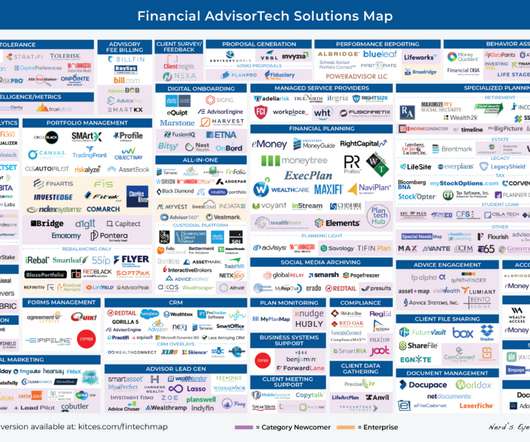

The Latest In Financial #AdvisorTech (August 2022)

Nerd's Eye View

AUGUST 1, 2022

Welcome to the August 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that Envestnet has acquired Redi2, one of the most widely used ‘revenue management’ systems in broker-dealers that facilitates the flow of dollars coming in and being paid out to advisors in al

Let's personalize your content