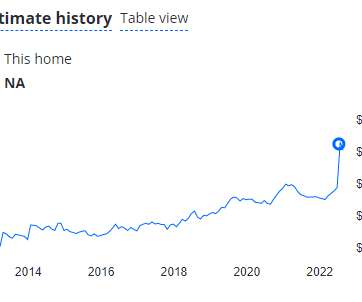

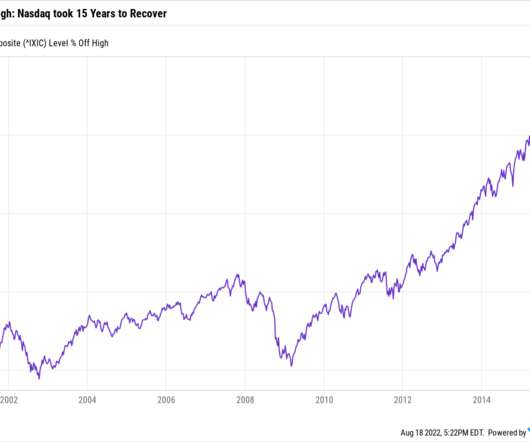

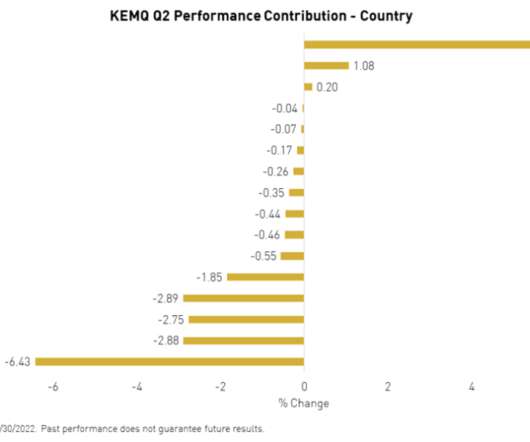

Is this chart going up or down?

The Reformed Broker

AUGUST 29, 2022

Is this chart going up or down? It’s not a trick question. Just look at it and tell me what primary the trend is. You’d be amazed at how many financial advisors, insurance brokers acting as financial advisors, financial planners, wirehouse wealth managers, financial consultants and other assorted intermediaries in this business could not for the life of them look at this chart and give you a straight answer.

Let's personalize your content