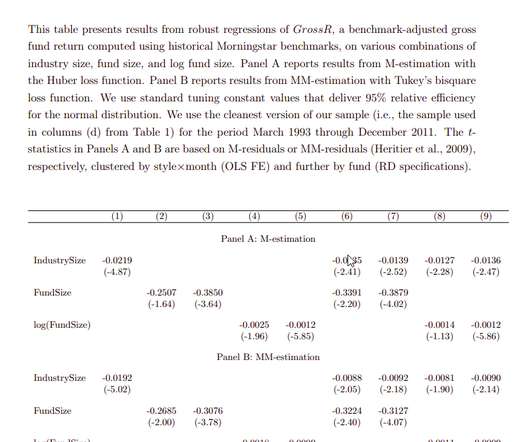

8Chart courtesy of StockCharts.Com, annotations by Mish. A long-term chart suggests the real driver for gold is not inflation, not the dollar, not conspiracies, not China, and not oil, but rather faith in central banks. Timeline Synopsis Nixon closed the gold redemption window on August 15, 1971. The price of gold was $35 an ounce. Faith in the dollar and central banks collapsed.

Let's personalize your content