10 Thursday AM Reads

The Big Picture

JANUARY 5, 2023

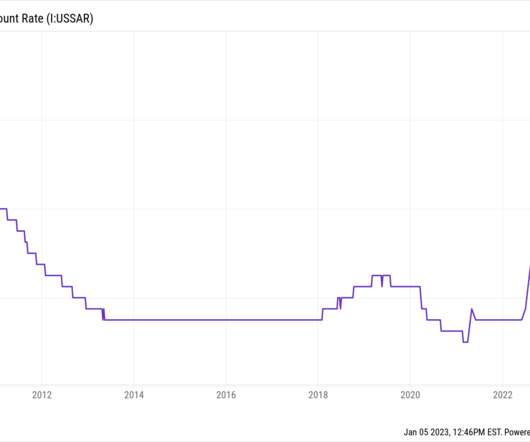

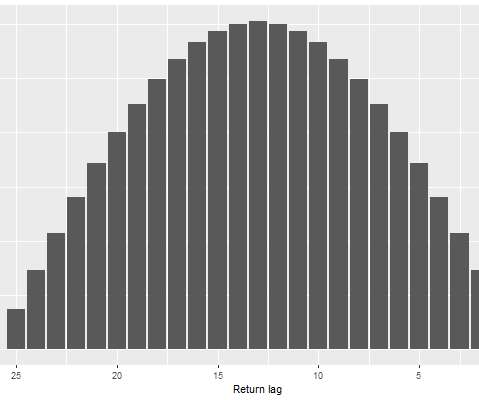

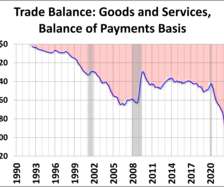

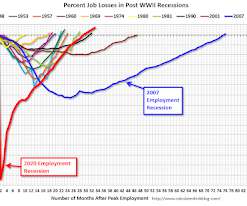

My early morning train WFH reads: • Get Ready for the Richcession : Well-off Americans could get hurt more than usual in the next downturn ( Wall Street Journal ). • Why Markets Were Down in 2022 : there was also an Occum’s razor answer for the losses in financial markets in 2022. Sometimes the reason asset prices fall is because they went up too much in the first place. ( Wealth of Common Sense ) see also Observations to Start 2023 : From 2010 through 2021, The S&P500 Index gained 330% — a

Let's personalize your content