The Great Resignation Is Long Over

The Big Picture

JULY 27, 2022

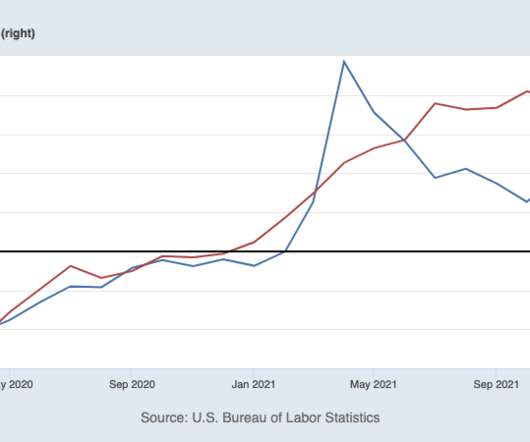

Today is Fed day, when we get the 75 bps increase that dramatically increases the odds of a recession. The main storyline is inflation, but the overlooked subplot here is Wages. I have detailed over the past decade or so the lagging nature of wages in America — deflationary in economic terms — and how that had begun to change in the late 2010s pre-pandemic.

Let's personalize your content