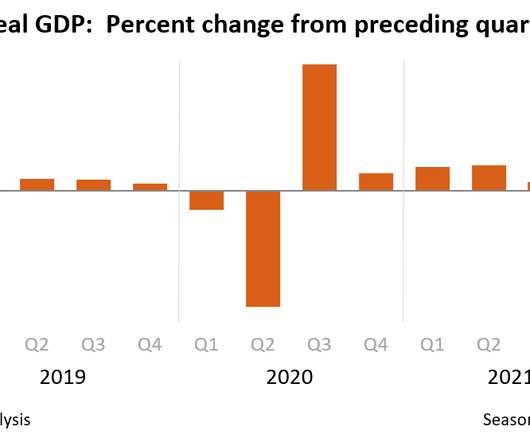

GDP = -0.9%

The Big Picture

JULY 28, 2022

Following a negative GDP print in the first quarter, a strong but inflation-racked economy expanded in the second quarter on a nominal basis, but contracted in real inflation-adjusted terms. BEA reported “Real gross domestic product decreased at an annual rate of 0.9 percent in the second quarter of 2022, following a decrease of 1.6 percent in the first quarter.

Let's personalize your content