Monday links: bond market losses

Abnormal Returns

OCTOBER 24, 2022

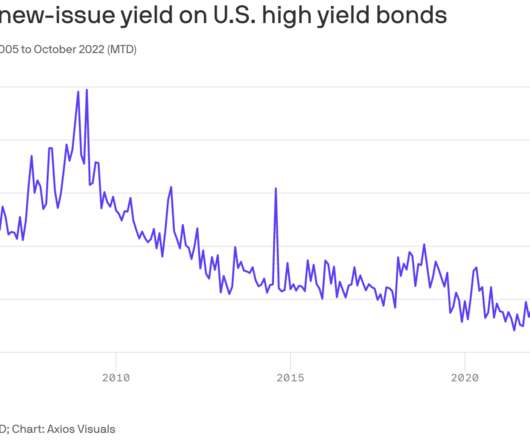

Strategy How much has indexing saved investors in fees? (evidenceinvestor.com) Some investors may not understand when they take on leverage. (rogersplanning.blogspot.com) Companies Brad Gerstner on how to turn Meta's ($META) stock around. (medium.com) Big tech companies are sitting on their own bond market losses. (theinformation.com) Snowflake ($SNOW) is growing into its valuation.

Let's personalize your content