Soft Landing RIP

The Big Picture

JULY 25, 2022

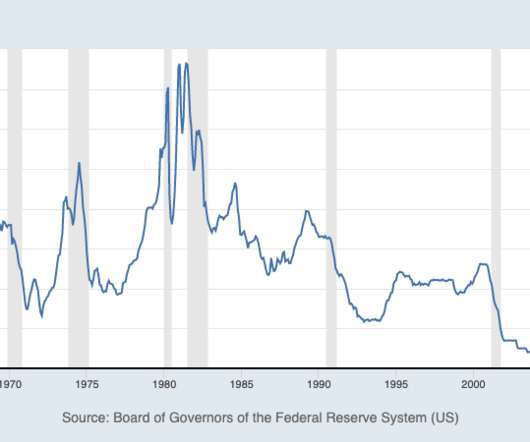

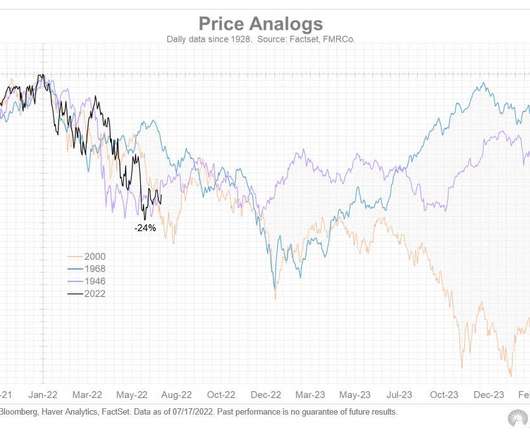

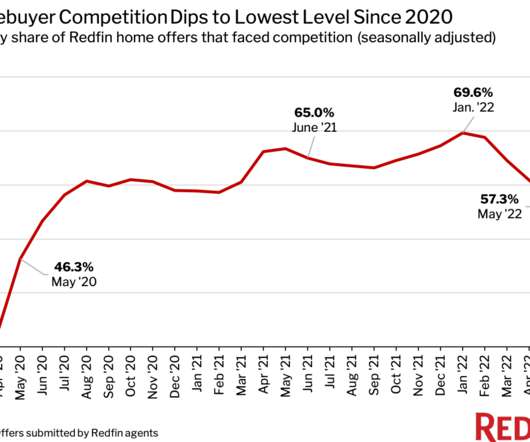

For the first half of this year, I have steadfastly refused to join Club Recessionista. I have not believed we were already in a recession, and I was hopeful that a moderate Fed gradually raising rates to throttle inflation could execute that soft landing. No longer. As I mentioned to Tom Keene last week, Nick Timiraos in the Wall Street Journal revealed the Fed’s intention to raise rates 75 basis points brought a reckoning to my hopes of a non-recessionary growth slow down.

Let's personalize your content