Tuesday links: accepting the risk of underperformance

Abnormal Returns

SEPTEMBER 28, 2022

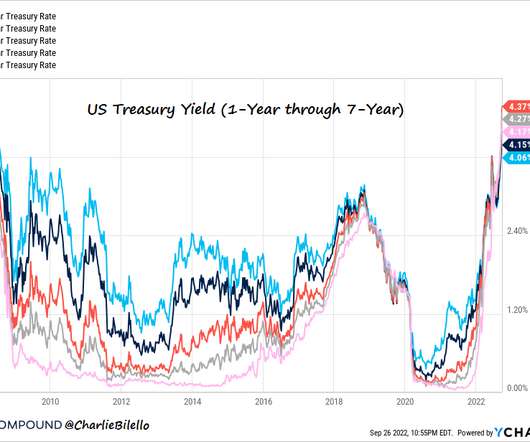

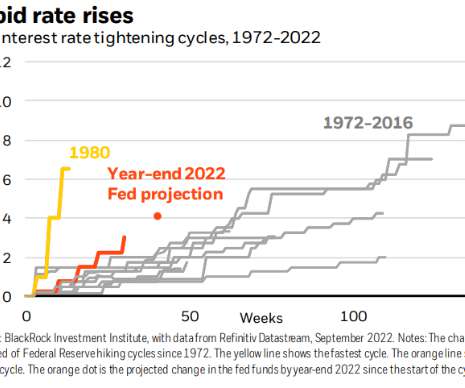

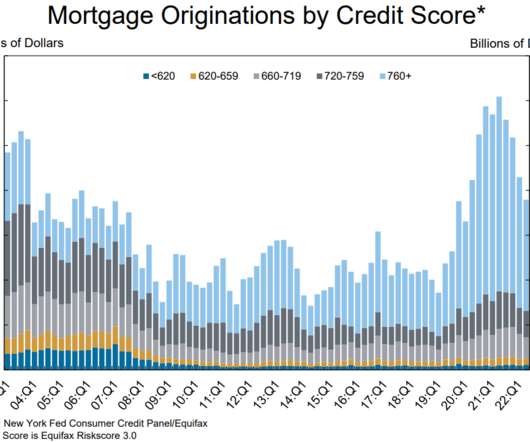

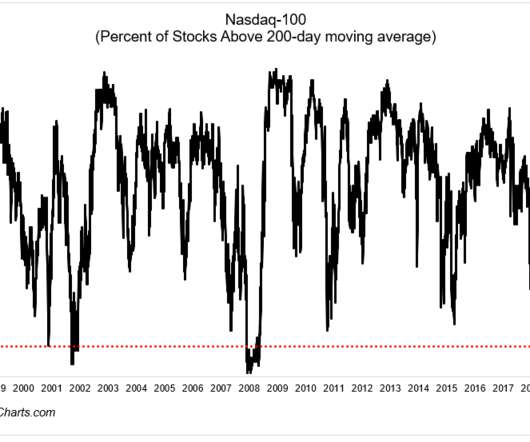

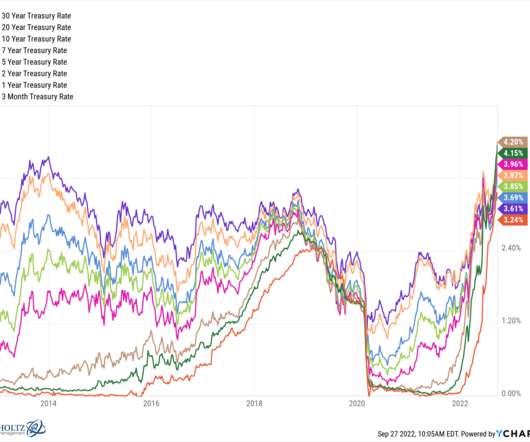

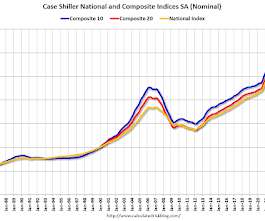

Rates Yields on cash equivalents are rising rapidly. (wealthmanagement.com) Rapidly rising real interest rates provide competition for stocks. (capitalspectator.com) Expected returns on bonds are finally attractive. (awealthofcommonsense.com) Markets Lumber prices are back down to pre-pandemic levels. (wsj.com) Don't fight the last war: this isn't 2008.

Let's personalize your content